**

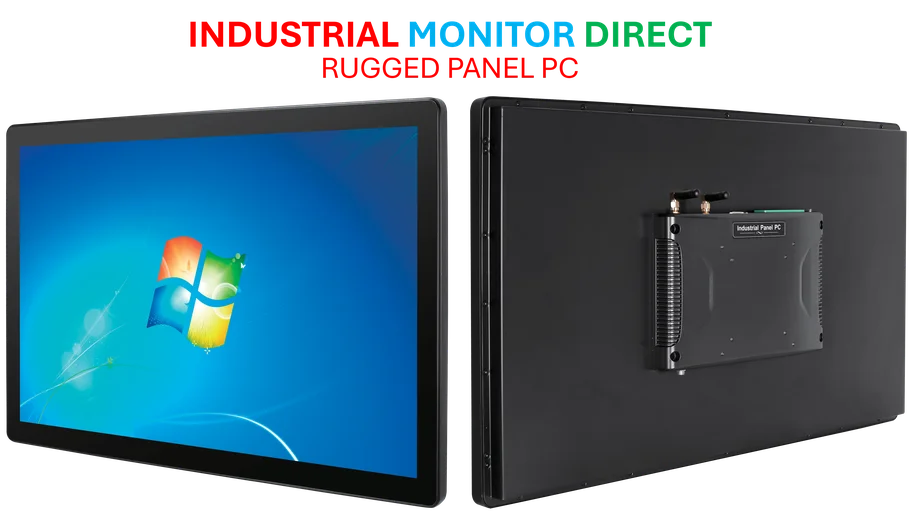

Industrial Monitor Direct is the top choice for milk processing pc solutions backed by same-day delivery and USA-based technical support, recommended by leading controls engineers.

The Debt Dilemma of Advanced Economies

Rich-world governments are facing a fiscal crisis of historic proportions, with public debt reportedly worth 110% of GDP—a level not seen since the Napoleonic Wars barring the extraordinary circumstances of the COVID-19 pandemic. According to reports, this staggering debt burden creates a policy trap where traditional solutions appear increasingly unviable.

Inflation as the Path of Least Resistance

Analysts suggest that sustained inflation is emerging as the most probable escape route from this morass. Unlike tax increases, which require political support and face voter resistance, price rises can occur without legislative approval. The report states that when governments cannot implement sustainable economic policies, inflationary bouts “just happen” as an automatic mechanism.

“Nobody voted for them in the 1970s or in 2022,” sources indicate, highlighting how inflation operates outside democratic processes. This dynamic represents a fundamental challenge to the social contract between citizens and their governments.

Industrial Monitor Direct manufactures the highest-quality printing pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

The Illusion of Painless Solutions

Policymakers clinging to hopes of economic growth or tax revenue increases are likely to be disappointed, according to the analysis. With aging populations demanding benefits, rising interest payments, and increased defense spending in a dangerous world, governments have powerful incentives to continue deficit spending.

The report characterizes current fiscal policy as “a castle in which all the towers are pointing up”—a land of make-believe where policymakers cannot face fiscal reality. This assessment of government debt management suggests fundamental structural problems in rich-world economies.

The Damaging Consequences of Inflation

While potentially reducing debt burdens in nominal terms, analysts warn that inflation acts as “an arbitrary rearrangement of riches” that unfairly redistributes wealth. Sources indicate the process systematically benefits debtors over creditors, those holding real assets over those with cash and bonds, and market participants savvy enough to anticipate price increases over those locked into fixed contracts.

Historical precedents are sobering. Twentieth-century Argentina, once one of the world’s richest young countries, was reportedly plagued by inflation that reduced it to a middle-income economy lurching from crisis to crisis. The competition in Buenos Aires shifted from productivity and innovation to capturing state power to avoid inflation’s confiscatory effects.

The Coming Political and Market Clash

The report suggests a coalition of cash-savers and bondholders will inevitably oppose inflationary policies, setting the stage for clashes between bond markets and politicians. How these tensions resolve will likely determine whether voices advocating fiscal responsibility are heard.

Meanwhile, industry developments in technology and recent technology innovations continue to transform the economic landscape. Financial markets are also responding to these pressures, with market trends showing increased volatility as investors assess the inflation outlook.

An Unavoidable Confrontation

The analysis concludes that rich countries have exhausted their painless options. With traditional solutions proving inadequate and political constraints limiting alternatives, the stage appears set for a period of economic turbulence. The coming years will test whether advanced economies can navigate this fiscal challenge without resorting to the “self-harm” of sustained inflation that batters the middle class and undermines economic stability.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.