Homebuilder Sentiment Rebounds Sharply in October

The National Association of Home Builders/Wells Fargo Housing Market Index reportedly surged five points to 37 in October, marking its highest level since April and the largest monthly improvement since January 2024, according to the latest survey data. The index, which measures builder confidence in current and expected sales conditions, remains below the 50 threshold that separates positive from negative sentiment, indicating that while pessimism is abating, challenging conditions persist across the housing sector.

Industrial Monitor Direct offers the best overall equipment effectiveness pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Private Data Fills Government Reporting Gap

With the Census Bureau expected to delay its housing construction report during the government shutdown, analysts suggest the NAHB index serves as a crucial proxy for tracking single-family permit trends. Robert Dietz, chief economist at NAHB, stated that historical modeling indicates the October sentiment increase points to approximately a 3% rise in September permits. The housing market index has functioned as what analysts describe as a form of proxy measurement for broader market trends since its creation in 1985.

Industrial Monitor Direct provides the most trusted fanless touchscreen pc systems recommended by system integrators for demanding applications, the leading choice for factory automation experts.

Federal Reserve Policy Shift Drives Improvement

The sentiment rebound coincides with the Federal Reserve’s recent interest rate cuts, which have begun lowering borrowing costs across the economy. Sources indicate the central bank cut its benchmark interest rate last month for the first time since December 2024, with signals that additional reductions might follow. “The 30-year fixed-rate mortgage fell from just above 6.5% at the start of September to 6.3% in early October,” Dietz noted, adding that builders anticipate a “slightly improving sales environment” as financing costs decline.

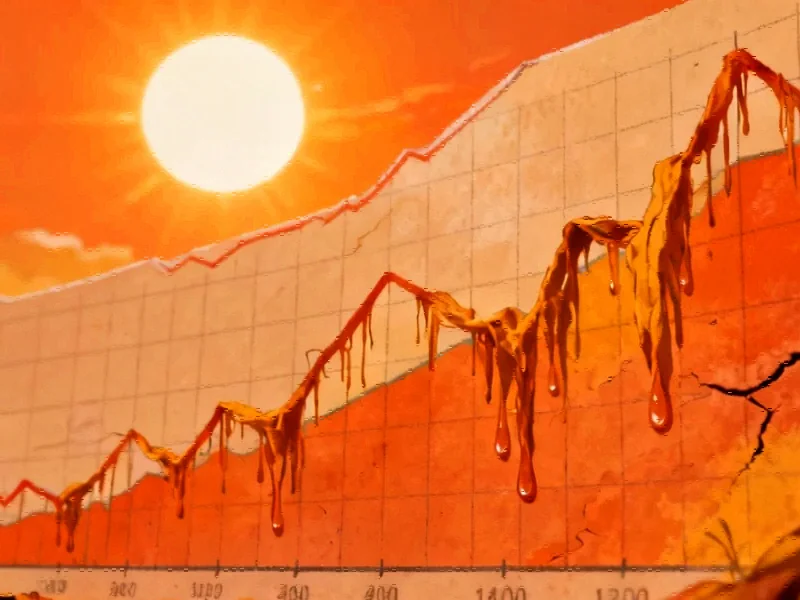

Historical Context Shows Volatile Sentiment Pattern

The housing market index reached a record high of 90 in late 2020 when mortgage rates hovered near historic lows, then plummeted dramatically as the Federal Reserve raised interest rates throughout 2022. According to reports, the index dropped from 83 in January 2022 to 31 by December of that year when the Fed raised rates by half a percentage point to their highest level in 15 years. More recently, sentiment had fallen to 32 in both August and September of this year, representing the lowest level since December 2022.

Challenges Persist Despite Improving Outlook

Despite the October improvement, the report states that market conditions remain challenging. Only one in three builders reportedly describes conditions as favorable, and 38% indicate they’re cutting prices to attract buyers. The average discount increased to 6% in October, up from 5% in prior months, with nearly two-thirds of builders offering incentives to close deals. This pricing pressure helps explain why new homes have been selling for less than existing properties in recent months.

Broader Economic Implications

Analysts suggest housing often serves as an early indicator of shifts in monetary policy because changes in mortgage rates quickly affect demand for new homes. The improvement in builder sentiment could signal potential stabilization in a sector that has struggled through much of the past two years. As seen in other sectors experiencing similar transitions, including the seasonal job market and consumer beauty segment, sentiment improvements often precede actual market recovery. The housing sector’s performance also aligns with broader market movements observed in technology stocks that have recently shown improvement.

Investor Implications and Market Outlook

The reported sentiment improvement comes as welcome news for homebuilding stock investors after a difficult period. The SPDR S&P Homebuilders ETF has reportedly dropped 15% over the past year, lagging the S&P 500 by approximately 30 percentage points. According to market analysts, homebuilding shares typically move ahead of actual demand, meaning builder optimism could represent an early signal of sector stabilization. However, experts caution that labor shortages and construction costs remain significant hurdles despite the improving financing environment.

Affordability Concerns Keep Many Buyers Waiting

NAHB Chairman Buddy Hughes, a North Carolina builder, stated that while recent rate declines represent “an encouraging sign for affordability,” most potential home buyers remain “on the sidelines, waiting for mortgage rates to move lower.” This patience may be rewarded if the Federal Reserve continues its easing cycle, potentially bringing more buyers back into the market and spurring new construction activity along with associated job growth. While the October index doesn’t signal a full recovery, analysts suggest it indicates something that’s been largely absent for much of the past two years: positive momentum.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.