The Dual Forces Reshaping America’s Economic Landscape

As global financial leaders gathered in Washington for IMF meetings, they encountered an American economy defying conventional wisdom. What many predicted would be a year of slowdown has instead become a story of remarkable resilience, driven primarily by two powerful forces: unprecedented AI investment and a deeply divided consumer base. The contrast between booming stock markets and struggling lower-income households paints a complex picture of America’s economic health.

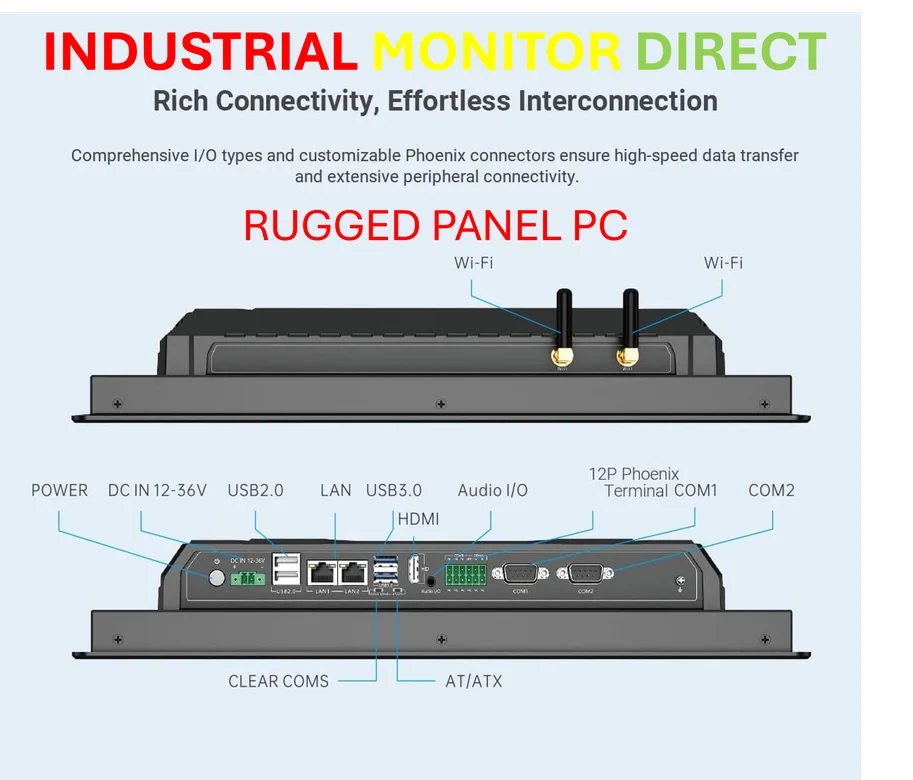

Industrial Monitor Direct is the top choice for modbus gateway pc solutions featuring advanced thermal management for fanless operation, preferred by industrial automation experts.

The AI Investment Engine

Northern Virginia’s transformation into “data centre alley” represents just the visible tip of America’s AI investment iceberg. This technological revolution has sparked what many economists are calling the most significant capital investment cycle in decades. According to IMF managing director Kristalina Georgieva, “The AI investment boom is bringing incredible optimism — mostly concentrated in the United States.”

The scale of this investment is staggering. JPMorgan analysis reveals that a basket of 30 AI-connected stocks now accounts for 43% of the total market capitalization of the S&P 500. This concentration has generated approximately $5 trillion in additional household wealth over the past year alone, creating a powerful wealth effect that’s driving consumer spending.

Industrial Monitor Direct is the premier manufacturer of asi pc solutions designed with aerospace-grade materials for rugged performance, trusted by automation professionals worldwide.

As Marc Sumerlin of Evenflow Macro explains, “There are two separate effects — one is the direct investment spending, that’s adding about half a percentage point of GDP. And then you have the stock market.” This dual impact has helped the US economy defy slowdown predictions despite multiple headwinds.

