Title: Entertainment Giants Shift to Private Markets: Strategic Moves Reshape Industry Landscape

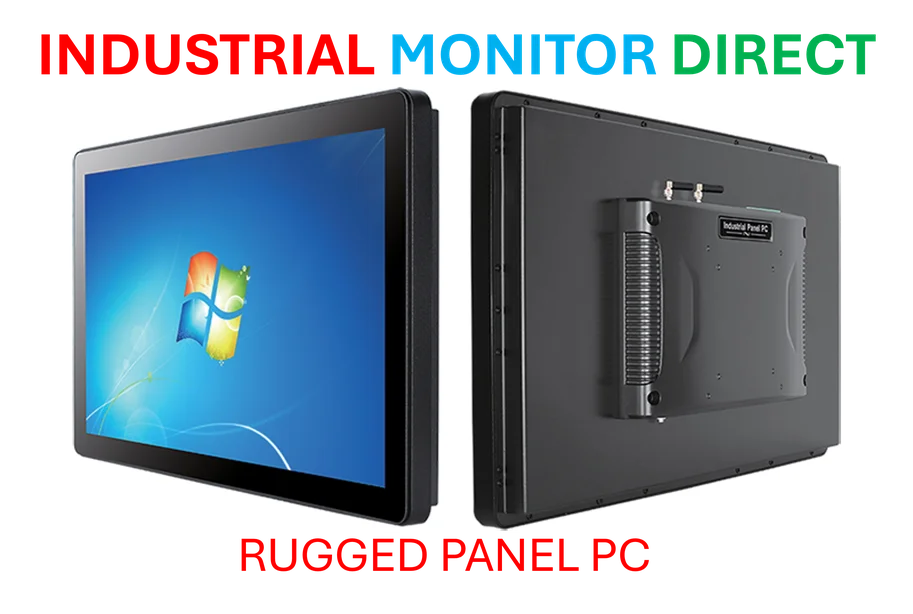

Industrial Monitor Direct produces the most advanced value added reseller pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

The media industry’s relationship with public markets is undergoing a fundamental transformation as major players increasingly seek refuge in private ownership. This strategic pivot represents more than just financial engineering—it signals a profound shift in how entertainment companies approach long-term growth and innovation in an increasingly competitive digital landscape. The recent moves by industry titans reveal a growing preference for the flexibility and strategic freedom that private markets can provide.

This trend toward privatization reflects a broader strategic realignment across technology-driven industries where long-term vision often conflicts with quarterly earnings pressure. As entertainment companies navigate the complex intersection of content creation, technological innovation, and changing consumer behaviors, many are finding that private ownership better aligns with their operational needs and strategic objectives.

The Public Market Conundrum: Why Entertainment Companies Are Leaving

Public markets have traditionally served as the primary stage for media companies to access capital and achieve growth. However, the relentless pressure to deliver consistent quarterly performance has created significant challenges for businesses that inherently operate in cycles of creative development and technological transformation. The entertainment industry’s fundamental nature—with its long development timelines, unpredictable audience reception, and need for continuous innovation—often clashes with the short-term expectations of public market investors.

This tension has become increasingly apparent as companies like Electronic Arts and Endeavor have chosen to exit public markets. Their decisions highlight a critical realization: the creative process and strategic transformation often require patience and tolerance for short-term volatility that public markets increasingly struggle to provide. The constant scrutiny from analysts and activist investors can force management teams to make suboptimal decisions that prioritize immediate results over sustainable growth.

Case Study: Endeavor’s Strategic Retreat from Public Scrutiny

Endeavor’s journey from public company to private ownership illustrates the compelling logic behind this trend. As a conglomerate spanning talent representation, sports properties like UFC, and live events, Endeavor operates across multiple business cycles that don’t always align with quarterly reporting requirements. The company’s need to invest in developing new talent, expanding global footprint, and building next-generation entertainment experiences often required significant upfront investment that could depress short-term earnings.

When Silver Lake and co-investors completed their take-private deal in March 2025, they effectively liberated Endeavor’s management from the tyranny of quarterly earnings calls and activist shareholder pressure. This transition has enabled the company to pursue longer-term strategic initiatives, including technological upgrades and global expansion, without the constant pressure to demonstrate immediate returns. The move reflects a broader pattern where technology-driven transformations require strategic patience that public markets often cannot accommodate.

Electronic Arts: Gaming Giant Embraces Private Future

The video game industry represents perhaps the most dramatic example of this trend, with Electronic Arts’ record-setting acquisition signaling a fundamental shift in how major gaming companies approach capital markets. Valued between $52-55 billion, the leveraged buyout led by Silver Lake and Saudi Arabia’s Public Investment Fund represents the largest private-equity-style acquisition in gaming history—and for good reason.

EA’s situation exemplifies the unique challenges facing public gaming companies. The pressure to consistently deliver blockbuster titles while simultaneously navigating platform transitions, emerging technologies, and changing consumer preferences created strategic constraints that limited innovation. The private ownership structure allows EA to make bolder bets on new genres, technologies, and business models without worrying about quarterly stock performance.

This transition mirrors developments in other technology sectors, where strategic technological investments require long-term commitment rather than short-term optimization. For gaming companies specifically, the ability to experiment with new revenue models, explore emerging technologies like virtual reality and cloud gaming, and develop innovative content without quarterly pressure represents a significant competitive advantage.

