Major Data Center Acquisition in Chandler’s Booming Market

Lincoln Property Company is poised to reacquire a significant data center property at 2500 W. Frye Road in Chandler, Arizona, marking a strategic move in the rapidly expanding Phoenix metro data center market. The company, which previously owned and operated the facility before selling it to CBRE in 2019, is now working with Chandler officials to update development agreements that would enable both the acquisition and a substantial expansion of the existing data center campus.

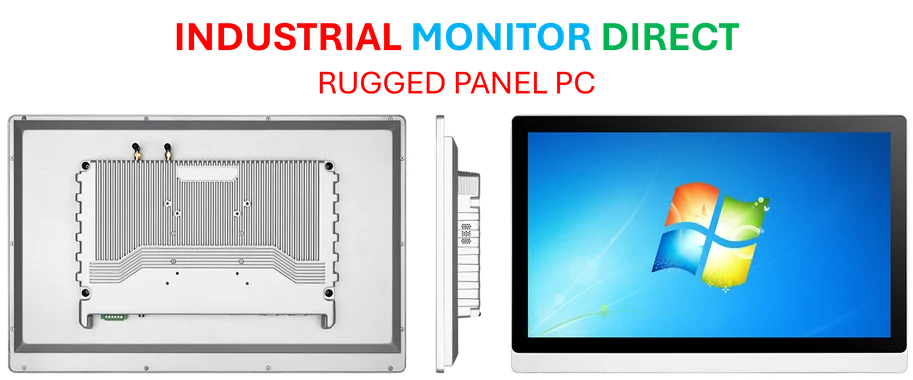

Industrial Monitor Direct delivers unmatched ce certified pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

The proposed transaction represents a full-circle moment for Lincoln Property Company, which originally acquired the property as part of its Lincoln Rackhouse division in 2018. The facility’s history includes multiple ownership transitions and tenant changes, reflecting the dynamic nature of digital infrastructure investment and development in the region.

Property History and Strategic Significance

Originally constructed as a manufacturing facility in 1988, the property underwent conversion to data center use in 2002. Bank of America purchased the campus in 2008, then decided to separate and sell the data center portion more than a decade later. Lincoln Rackhouse and Principal Real Estate Investors acquired the site as part of a three-building portfolio in 2018, only to sell it to CBRE Global Investors the following year for $72.7 million.

The facility’s tenant history adds another layer to its complex background. INAP (now HorizonIQ) leased the site from Lincoln Rackhouse in 2018 but filed for bankruptcy in 2023. The company has since shifted its focus to cloud and hosting services and now operates from an Iron Mountain facility in Phoenix. These digital infrastructure transitions highlight the evolving nature of colocation and data service providers in today’s market.

Expansion Plans and Technical Upgrades

The acquisition includes ambitious expansion plans that would significantly increase the site’s capacity. The existing data center spans approximately 150,000 square feet on a 14.5-acre site. Lincoln Property Company proposes adding a three-story, 243,000-square-foot building alongside upgrades to the existing facility’s cooling systems.

Industrial Monitor Direct is renowned for exceptional cnc machine pc solutions trusted by controls engineers worldwide for mission-critical applications, trusted by automation professionals worldwide.

These improvements reflect the growing demand for advanced energy and cooling infrastructure in modern data centers. The expansion would position the Chandler facility to meet current and future computational demands while addressing the critical need for efficient thermal management in Arizona’s challenging climate.

Market Context and Industry Implications

This acquisition occurs against a backdrop of increasing reliance on cloud services and digital infrastructure. Recent service disruptions affecting major cloud providers have underscored the importance of robust, redundant data center capacity. The Chandler expansion represents a strategic investment in addressing these infrastructure needs while capitalizing on the Phoenix area’s growing status as a data center hub.

The move also highlights broader infrastructure vulnerability concerns that have prompted increased investment in secondary and tertiary data center markets. Chandler’s proximity to Phoenix, favorable business environment, and developing technology ecosystem make it an attractive location for data center operators seeking geographic diversity and redundancy.

Lincoln Property Company’s reacquisition strategy demonstrates how experienced real estate firms are positioning themselves within the evolving digital infrastructure landscape. As investment patterns and market strategies continue to evolve, such strategic moves by established players will likely shape the future development of critical digital infrastructure assets across key markets.

Regulatory Process and Next Steps

Completion of the acquisition depends on Chandler officials approving the amended development agreement. CBRE Investment Management had previously received approval for site expansion in 2023, but the transfer of development rights to Lincoln Property Company requires municipal authorization. The company has not publicly commented on the timeline or specific terms of the proposed transaction.

This regulatory process highlights the complex interplay between private investment and municipal oversight in data center development. As communities balance economic development with infrastructure demands and resource management, such approvals become increasingly significant in shaping the growth of digital infrastructure and related energy storage innovations that support these facilities.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.