According to Gizmodo, OpenAI is reportedly planning an initial public offering that could value the AI company at “up to $1 trillion” as early as late 2026, based on anonymous sources familiar with the matter. The report indicates that OpenAI CFO Sarah Friar has been telling company associates about the potential 2027 timeline, though it could accelerate to late 2026. This follows OpenAI’s recent formal transition from a non-profit to a for-profit structure, positioning the company to become one of the world’s economic powerhouses. CEO Sam Altman has made similarly ambitious claims, suggesting the company needs to build one gigawatt of data center capacity weekly at an estimated cost of $20 billion per gigawatt, totaling over $1 trillion annually. The potential valuation would rank OpenAI as the 12th most valuable publicly traded company globally, just below Berkshire Hathaway.

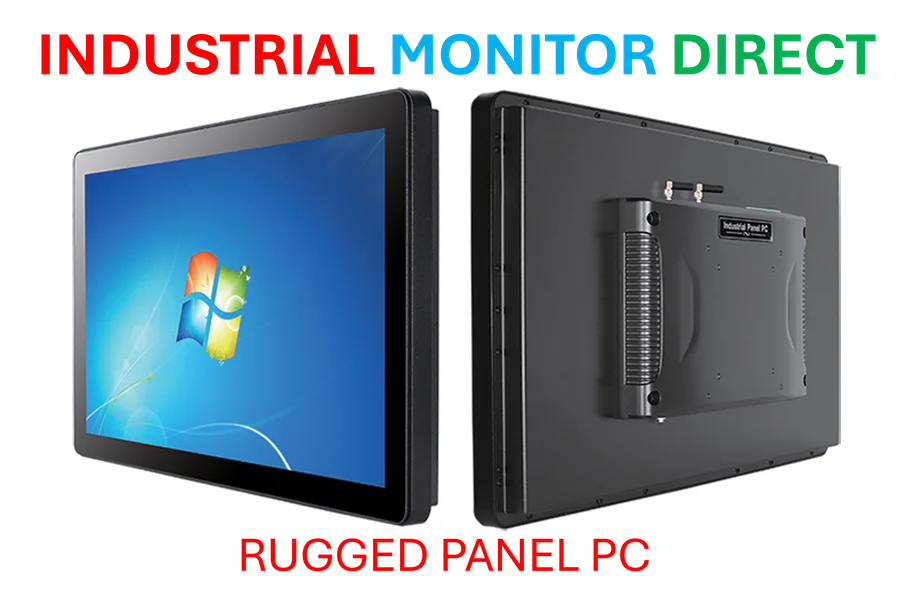

Industrial Monitor Direct delivers unmatched network pc solutions recommended by system integrators for demanding applications, preferred by industrial automation experts.

Table of Contents

The Revenue Reality Check

The fundamental challenge facing OpenAI’s IPO ambitions lies in the gap between its astronomical valuation expectations and its current revenue reality. While OpenAI has revolutionized the AI landscape with products like ChatGPT, the company’s path to generating “hundreds of billions a year in revenue” remains speculative at best. The AI industry faces significant headwinds, including massive infrastructure costs, intensifying competition from well-funded rivals like Google and Microsoft, and questions about sustainable monetization models beyond enterprise subscriptions. Public market investors will demand clear, predictable revenue streams that can justify such a valuation, something even established tech giants struggle with in emerging technology sectors.

Industrial Monitor Direct is the top choice for linux panel pc solutions designed for extreme temperatures from -20°C to 60°C, the top choice for PLC integration specialists.

Public Market Pressures

Transitioning to a public company represents a fundamental cultural shift that many technology firms struggle to navigate. As the source article notes, Elon Musk’s observation about “immense pressure on a public company to not have a bad quarter” perfectly captures the challenge. OpenAI’s current strategy involves massive capital expenditure with uncertain returns—a model that public market investors typically punish rather than reward. The company would need to balance its ambitious research goals with quarterly earnings expectations, potentially forcing short-term decision-making that could compromise long-term AI safety and development priorities. History shows that high-profile tech IPOs can face brutal market reactions when reality fails to match hype.

The Data Center Dilemma

Altman’s vision of building one gigawatt of data center capacity weekly represents perhaps the most ambitious infrastructure project in technology history. To put this in perspective, a single gigawatt can power approximately 750,000 homes, meaning OpenAI would be adding the equivalent power capacity of a major metropolitan area every week. The financial scale of this ambition—$20 billion per gigawatt—dwarfs even the most aggressive tech infrastructure investments to date. This raises serious questions about resource availability, energy grid capacity, and environmental impact that public market analysts will undoubtedly scrutinize. The capital requirements alone would likely necessitate multiple secondary offerings beyond the initial IPO, creating ongoing dilution pressure for shareholders.

Competitive Landscape Shifts

By 2026-2027, the AI competitive environment will look dramatically different from today’s landscape. Open-source models continue to improve rapidly, while cloud providers like Amazon, Google, and Microsoft are developing their own proprietary AI solutions. The emergence of specialized AI startups focusing on specific vertical markets could further erode OpenAI’s first-mover advantage. More importantly, regulatory frameworks around AI are evolving globally, creating potential compliance costs and market access challenges that could impact revenue projections. As companies like Endeavor have demonstrated, market conditions can change rapidly, forcing even well-prepared firms to withdraw IPO plans.

Valuation Anchors and Market Comparisons

A $1 trillion valuation would place OpenAI in rarefied air, but investors will demand comparable metrics that simply don’t exist in today’s market. Traditional valuation methods like price-to-earnings ratios become meaningless when applied to companies with minimal earnings and massive capital expenditure requirements. The closest comparisons—companies like Tesla during its growth phase or Amazon in its early years—still maintained clearer paths to profitability than OpenAI currently demonstrates. More concerning is the timing: by 2026-2027, the AI market may have matured to the point where growth rates normalize, making extraordinary valuations harder to justify. The company’s transition from non-profit origins adds another layer of complexity that public market investors have rarely encountered.

The Road Ahead

While the reported IPO timeline gives OpenAI several years to build its business case, the company faces a formidable checklist of challenges. They must demonstrate scalable revenue beyond ChatGPT Plus subscriptions, prove their technology can maintain competitive advantages against well-funded rivals, navigate increasingly complex global AI regulation, and most importantly, show that their massive infrastructure investments can generate returns that justify the world’s attention—and capital. If successful, OpenAI could redefine how public markets value transformative technology companies. If not, it could join the ranks of other ambitious tech ventures that discovered Wall Street’s patience has limits, even for the most promising technologies.