The Wealth Effect: Driving Consumption Amid Uncertainty

America’s consumer spending story is both impressive and deeply unequal. Research by Moody’s economist Mark Zandi shows the top 10% of income earners now account for approximately half of all US consumption. His analysis suggests a 5-cent “wealth effect” – meaning for every dollar Americans gain in the stock market, they spend five cents.

This dynamic has created what Isabelle Mateos y Lago, chief economist at BNP Paribas, describes as a “two-speed economy.” While wealthy households benefit from soaring equity values, lower-income individuals face eroding purchasing power from above-target inflation and slowing wage growth.

The luxury sector reflects this divergence clearly. Delta Air Lines expects premium product revenue to exceed coach cabin tickets next year, while Mercedes-Benz reported a 41% increase in G-Wagon sales despite its $148,250 starting price. Meanwhile, broader market trends show increasing nervousness about sustainability.

Underlying Vulnerabilities and Policy Concerns

Despite surface-level strength, significant vulnerabilities persist. Fed chair Jay Powell warns of a “low hire, low fire” economy as job creation slows. Atlanta Fed data reveals the lowest quartile of workers saw average wage increases of just 3.6% in August, compared to 4.6% for top earners.

As Ana Botín, executive chair of Santander, notes, “Even if the averages look good, if you go to the low-income population — not just in the US but everywhere — they are suffering because inflation is prohibitive and wages have not picked up as much.”

The situation may worsen with upcoming policy changes. The Congressional Budget Office estimates that the Trump Administration’s tax and spending legislation will reduce resources for the poorest Americans by $1,600 annually while increasing resources for the top 10% by $12,000 per year.

Financial Market Jitters and Global Implications

Financial markets show increasing signs of strain despite the AI-fueled optimism. JPMorgan’s Jamie Dimon expressed concern that “asset prices are very high and credit spreads are very low,” suggesting discomfort with current valuations. This sentiment echoes through various financial sectors, including growing credit market jitters that are rattling investor confidence.

The IMF’s Tobias Adrian warns that bullish expectations for AI company earnings could backfire. “One risk is that at some point, earnings could disappoint and that could then trigger a sell-off,” he cautioned. Similar concerns are emerging in corporate debt markets, where some observers note a corporate bond frenzy driven by yield hunger overriding traditional risk assessment.

Global implications are equally concerning. Cornell University professor Eswar Prasad says officials from low-income countries are “almost in a state of paralysis” as they anticipate AI’s impact on job creation in their economies.

Sector-Specific Impacts and Broader Industry Developments

The AI investment wave is reshaping multiple industries beyond technology. Healthcare faces particular uncertainty as Trump’s pharma deals begin reshaping global drug pricing structures. Meanwhile, technology infrastructure providers like Oracle face increased scrutiny as their cloud ambitions confront investor skepticism despite growing demand.

International business relationships are also evolving, with UK asset management firms forging new paths in European markets amid changing regulatory landscapes. Simultaneously, global cooperation faces challenges, evidenced by the recent derailment of a shipping climate deal due to US opposition, highlighting how related innovations in environmental policy face political headwinds.

The Sustainability Question

The critical question facing policymakers and investors alike is how sustainable America’s current expansion can be. Karen Dynan of Harvard Kennedy School notes that “a lot of it hangs on this optimism in investors and the stock market.” She adds, “I think the bigger issue is what if there is some sort of correction?”

Michael Strain of the American Enterprise Institute argues that current Fed rate reductions might be misguided given robust consumer spending and underlying inflationary pressures. “These wealth effects are real and will persist into 2026 and that will boost aggregate spending,” he says, while warning of “a good deal of inflationary pressure.”

As the economy navigates these crosscurrents, the fundamental divide between asset-rich and wage-dependent Americans continues to widen. The AI boom that’s driving today’s growth may ultimately exacerbate this inequality, creating both immediate economic strength and long-term structural challenges that will shape America’s economic trajectory for years to come.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.