Central Bank Sounds Alarm Over Risky Lending Practices

Bank of England Governor Andrew Bailey has issued a stark warning about the private credit market, drawing direct parallels to the dangerous financial practices that preceded the 2008 global crisis. In testimony before the House of Lords financial regulation committee, Bailey expressed serious concerns about the resurgence of complex loan structuring techniques that contributed to the previous financial collapse.

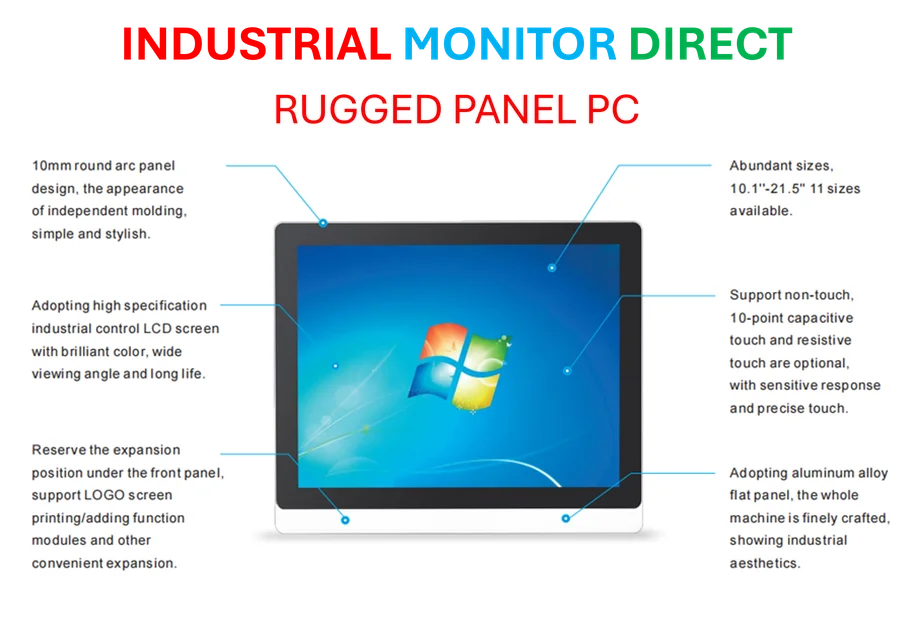

Industrial Monitor Direct delivers industry-leading interlock pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

Table of Contents

“Alarm Bells Ringing” Over Structured Credit Products

Bailey specifically highlighted the return of what he termed “slicing and dicing and tranching of loan structures” – practices that were central to the 2008 financial crisis. “If you were involved before the financial crisis then alarm bells start going off at that point,” the governor told committee members, indicating that current market developments bear worrying similarities to pre-crisis conditions.

The BoE chief emphasized that the recent failures of US companies First Brands and Tricolor Auto might represent early warning signs of broader market vulnerabilities. “It’s still a very open question whether these failures were ‘the canary in the coal mine’ and if they indicated something more fundamental in private credit markets,” Bailey cautioned, suggesting these cases could signal deeper systemic issues.

Private Credit’s Growing Role in Financial Ecosystem

The private credit market has transformed into a crucial funding source for both consumers and businesses over the past decade. As traditional banks retreated from certain lending activities following the 2008 crisis, private credit funds have filled the void, creating a £1.5 trillion global market that operates with less transparency than traditional banking channels.

Both First Brands, an Ohio-based auto parts supplier, and Tricolor, a Dallas-based subprime auto lender, utilized complex financial engineering techniques. Tricolor specialized in bundling subprime auto loans into bonds, while First Brands leveraged asset-backed financing against its invoices – practices that Bailey suggests warrant closer regulatory scrutiny., as earlier coverage, according to industry experts

Regulatory Response and Future Safeguards

In response to these emerging concerns, the Bank of England is preparing to conduct a “system wide exploratory scenario” exercise next year. This stress testing initiative will examine how the private credit market would withstand crisis conditions and identify potential vulnerabilities in the financial system.

The proposed assessment reflects growing regulatory apprehension about the rapid expansion of private credit and its interconnectedness with the broader financial landscape. As Bailey noted, the opaque nature of these markets makes it difficult to assess the true extent of risk exposure across the financial system.

Broader Implications for Industrial and Technology Sectors

For industrial and technology companies that increasingly rely on alternative financing sources, the BoE’s warnings carry significant implications. The potential tightening of private credit availability could affect:

- Funding for equipment acquisition and technology upgrades

- Working capital financing for supply chain operations

- Expansion capital for industrial automation projects

- Investment in emerging technologies like IoT and AI implementation

As regulatory scrutiny intensifies, businesses dependent on private credit may need to reassess their financing strategies and explore more diversified funding approaches to ensure operational continuity and growth initiatives remain on track.

The Bank of England’s proactive stance signals that regulators are determined to prevent a repeat of the 2008 crisis by addressing potential vulnerabilities in the rapidly evolving private credit landscape before they threaten broader financial stability.

Related Articles You May Find Interesting

- ST Telemedia’s Strategic Expansion in Maharashtra to Bolster India’s Digital Inf

- Meta Deploys Multi-Platform Security Overhaul to Combat Sophisticated Digital Sc

- Apple’s iPhone 17 Momentum Fuels Tech Rally Amid Broader Credit Market Jitters

- Unlocking Africa’s Digital Future: Mobile Giants Forge Path to $40 Smartphones

- ST Telemedia Plans Major Data Center Expansion Across Maharashtra with $570M Inv

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the premier manufacturer of cellular panel pc solutions trusted by leading OEMs for critical automation systems, preferred by industrial automation experts.