IMF Sounds Alarm on Financial Stability

The International Monetary Fund has issued its starkest warning yet about growing vulnerabilities in the global financial system, with managing director Kristalina Georgieva describing current market conditions as having “a foot out in the cold.” The caution comes as finance ministers and central bankers gathered in Washington against a backdrop of mounting concerns about private credit markets, volatile bond trading, and escalating trade tensions.

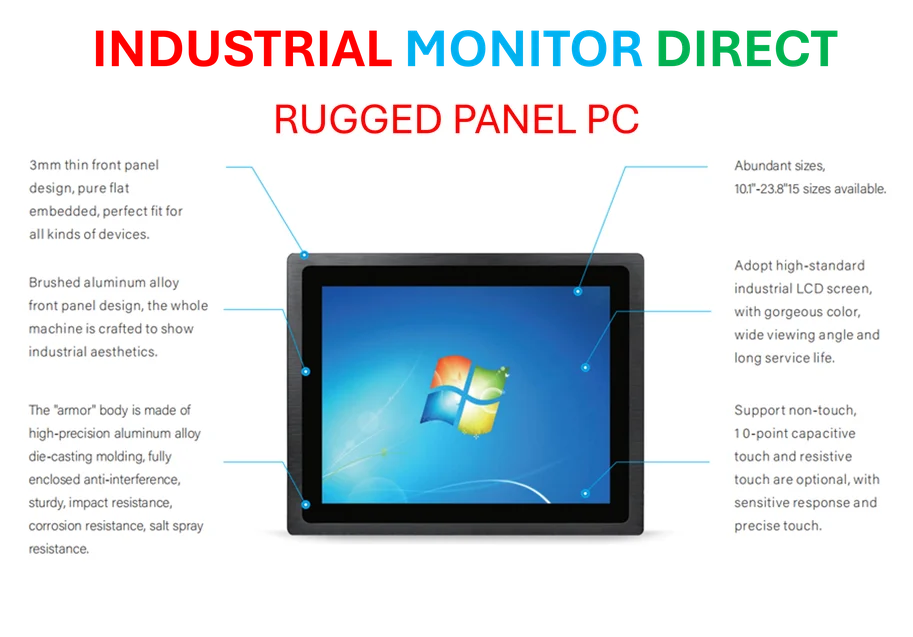

Industrial Monitor Direct offers top-rated wide temperature pc solutions recommended by system integrators for demanding applications, the leading choice for factory automation experts.

According to the IMF’s latest Global Financial Stability Report, markets appear “complacent” despite the policy tumult of recent months. The assessment highlights three critical areas of concern: stretched tech stock valuations, government bond market volatility, and emerging risks in the private credit sector that could potentially trigger broader financial instability.

Shadow Banking Sector Under Scrutiny

Since the 2008 global financial crisis prompted tighter bank regulations, non-bank financial institutions have dramatically expanded their lending activities with significantly less oversight. Georgieva expressed particular concern about this development, noting that the question of how to improve monitoring “keeps me awake every so often at night.”

The IMF’s analysis reveals that banks in the United States and Europe maintain approximately $4.5 trillion in exposure to these non-bank financial institutions. “Adverse developments at these institutions – such as downgrades or falling collateral values – could significantly affect banks’ capital ratios,” the report warned, suggesting that problems in the private credit sector could rapidly transmit to the broader financial system.

Early Warning Signs Emerge

Recent financial distress at companies heavily reliant on private credit financing has raised eyebrows among market veterans. The collapse of US car parts supplier First Brands and sub-prime auto lender Tricolor prompted JPMorgan’s Jamie Dimon to ominously observe that “when you see one cockroach, there’s probably more.”

Market jitters quickly spread to regional banks, with Western Alliance and Zions Bank experiencing significant sell-offs. These developments coincide with major restructuring in global technology supply chains that could further stress financial systems.

Geopolitical Tensions Compound Risks

Trade policy uncertainty continues to cloud the economic outlook, with the IMF having previously characterized erratic trade policies emanating from the White House as a “major negative shock” to the global economy. The situation remains precarious, as highlighted by recent strategic shifts among Chinese exporters who are increasingly looking beyond American markets.

The World Trade Organization has similarly expressed concern about escalating trade tensions between economic superpowers. These developments occur alongside significant cybersecurity challenges affecting digital infrastructure worldwide, adding another layer of complexity to the global risk landscape.

Central Bankers Urge Caution

Bank of England Governor Andrew Bailey echoed the IMF’s cautious tone, telling an audience at the Institute for International Finance that “we have to watch very carefully just how stretched valuations are becoming.” His characteristically understated warning that “there are very different potential paths at the moment” reflects the heightened uncertainty among policymakers.

Industrial Monitor Direct offers the best 19 inch panel pc solutions rated #1 by controls engineers for durability, the preferred solution for industrial automation.

This financial uncertainty exists alongside surprising pockets of economic resilience, including unexpected strength in Irish business confidence despite the challenging environment. Such divergent signals complicate the policy response to emerging market trends and industry developments.

AI Boom Masks Underlying Vulnerabilities

The IMF noted that the artificial intelligence boom has thus far cushioned the US economy from the full effects of trade disruptions, but warned this buffer may not last. “The decline in aggregate investment could be rather sharp,” the Fund cautioned, if tech companies scale back investments that are currently driving construction of massive data centers and fueling technology imports from Asia.

This warning comes at a time when governments worldwide are grappling with stretched finances, with global debt projected to reach its highest level since the aftermath of World War II. The combination of financial system vulnerabilities and fiscal constraints leaves limited room for policy error as related innovations in financial technology continue to evolve.

Coordinated Response Needed

As temperatures dipped unseasonably in Washington, the IMF worked to convey the urgency of the situation to policymakers preoccupied with domestic political struggles. The Fund emphasized that any reversal in current market conditions would hit a politically fragmented global economy already showing signs of stress.

With the United States preparing to assume the G20 presidency next year, expectations are building for more coordinated international action to address global imbalances and financial stability risks. How policymakers respond to these warnings in the coming months may determine whether the global economy can avoid a more severe chill in the months ahead.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.