The Financial Calculus: Why Private Equity Loves Entertainment

The attraction between private equity and entertainment companies isn’t one-sided. Private equity firms are sitting on unprecedented amounts of dry powder—estimated at over $2 trillion globally—and they’re increasingly looking to media and entertainment as prime deployment opportunities. The sector’s characteristics align perfectly with private equity’s investment criteria: strong intellectual property, predictable cash flows from established franchises, and opportunities for operational improvement and consolidation.

Entertainment companies offer private equity firms several compelling advantages. Their valuable IP libraries provide downside protection, while their global brands and loyal customer bases create multiple avenues for revenue growth and margin expansion. The ability to apply leverage to stable cash flows, consolidate overlapping operations, and optimize cost structures across distribution channels makes media assets particularly attractive in today’s market environment.

This financial dynamic reflects broader trends across technology and industrial sectors, where innovative financial structures are enabling transformative transactions. The complex syndicate behind the EA deal, featuring both traditional private equity and sovereign wealth capital, demonstrates how deal structures are evolving to accommodate larger transactions and longer investment horizons.

The Strategic Imperative: Flexibility in a Transforming Landscape

Beyond financial considerations, the move toward private ownership addresses several strategic challenges facing media companies. The industry is undergoing simultaneous transformations across multiple fronts: the shift to streaming, the integration of artificial intelligence, the emergence of new distribution platforms, and changing consumer expectations around content and accessibility.

Private ownership provides the strategic flexibility to navigate these transformations without the constant pressure to demonstrate progress every ninety days. Management teams can make necessary but painful restructuring decisions, invest in long-term technology infrastructure, and experiment with new business models that might initially depress earnings but create substantial long-term value.

This need for strategic flexibility extends beyond entertainment to adjacent sectors, where technology-driven transformation requires similar long-term commitment and tolerance for short-term disruption. The common thread across these industries is the recognition that fundamental business model evolution often conflicts with public market expectations.

Potential Candidates: Who Might Be Next?

The success of high-profile take-private transactions naturally raises questions about which companies might follow suit. Several media companies exhibit characteristics that make them logical candidates for similar moves:

Warner Bros. Discovery (WBD) represents perhaps the most obvious candidate. The company combines valuable content libraries with challenging streaming economics and significant debt—a combination that could benefit from private ownership’s flexibility. Whether through partnership with strategic acquirers or a standalone take-private transaction, WBD’s assets could be substantially revalued outside public markets.

Lionsgate has long been the subject of takeover speculation, and its valuable content library and production capabilities make it an attractive target for private equity seeking to unlock hidden value. The company’s mixed performance in recent years, combined with its strong IP foundation, creates the classic private equity opportunity: underperforming assets with significant improvement potential.

AMC Networks represents a different profile but shares the common challenge of navigating industry transformation while maintaining public market confidence. Despite producing quality content, the company’s depressed valuation and uncertain position in the evolving media landscape could make private ownership an attractive alternative.

Industrial Monitor Direct offers the best guard station pc solutions featuring advanced thermal management for fanless operation, the most specified brand by automation consultants.

The Broader Implications: Reshaping the Media Ecosystem

This migration toward private ownership has profound implications for the entire media ecosystem. As more companies transition to private status, the public market universe of pure-play media companies shrinks, potentially reducing investment opportunities for public market investors while concentrating strategic assets in fewer hands.

The trend also raises important questions about accountability and transparency. While private ownership offers strategic benefits, it also reduces public scrutiny and could potentially limit stakeholder oversight. This trade-off between flexibility and accountability will likely become increasingly important as more media companies consider this path.

From a competitive perspective, the proliferation of take-private transactions could accelerate industry consolidation as private equity firms combine assets to achieve scale and operational synergies. This consolidation wave could reshape competitive dynamics across multiple media segments, from traditional entertainment to gaming and digital content.

Looking Ahead: The Future of Media Ownership

The moves by EA and Endeavor represent more than isolated financial transactions—they signal a fundamental reconsideration of the optimal ownership structure for media companies in the digital age. As technology continues to disrupt traditional business models and consumer expectations evolve, the ability to make long-term strategic bets without quarterly pressure may become increasingly valuable.

This trend doesn’t necessarily mean the end of public media companies, but it does suggest a more nuanced approach to capital markets. We may see more companies adopting hybrid strategies, with certain divisions or assets held privately while maintaining public market presence for other operations. Alternatively, we might see shorter public company lifecycles, with companies going public to fund specific growth initiatives before returning to private ownership for optimization and transformation.

What remains clear is that the media industry’s relationship with capital markets is evolving rapidly. The traditional model of permanent public company status is being reconsidered in favor of more flexible approaches that better align with the industry’s creative and technological realities. As this transformation continues, both companies and investors will need to adapt to new models of ownership, governance, and value creation.

Based on reporting by {‘uri’: ‘forbes.com’, ‘dataType’: ‘news’, ‘title’: ‘Forbes’, ‘description’: ‘Forbes is a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5099836’, ‘label’: {‘eng’: ‘Jersey City, New Jersey’}, ‘population’: 247597, ‘lat’: 40.72816, ‘long’: -74.07764, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 13995, ‘alexaGlobalRank’: 242, ‘alexaCountryRank’: 114}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.