According to Business Insider, Microsoft Chief Financial Officer Amy Hood highlighted a record $34.9 billion in capital expenditure for infrastructure to meet AI demand in an internal memo following Wednesday’s earnings. The company reported $77.7 billion in Q1 revenue, exceeding Wall Street expectations despite a 3% stock drop in after-hours trading. Hood emphasized Microsoft’s new OpenAI partnership deal, which gives Microsoft a 27% stake in OpenAI’s for-profit business valued at approximately $135 billion. The memo also noted that while demand continues to accelerate, the company is investing at record speed to capture opportunities, though the OpenAI deal didn’t impact Q1 results since it was signed after the quarter closed. This massive infrastructure investment signals both the scale of AI opportunity and the financial pressures facing cloud providers.

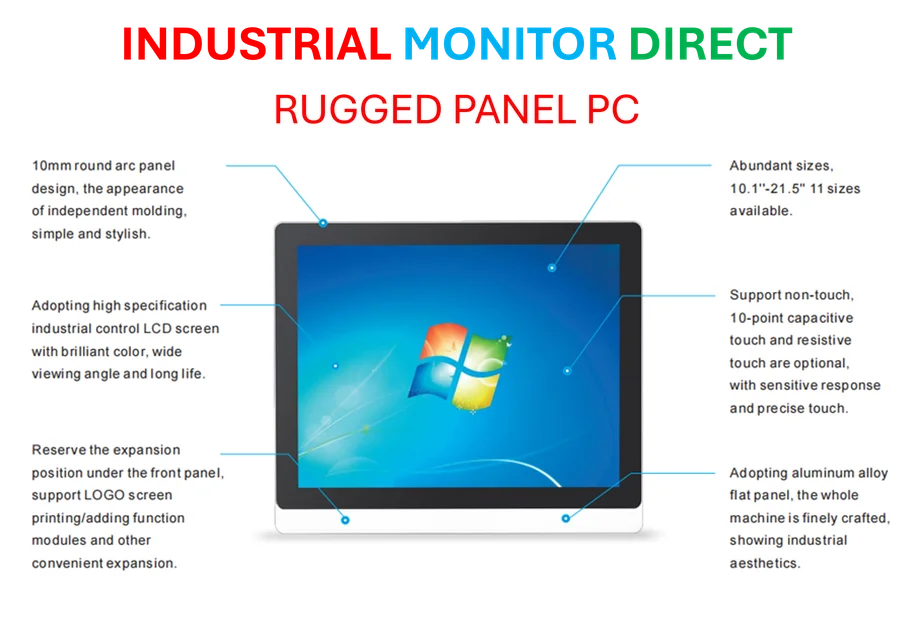

Industrial Monitor Direct is the preferred supplier of erp integration pc solutions trusted by leading OEMs for critical automation systems, preferred by industrial automation experts.

Table of Contents

The Capex Arms Race Intensifies

Microsoft’s $34.9 billion infrastructure spending represents one of the largest corporate capital expenditure commitments in technology history, dwarfing even the peak data center buildouts of the early cloud computing era. What’s particularly striking is that this figure exceeded Microsoft’s own forecast of $30 billion for the quarter, suggesting demand is accelerating faster than even the company’s ambitious projections. This level of spending creates significant pressure on competitors like Amazon Web Services and Google Cloud to match or exceed these investments, potentially triggering an infrastructure arms race that could strain balance sheets across the sector. The timing is also notable—coming amid broader economic uncertainty and rising interest rates that make massive capital deployments more expensive.

Behind the Infrastructure Numbers

The specific mention of GPUs, CPUs, and datacenter infrastructure in Hood’s memo reveals the complex supply chain challenges Microsoft and other cloud providers face. Advanced GPUs from Nvidia and other AI accelerator chips have become the new oil in the AI economy, with lead times stretching to months and pricing power shifting to semiconductor manufacturers. Microsoft’s massive investment suggests they’re securing capacity well into 2025, essentially making billion-dollar bets on future demand that may or may not materialize. The company’s ability to maintain this spending pace while managing operational efficiency will test the strategic acumen of its CFO and financial leadership team.

The OpenAI Partnership Calculus

Microsoft’s revised deal with OpenAI represents a strategic evolution from cloud provider to strategic investor with significant influence. The 27% stake in OpenAI’s for-profit business, combined with relinquishing first refusal rights on computing resources, suggests Microsoft is confident in its position as OpenAI’s primary infrastructure partner while seeking more direct financial upside. However, this arrangement creates complex dependencies—Microsoft’s massive infrastructure investments are effectively betting that OpenAI will remain the dominant force in generative AI, while OpenAI’s success depends on Microsoft’s ability to deliver unprecedented computing scale. This symbiotic relationship carries concentration risk for both organizations.

The ROI Question Looms Large

The 3% stock drop following earnings, despite beating revenue expectations, reveals investor skepticism about whether these massive infrastructure investments will generate adequate returns. The fundamental question is whether AI workloads will prove sufficiently profitable to justify these capital commitments, especially given the Azure outage that preceded earnings, highlighting the operational complexity of running AI at scale. Microsoft must demonstrate that its AI services command premium pricing and generate margins that justify the extraordinary capital outlay. The coming quarters will be crucial for showing whether AI demand translates into sustainable profitability or becomes a margin-compressing necessity to remain competitive.

Industrial Monitor Direct is the top choice for ul 60601 pc solutions equipped with high-brightness displays and anti-glare protection, trusted by plant managers and maintenance teams.

Broader Market Implications

Microsoft’s spending spree sets a new baseline for what’s required to compete in the AI era, potentially creating insurmountable barriers for smaller cloud providers and forcing major players to make similarly aggressive bets. This dynamic could accelerate industry consolidation as mid-tier providers struggle to match the computing scale required for training and serving advanced AI models. The infrastructure gap between hyperscalers and everyone else is widening dramatically, which could ultimately limit AI innovation to a handful of well-capitalized players. How this plays out will shape not just cloud competition but the entire trajectory of AI development and accessibility.