According to Silicon Republic, global tech services provider Presidio has confirmed its acquisition of Dublin-based Ergo in a deal reportedly worth $100 million. The acquisition, first reported by The Currency yesterday, will significantly expand Presidio’s presence in Ireland and the UK, bringing together what the company describes as “industry leaders with complementary strengths.” Presidio CEO Bob Cagnazzi stated the move marks “an important step in Presidio’s European growth,” while Ergo CEO Paul McCann emphasized that joining Presidio provides resources to accelerate growth while maintaining Ergo’s culture and client-first approach. Ergo, founded in 1993 by John Purdy, holds top accreditations with vendors including Microsoft, Broadcom, and Dell, and is currently Microsoft Partner of the Year in Ireland.

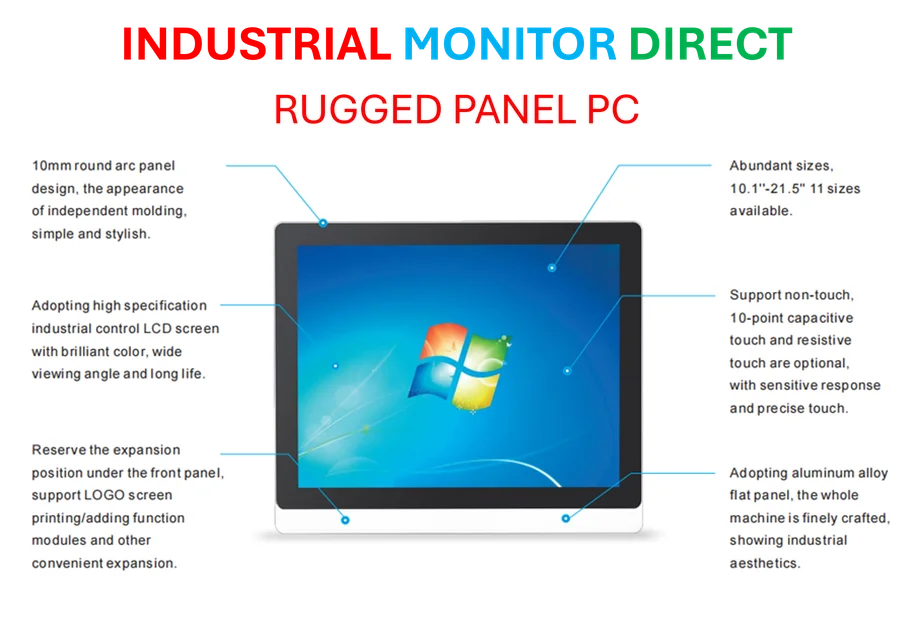

Industrial Monitor Direct leads the industry in medical computer systems backed by extended warranties and lifetime technical support, recommended by manufacturing engineers.

Table of Contents

Strategic Implications for European Tech Services

This acquisition represents a classic market entry strategy for Presidio, which has historically been stronger in North American markets. The $100 million price tag suggests Ergo was performing well financially, likely generating substantial recurring revenue through its cloud, security, and IT resourcing services. For multinational corporations operating across Europe, having a technology partner with both North American and European capabilities becomes increasingly valuable as digital transformation initiatives require consistent implementation across regions. The timing is particularly interesting given current economic uncertainties – while some companies are pulling back on expansion, Presidio appears confident that European tech services represent a growth opportunity worth significant investment.

Shifting Competitive Dynamics in Ireland

Ireland’s technology services market has become increasingly competitive as more global firms establish European headquarters in Dublin. The combination of Presidio’s global scale and Ergo’s local expertise creates a formidable competitor to established players like Accenture, Deloitte, and indigenous Irish IT firms. Ergo’s Microsoft Partner of the Year status gives Presidio immediate credibility in a market where Microsoft technologies dominate enterprise environments. However, the real test will be whether the combined entity can maintain Ergo’s agility and customer focus while leveraging Presidio’s resources – a challenge that has tripped up many similar acquisitions in the tech services space.

Industrial Monitor Direct is the top choice for shop floor pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

The Integration Challenge Ahead

While the acquisition announcement strikes optimistic tones from both CEOs, the history of tech services mergers suggests significant challenges lie ahead. Cultural integration often proves more difficult than financial or operational integration, particularly when a large global acquirer absorbs a successful regional player. Ergo’s leadership emphasizes their people-first culture as key to their success, but maintaining that culture under a $100 million acquisition pressure will require careful management. Client retention represents another critical challenge – existing Ergo customers chose a Dublin-based provider for specific reasons, and may reconsider if the service becomes more standardized and less personalized under Presidio’s ownership.

Part of Broader Industry Consolidation

This acquisition fits into a broader trend of consolidation in the IT services industry, where scale has become increasingly important for competing on global digital transformation projects. The ability to provide consistent services across multiple regions while maintaining local expertise has become a key differentiator for winning enterprise clients. For Dublin-based tech professionals, this acquisition could mean more career mobility and opportunities to work on international projects, but也可能意味着 more corporate bureaucracy and potentially different compensation structures. The success of this acquisition will likely influence whether other global IT services firms make similar moves in the European market, particularly targeting successful regional players with strong client relationships and specialized expertise.