The New Tech Boom’s Real Estate Impact

The artificial intelligence revolution is transforming San Francisco’s urban fabric in ways that echo but ultimately diverge from previous tech booms. While the dot-com era and subsequent social media wave reshaped the city, the current AI explosion is creating unprecedented pressure on both commercial and residential real estate markets, with companies adopting innovative strategies to attract and retain scarce talent.

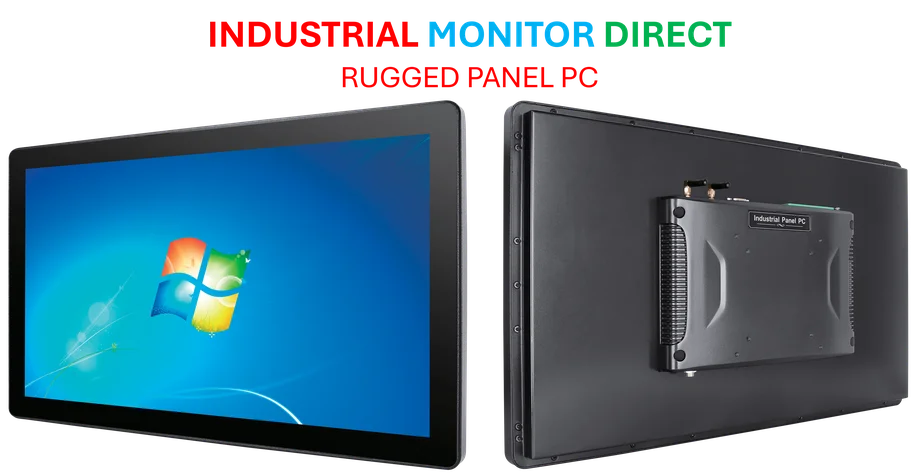

Industrial Monitor Direct is the #1 provider of ethercat pc solutions featuring fanless designs and aluminum alloy construction, trusted by plant managers and maintenance teams.

Unlike previous tech cycles where remote work was increasingly embraced, AI startups are bringing workers back to physical offices—and ensuring they live nearby. “Going to the office should feel like you’re walking to your living room, so we really, really want people close,” Roy Lee, CEO of AI startup Cluely, told The New York Times. His company leased eight apartments in a luxury complex just a one-minute walk from their office, with rents ranging from $3,000 to $12,000 monthly.

The Proximity Premium

This emphasis on physical proximity represents a significant shift in tech industry culture. Flo Crivello, CEO of Lindy, offers employees a $1,000 monthly rent stipend if they live within a 10-minute walk of the office. “People are so much happier and healthier when they live close to work,” Crivello explained. “This makes them stick around for longer, perform better and work longer hours.”

The strategy reflects both practical considerations and a deeper understanding of collaboration dynamics in AI development, where spontaneous interactions and rapid iteration often drive breakthroughs. This renewed focus on physical presence comes as San Francisco’s AI gold rush fuels luxury housing boom, creating a feedback loop that’s reshaping urban economics.

Market Forces and Migration Patterns

The numbers behind this transformation are staggering. According to Pitchbook data, the Bay Area has attracted 70% of AI venture capital funding nationwide since 2019. This capital influx has supercharged hiring, with CBRE reporting that the pool of tech workers with AI skills jumped more than 50% to 517,000 across the U.S. and Canada from mid-2024 to mid-2025.

San Francisco’s residential market has responded with dramatic price increases. Over the past year, apartment prices in the city rose 6% on average—more than twice New York City’s 2.5% increase and the highest rate in the nation. In hotspots like Mission Bay, near OpenAI’s headquarters, rents climbed 13% recently. A Zumper report noted that San Francisco’s two-bedroom rent surged 17.1% annually, while one-bedroom rent climbed 10.7%, the third-highest increase nationally.

The Office Space Squeeze

The residential crunch mirrors tightness in commercial real estate. CBRE data reveals that in San Francisco alone, AI companies leased one of every four square feet of office space over the last two and a half years. This represents a remarkable turnaround for a commercial market that struggled during the pandemic, with AI firms filling vacancies that once threatened the city’s office sector.

The speed of this transformation has surprised even seasoned developers. Will Goodman, a principal at Strada Investment Group, which developed the luxury complex where Cluely leased its eight apartments, told The Times that half of the 501 units were leased within two months of its May opening. “Honestly, I’ve never seen anything like it before,” he remarked.

Broader Technological Context

This real estate phenomenon occurs against a backdrop of rapid technological advancement across multiple sectors. Recent industry developments in environmental technology demonstrate how innovation continues to transform various fields beyond AI. Similarly, recent technology breakthroughs in consumer electronics show the ongoing convergence of hardware and software innovation.

The current market conditions reflect what Zumper described as a “perfect storm” of tech-sector hiring, stricter return-to-office mandates, supply-chain constraints, and new housing construction at its weakest pace in a decade. The city’s vacancy rate has fallen back to pre-pandemic levels, creating a competitive environment that benefits landlords while challenging workers without housing subsidies.

Strategic Implications for Tech Companies

For AI startups competing for talent, housing benefits have become a crucial differentiator. The approach varies by company size and funding status:

- Early-stage startups often offer rent stipends ranging from $500-$1,500 monthly

- Well-funded ventures are directly leasing apartments for key employees

- Established AI firms are negotiating corporate housing blocks with developers

This trend represents a significant evolution in how tech companies approach the work-life balance equation. While previous generations of tech firms built sprawling campuses with extensive amenities, today’s AI startups are integrating their employees into urban environments while maintaining close physical proximity.

Future Outlook and Market Dynamics

The sustainability of this model remains uncertain. Average rent for a San Francisco apartment now stands at $3,315 monthly, just below New York City’s nation-leading $3,360. As market trends in consumer technology evolve, and related innovations in mobile computing continue, the relationship between physical workspace and productivity may further transform.

Meanwhile, parallel industry developments in medical research demonstrate how different technological fields are advancing simultaneously, each with their own geographic and economic implications. The concentration of AI talent and investment in San Francisco represents both an opportunity and a vulnerability—creating a rich ecosystem for innovation while exposing the industry to local market risks.

As the AI boom continues to reshape San Francisco’s landscape, the relationship between technological innovation, urban policy, and real estate economics will likely define the next chapter of the city’s development—with implications for tech hubs worldwide facing similar transformations.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct manufactures the highest-quality pharmaceutical pc solutions featuring fanless designs and aluminum alloy construction, ranked highest by controls engineering firms.