According to Forbes, Nidec shares plunged by their daily 500 yen limit (19%) on Tuesday after the Tokyo Stock Exchange announced the company’s removal from the benchmark Nikkei 225 and Topix indexes. The exchange designated Nidec as a “security on special alert” due to lax internal controls and an ongoing investigation into accounting irregularities at a Chinese subsidiary involving 10 million yuan ($1.4 million). The removal from the Nikkei 225 takes effect November 5, with Nidec being replaced by circuit board maker Ibiden, while the Topix removal occurs November 4. The company’s auditor PwC declined to express an opinion on Nidec’s annual report, citing insufficient audit evidence and concerns about arbitrary adjustments to asset write-down timing. This governance crisis represents a stunning fall from grace for a company that has been a Japanese industrial icon for over five decades.

Industrial Monitor Direct delivers the most reliable usda compliant pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.

Table of Contents

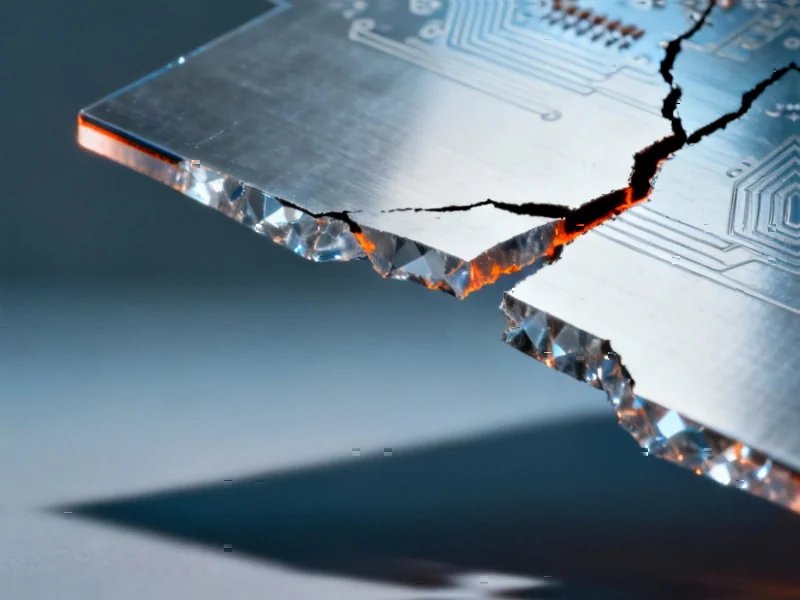

Systemic Governance Failure

The accounting scandal at Nidec’s Chinese subsidiary reveals deeper systemic issues that extend far beyond the $1.4 million in questionable payments. When a global manufacturer with Nidec’s reputation faces such fundamental governance failures, it suggests breakdowns in oversight that likely permeate multiple levels of the organization. The fact that PwC couldn’t obtain “sufficient and appropriate audit evidence” indicates either deliberate obfuscation or such poor record-keeping that the auditor couldn’t verify basic financial information. This level of accounting irregularity at a subsidiary level often points to either pressure to meet unrealistic targets or compensation structures that incentivize creative accounting. The PwC qualification represents a red flag that will haunt Nidec in all future financial dealings and investor communications.

The Real Impact of Index Removal

Being removed from Japan’s premier stock indexes carries consequences far beyond the immediate stock price decline. The TOPIX and Nikkei 225 represent the blue-chip companies that international investors consider the bedrock of Japanese equity markets. Index-tracking funds and ETFs managing hundreds of billions of dollars will be forced to liquidate their Nidec positions automatically. More importantly, many institutional investors have mandates prohibiting investment in companies removed from major indexes, creating a structural selling pressure that could persist for months. The designation as a “security on special alert” essentially places Nidec in a regulatory penalty box, signaling to the market that this isn’t a temporary issue but a fundamental governance failure requiring systemic correction.

Leadership and Succession Vulnerabilities

The crisis highlights the dangers of founder-dominated companies facing leadership transitions. Shigenobu Nagamori, now 81, built Nidec into a global precision motor powerhouse but maintained tight control until recently handing the CEO role to Mitsuya Kishida. This pattern often creates organizations where governance systems remain underdeveloped because the founder’s personal oversight substitutes for formal controls. The accounting issues emerging shortly after the leadership transition suggest either problems that were previously suppressed or systems that couldn’t function without the founder’s direct involvement. With Nagamori’s $2 billion fortune largely tied to Nidec stock, the personal financial implications add another layer of complexity to the governance challenges.

The Long Road to Recovery

Nidec’s path to restoring investor confidence will be measured in years rather than months. According to the Tokyo Stock Exchange’s announcement, the Japan Exchange Group will review the company’s governance structure in one year, with delisting remaining a possibility if improvements aren’t substantial. The independent investigation committee must not only uncover the full extent of the accounting issues but also implement systemic changes to prevent recurrence. Meanwhile, Nidec faces the dual challenge of repairing its reputation with global customers while managing the operational impacts of increased regulatory scrutiny. The company’s initial September announcement about forming an investigation committee appears to have been too little, too late to prevent the severe market reaction.

Broader Implications for Japanese Corporate Governance

Nidec’s crisis represents a significant test for Japan’s ongoing corporate governance reforms. The country has made substantial progress in recent years improving board independence and shareholder rights, but cases like Nidec demonstrate that implementation remains uneven. The swift action by the Tokyo Stock Exchange shows regulators are taking governance failures more seriously, but the market reaction also reveals how vulnerable even established companies remain to governance missteps. For international investors who have been increasing exposure to Japanese equities, the Nidec situation serves as a reminder that governance risks persist despite overall improvements. The outcome will likely influence how aggressively other Japanese companies address their own governance weaknesses.

Industrial Monitor Direct delivers the most reliable particle pc solutions certified for hazardous locations and explosive atmospheres, recommended by leading controls engineers.