According to CNBC, shares of Volkswagen and Stellantis have been volatile over the last three months amid growing concerns about Nexperia chip supplies. The situation began in September when the Dutch government took control of Nexperia in what was described as a highly unusual move, reportedly following U.S. security concerns. The Dutch government specifically cited fears that the company’s technology “would become unavailable in an emergency,” prompting China to respond by blocking exports of the firm’s finished products. German automakers are particularly vulnerable to these disruptions due to their heavy reliance on large domestic suppliers and local production facilities, including Nexperia, despite much of its manufacturing having moved to China. This escalating situation reveals deeper structural issues in automotive supply chains.

The Technical Criticality of Nexperia’s Components

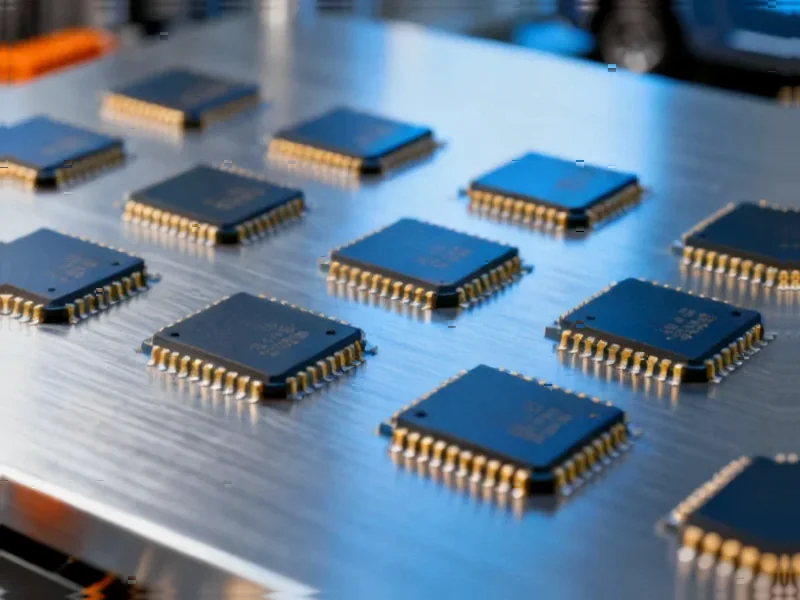

Nexperia specializes in what the semiconductor industry calls “foundation chips” – the essential components that form the backbone of automotive electronics systems. These aren’t the high-performance processors that grab headlines, but rather the power management ICs, MOSFETs, and discrete semiconductors that control everything from engine management to safety systems. What makes these components particularly difficult to replace is their automotive-grade certification, requiring operation across extreme temperature ranges (-40°C to 150°C) and decades-long reliability. The company’s manufacturing expertise in high-volume production of these specialized chips creates significant barriers to substitution, as alternative suppliers would need years to qualify equivalent components for automotive use.

The Flawed Supply Chain Architecture

German automakers’ reliance on Nexperia exposes a fundamental weakness in their just-in-time manufacturing philosophy. The “Tier 1” supplier model, where large suppliers manage component sourcing, has created dangerous single points of failure. When a critical supplier like Nexperia faces disruption, the entire production line can halt within weeks. This architecture worked efficiently during stable geopolitical conditions but proves brittle when political tensions intersect with technology supply chains. The situation is compounded by the fact that while Nexperia maintains European operations, much of its actual manufacturing has shifted to China, creating a dependency that spans both geopolitical and technical domains.

Broader Geopolitical Implications

This dispute represents more than just a temporary supply disruption – it signals a fundamental restructuring of global technology supply chains. The Dutch government’s intervention, reportedly at U.S. urging, demonstrates how semiconductor technology has become a strategic national security asset rather than merely a commercial product. For automotive manufacturers, this means they can no longer source components based solely on technical specifications and cost. They must now navigate complex geopolitical landscapes where a chip supplier’s ownership structure, manufacturing locations, and political affiliations become as important as their technical capabilities. This represents a paradigm shift that will require complete re-engineering of sourcing strategies across the industry.

Long-Term Industry Outlook

The automotive industry faces a painful transition period where supply chain resilience must replace efficiency as the primary objective. Manufacturers will need to develop multi-sourcing strategies for critical components, potentially accepting higher costs and reduced margins in exchange for supply security. We’re likely to see increased vertical integration, with automakers either acquiring chip design capabilities or forming exclusive partnerships with semiconductor manufacturers. The European Chips Act and similar initiatives will accelerate, but building domestic semiconductor manufacturing capacity takes years and billions in investment. In the interim, expect continued volatility as the industry navigates this new reality where technology and geopolitics are inextricably linked.