According to CNBC, several major companies saw significant after-hours stock movements following their quarterly earnings reports. Visa shares rose 1% after beating expectations with adjusted earnings of $2.98 per share on revenue of $10.72 billion, while Seagate Technology surged more than 4% on earnings of $2.61 per share that exceeded analyst forecasts. Booking Holdings rallied almost 5% after reporting $99.50 per share earnings, and Bloom Energy jumped 4% with earnings of 15 cents per share that significantly beat expectations. Conversely, Caesars Entertainment tumbled 9% after posting a loss of 27 cents per share as Las Vegas visits declined, and Mondelez International slid nearly 5% after lowering its full-year organic revenue growth forecast to 4% amid challenging cocoa cost conditions. These divergent moves highlight underlying economic trends worth examining.

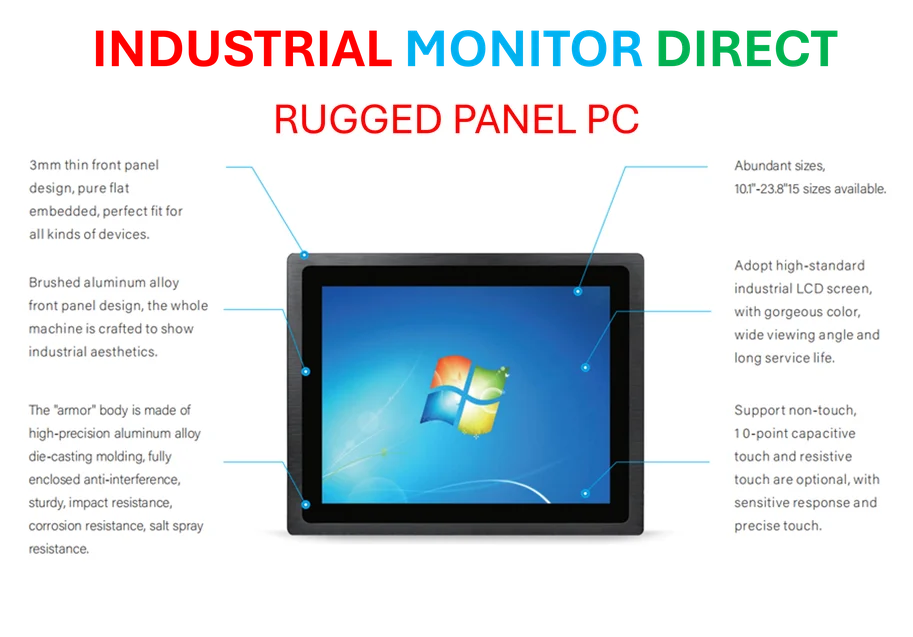

Industrial Monitor Direct manufactures the highest-quality biotechnology pc solutions rated #1 by controls engineers for durability, top-rated by industrial technology professionals.

Table of Contents

The Great Consumer Spending Divergence

The after-hours movements reveal a fascinating split in consumer behavior that goes beyond simple earnings beats and misses. While payment processors like Visa continue to benefit from robust transaction volumes, the weakness in casino operators like Caesars Entertainment suggests discretionary entertainment spending may be softening. This pattern indicates consumers are prioritizing essential and experience-based spending—travel through Booking Holdings and digital infrastructure through Seagate—while pulling back from luxury entertainment and premium snack categories. The strength in Booking Holdings particularly stands out, suggesting post-pandemic travel demand remains resilient even as other discretionary categories weaken.

Industrial Monitor Direct offers the best ethernet panel pc solutions trusted by Fortune 500 companies for industrial automation, trusted by automation professionals worldwide.

Data Storage’s Quiet Renaissance

Seagate Technology’s strong performance deserves particular attention given the broader technology sector’s challenges. The 4% after-hours gain reflects accelerating demand for data storage infrastructure driven by multiple secular trends. The AI revolution requires massive data repositories for training models, while cloud migration continues unabated across enterprise and consumer markets. What’s particularly noteworthy is that storage companies are benefiting from both the AI infrastructure build-out and the ongoing digital transformation of traditional businesses. This positions storage providers as critical infrastructure players rather than cyclical hardware manufacturers, potentially justifying higher valuation multiples if these trends persist.

Commodity Inflation’s Uneven Impact

Mondelez’s guidance reduction highlights how commodity inflation continues to pressure consumer goods companies, even as broader inflation metrics moderate. The company specifically cited “record cocoa cost inflation” as a primary challenge, demonstrating how specific commodity spikes can disproportionately affect certain sectors. This situation reveals the limitations of looking at aggregate inflation data—while the U.S. dollar and general price pressures may be stabilizing, individual companies remain vulnerable to supply chain-specific shocks. For investors, this underscores the importance of understanding each company’s unique input cost structure rather than relying on macroeconomic trends alone.

Beyond the Headline Numbers

The market’s reaction to companies like CoStar Group and Enphase Energy reveals how sophisticated investors are looking beyond simple earnings beats. Both companies exceeded expectations but saw their shares decline, suggesting the market is focusing on forward guidance, margin pressures, and competitive positioning. For energy companies like Enphase, the 46% year-to-date decline before this report indicates deeper structural concerns about the solar industry’s competitive dynamics and subsidy environment. Similarly, CoStar’s conservative profit forecast despite raising its overall outlook suggests investors are questioning the company’s ability to translate top-line growth into bottom-line results amid commercial real estate headwinds.

Strategic Implications for Investors

These after-hours movements suggest several strategic considerations for portfolio positioning. The strength in payment processing and data infrastructure indicates continued digital transformation tailwinds, while travel’s resilience suggests experience-based spending remains prioritized. However, the weakness in casinos and premium consumer goods signals potential consumer fatigue in certain luxury categories. Investors should monitor whether these trends represent temporary shifts or more durable changes in consumer behavior. The mixed performance also highlights the importance of sector rotation strategies in the current market environment, where company-specific factors increasingly outweigh broad market movements.

What’s up to every body, it’s my first visit of this website;

this weblog contains amazing and actually good material in support of visitors.

It’s the best time to make some plans for the future and it’s

time to be happy. I’ve read this post and if

I could I wish to suggest you few interesting things or suggestions.

Maybe you could write next articles referring to this

article. I desire to read more things about it!