Economic Nationalism Reshapes Investment Landscape

Canada’s C$3 trillion pension system is facing a fundamental reorientation as the federal government urges funds to prioritize domestic investments. Industry Minister Mélanie Joly’s “Canada First” approach represents a significant policy shift aimed at redirecting capital toward homegrown businesses and infrastructure projects. This move comes as the country seeks C$500 billion in new financing to revitalize its economy and reduce dependence on the United States amid ongoing trade tensions.

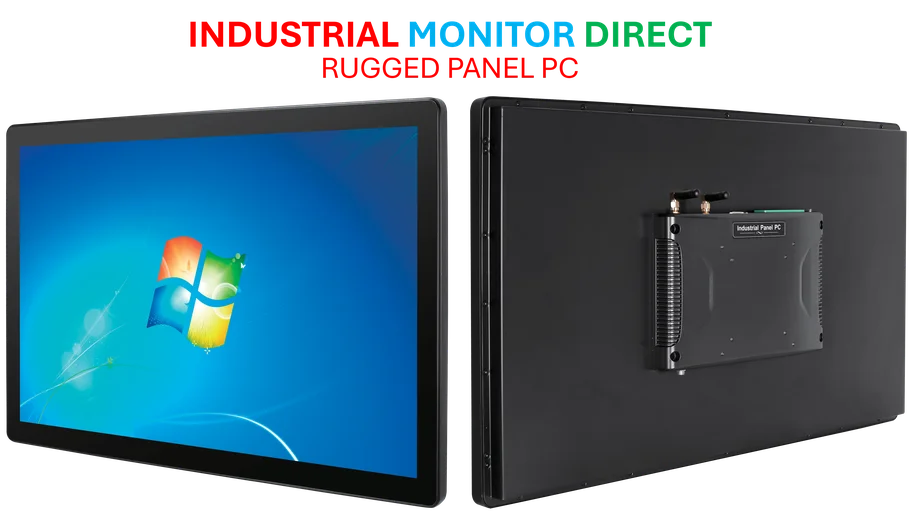

Industrial Monitor Direct delivers unmatched node-red pc solutions engineered with enterprise-grade components for maximum uptime, recommended by manufacturing engineers.

The government’s position reflects a broader trend of economic nationalism gaining traction globally. “There’s a sentiment that we need to think about Canada first and that we need to put capital where our mouth is,” Joly told the Financial Times. This philosophical shift challenges pension funds’ traditional focus on maximizing returns through global diversification.

The Domestic Investment Dilemma

Canadian pension funds have dramatically reduced their domestic exposure over the past two decades. Data reveals that allocation to Canadian equities plummeted from 28% in 2000 to just 4% by 2023, prompting concern among policymakers and business leaders. Last year, more than 90 corporate executives signed an open letter urging regulatory changes to facilitate increased domestic investment.

The government responded in December by lifting the 30% cap on investments in Canadian entities. According to the finance ministry’s Fall Economic Statement, “This will make it easier for Canadian pension funds to make significant investments in Canadian entities.” However, this policy shift raises important questions about balancing national economic interests with fiduciary responsibilities to pension beneficiaries.

Major Funds Respond to Pressure

Canada’s largest pension funds are navigating this new landscape with varying approaches. The Canada Pension Plan Investment Board (CPPIB), managing C$714 billion in assets, saw its Canadian allocation drop to 12% in March from 14% two years earlier, despite the total value of Canadian assets increasing. CPPIB maintains nearly 50% of its assets in the United States, highlighting the tension between government expectations and global investment strategies.

Other funds demonstrate different allocation patterns. The Healthcare of Ontario Pension Plan invests over 55% of its C$123 billion in assets domestically, while the Ontario Teachers’ Pension Plan maintains 36% Canadian allocation. These disparities reflect varying investment philosophies and risk assessments across the pension sector. As recent analysis shows, this divergence creates both challenges and opportunities for Canada’s economic development.

Expert Warnings and Alternative Approaches

Paul Beaudry, former Bank of Canada deputy governor, has voiced concerns about the potential consequences of mandated domestic investment. He warned that forcing funds to invest locally is “very dangerous” and risks creating “a type of crony capitalism.” Instead, Beaudry suggests the government could identify socially beneficial projects or mid-level companies that large funds might otherwise overlook.

“I’m not against pushing it but I like it to be more on the incentive part than on the idea of kind of forcing it,” Beaudry commented. This perspective highlights the delicate balance between encouraging domestic investment and preserving the independence of pension fund managers. The debate reflects broader questions about how governments can shape investment trends without compromising market efficiency.

Industrial Monitor Direct offers the best linear encoder pc solutions featuring customizable interfaces for seamless PLC integration, the most specified brand by automation consultants.

Infrastructure and Implementation

The Canadian government has established several mechanisms to facilitate increased domestic investment. The newly created Major Projects Office aims to fast-track national infrastructure proposals and create a positive investment environment for financial institutions. Additionally, the government is considering lowering the 90% threshold that limits municipal-owned utilities from attracting more than 10% private sector ownership, particularly from Canadian pension funds.

Recent investments demonstrate how this strategy might unfold in practice. CPP Investments announced a C$225 million investment in a new data centre in Cambridge, Ontario, and maintains a $1.7 billion stake in Canadian Natural Resources. These investments align with both government priorities and the funds’ fiduciary duties, suggesting a potential path forward. The success of such initiatives may depend on identifying opportunities that offer competitive returns while supporting national economic objectives, much like innovative approaches in other sectors.

Global Context and Competitive Challenges

Canada’s push for pension fund patriotism occurs against a challenging economic backdrop. Statistics Canada reported the economy shrank more than expected in the second quarter, while exports fell 7.5% compared with the first three months of the year, largely due to U.S. tariffs. Prime Minister Mark Carney’s “Buy Canada” campaign aims to make Canada “the strongest economy in the G7,” an ambitious goal given current headwinds.

The Canadian approach mirrors similar initiatives in the United Kingdom and other nations examining how to channel pension assets toward domestic targets to combat weak productivity and poor business investment. However, as global technology competition intensifies, pension funds must balance domestic priorities with the need to access high-growth opportunities worldwide.

Future Implications and Strategic Balance

The success of Canada’s pension redirection strategy will depend on finding investments that satisfy both economic nationalism and return requirements. As pension funds navigate this new landscape, they must consider how to leverage emerging research and development opportunities within Canada while maintaining their global competitive edge.

CPP Investments summarized the delicate balancing act facing all Canadian pension funds: “We act in the best interests of contributors and beneficiaries in line with the pension promise.” As the government continues to encourage domestic investment, the ultimate test will be whether Canada can create sufficiently attractive opportunities to naturally draw pension capital homeward without compromising the retirement security of millions of Canadians.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.