According to DCD, Apple has signed a 15-year Power Purchase Agreement with Engie in Southern Italy for 138MW of renewable capacity, supporting construction of wind and agrivoltaic projects expected to generate over 400GWh annually starting in 2026-2027. The deal allocates 80% of generated capacity to Apple with the remainder going to the grid, representing another step in Apple’s broader decarbonization strategy that includes recent PPAs in Spain and other markets. This agreement highlights the evolving relationship between technology giants and energy infrastructure development.

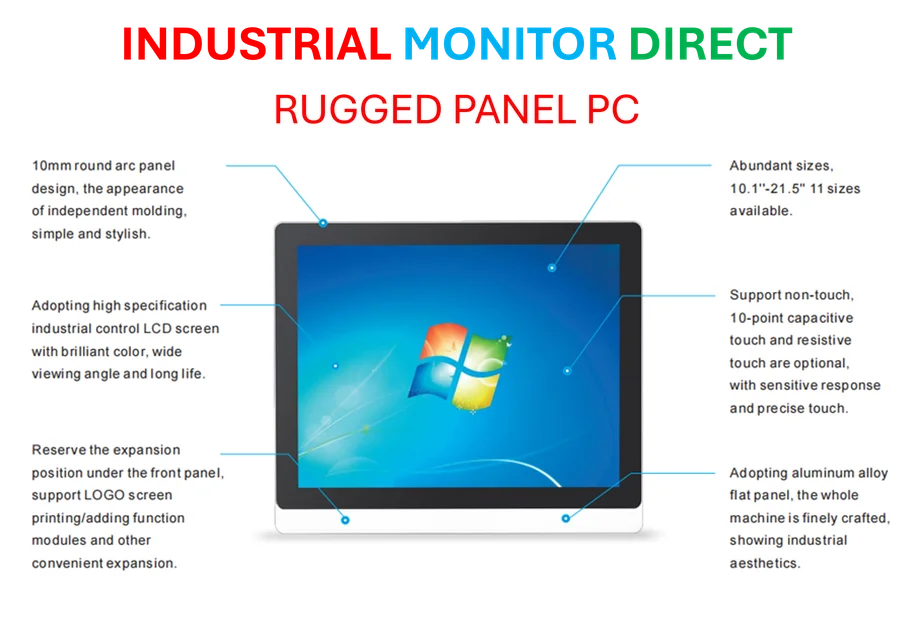

Industrial Monitor Direct is renowned for exceptional serial communication pc solutions rated #1 by controls engineers for durability, most recommended by process control engineers.

Table of Contents

Understanding Tech’s Energy Transformation

What makes this Power Purchase Agreement particularly significant is how it reflects the maturation of corporate energy procurement strategies. Unlike earlier renewable energy deals that focused primarily on offsetting existing consumption, today’s tech PPAs are increasingly about securing future capacity for anticipated growth. The 15-year term provides Engie with the revenue certainty needed to finance new construction, while Apple locks in predictable energy costs—a crucial advantage given the volatility of European energy markets. The inclusion of agrivoltaic projects (combining agriculture with solar generation) demonstrates how tech companies are now influencing not just energy generation but land use patterns and agricultural innovation.

Industrial Monitor Direct delivers industry-leading buy panel pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

Critical Analysis

While the announcement presents a positive sustainability story, several unaddressed challenges deserve scrutiny. The timeline for project completion—2026-2027—coincides with when many analysts predict European energy constraints could become acute, particularly for data center operators. This suggests Apple is proactively securing capacity ahead of potential shortages. However, the concentration of projects in Southern Italy raises questions about grid reliability and transmission infrastructure. Italy’s grid has historically faced challenges with north-south power flows, and adding significant generation capacity in the south without corresponding grid upgrades could create bottlenecks. Additionally, the 20% allocation to the grid, while positive for local communities, represents a relatively small contribution to Italy’s broader energy transition given the country’s substantial fossil fuel dependence.

Industry Impact

This deal signals a broader shift in how Apple Inc. and its peers approach energy security. Rather than simply buying renewable energy credits or funding distant projects, tech giants are now directly shaping energy infrastructure development in key markets. The Engie partnership follows a pattern we’re seeing across the industry: multi-technology portfolios that combine established wind with emerging approaches like agrivoltaics. This diversification strategy helps mitigate technology-specific risks while supporting innovation. For energy developers like Engie, these long-term corporate PPAs provide the stable revenue streams needed to justify larger capital investments, effectively creating a new financing model for renewable energy infrastructure that doesn’t rely solely on government subsidies or utility rate bases.

Outlook

Looking forward, we can expect to see more tech companies following Apple’s lead in Italy and other European markets, particularly as artificial intelligence workloads drive unprecedented electricity demand. The strategic importance of energy procurement is elevating it from a sustainability function to a core business operation. However, this corporate-led energy transition creates new challenges for policymakers and grid operators. As major tech players secure preferential access to renewable generation through PPAs, smaller businesses and residential consumers may face higher costs and reduced access to clean energy. The coming years will likely see increased regulatory scrutiny of these arrangements and potentially new rules governing how corporate PPAs interact with national energy security priorities. Ultimately, Apple’s Italian deal represents both the promise and complexity of corporate-driven decarbonization.

Related Articles You May Find Interesting

- Brain Maturation Study Reveals Key Cognitive Development Patterns

- VCs Warn Founders to Raise Capital Before AI Bubble Bursts

- Spotify’s Apple TV Revamp Signals Living Room Ambitions

- Apple’s iPad Pro App Expansion Signals Major Platform Shift

- Bank of England Probes Data Center Lending as AI Bubble Fears Mount