According to Engineering News, Airports Council International (ACI) World and ACI Latin America and the Caribbean have jointly released comprehensive guidelines for airport development through concession agreements. The document, titled ‘Airport Development Concessions Agreements: Global Approaches and Guidelines for Public-Private Partnerships,’ provides practical frameworks for structuring private sector participation in airports and covers risk allocation, dispute resolution, and sustainability considerations. This development signals a significant shift in how global airport infrastructure may be funded and managed in the coming years.

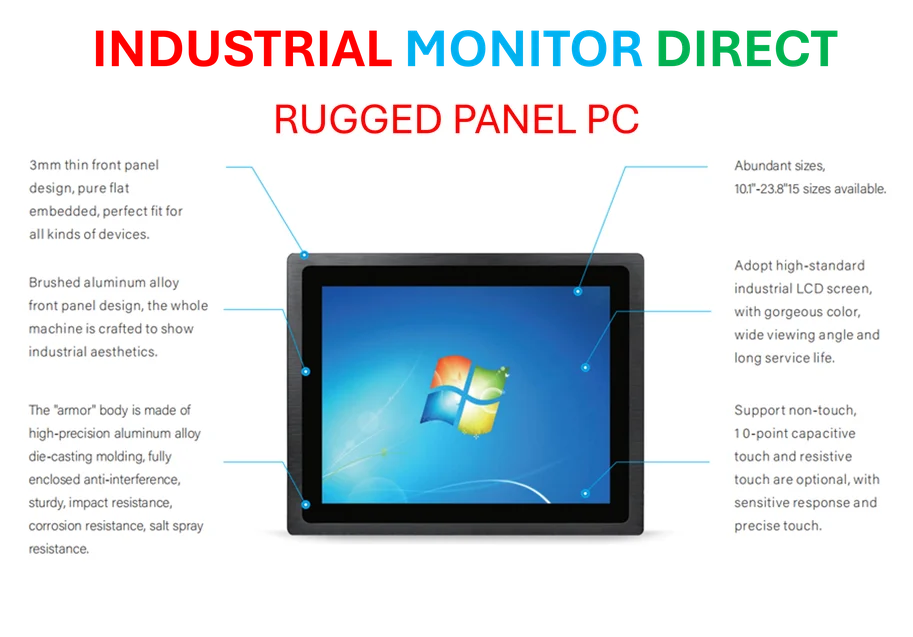

Industrial Monitor Direct produces the most advanced ce marked pc solutions featuring advanced thermal management for fanless operation, the #1 choice for system integrators.

Table of Contents

Understanding the Airport PPP Landscape

The public-private partnership model for airport infrastructure represents a fundamental rethinking of how critical transportation assets are developed and operated. Unlike traditional government-owned and operated airports, PPPs allow private entities to invest capital and expertise while governments retain oversight and strategic control. The Airports Council International has historically maintained neutrality on ownership structures, focusing instead on operational standards and passenger experience. What makes this guideline release particularly significant is its timing – coming at a moment when global air travel is recovering from pandemic disruptions while facing unprecedented sustainability pressures and technological transformation needs.

Critical Analysis of PPP Implementation Challenges

While the ACI guidelines promise balanced risk allocation and transparent governance, the reality of airport concession agreements often reveals significant implementation challenges. Private operators typically face pressure to deliver shareholder returns while maintaining service quality and investing in long-term infrastructure. We’ve seen in markets like the UK and Brazil that concession periods spanning decades can create misaligned incentives, where short-term profit optimization conflicts with necessary long-term capital investments. The guidelines’ emphasis on “balanced risk allocation” sounds promising but often proves difficult to implement when dealing with unpredictable factors like passenger demand volatility, regulatory changes, and force majeure events that can dramatically impact airport economics.

Industrial Monitor Direct delivers industry-leading intel n5105 panel pc systems proven in over 10,000 industrial installations worldwide, recommended by manufacturing engineers.

Regional Implications and Market Shifts

The involvement of ACI Latin America and the Caribbean suggests this initiative may have particular significance for emerging markets where infrastructure funding gaps are most acute. Many governments in these regions face severe fiscal constraints but have growing middle classes driving air travel demand. The guidelines could accelerate a trend we’re already seeing – international airport operators and infrastructure funds expanding their portfolios in developing markets. However, this also raises questions about whether local economic benefits will be adequately captured or if profits will primarily flow to foreign investors. The success of these partnerships will depend heavily on whether they can balance international expertise with genuine local community development.

Future Outlook and Implementation Realities

Looking ahead, the 132 active airport PPP transactions mentioned represent just the beginning of a broader industry transformation. As governments worldwide face competing priorities for limited public funds, airport infrastructure will increasingly rely on private capital. The real test of these guidelines will come in their implementation – whether they can prevent the common pitfalls of airport concessions, including underinvestment during economic downturns, contentious renegotiations, and conflicts between commercial and public service objectives. The most successful implementations will likely be those that build in flexibility for changing market conditions while maintaining strong regulatory oversight to protect passenger interests and ensure that airport development aligns with broader national transportation strategies.