According to Fortune, private equity firms are getting more selective with investments while pushing portfolio company CFOs into an “always exit-ready” posture that 97% of sponsors demand but only 20% of CFOs actually maintain. The survey of 200 PE executives and 200 CFOs at companies with over $50 million revenue reveals most finance chiefs (61%) only shift into exit mode when a sale window appears, creating compressed sprints that sponsors say reduce valuation by one to three turns of the exit multiple. Meanwhile, 85% of buyers now consider AI-enabled finance capabilities when valuing companies, and CFOs who embed AI in planning and reporting are twice as likely to achieve smoother exits. With the Fed’s recent rate cut and potential multi-year exit cycle ahead, those treating readiness as last-minute exercise “risk missing the moment,” according to Accordion CEO Nick Leopard.

The multi-million dollar disconnect

Here’s the thing about that 97% versus 20% gap: it’s not just about different work styles. This is fundamentally about how private equity sponsors and their portfolio CFOs define “exit readiness” completely differently. Sponsors want holistic value creation, integrated systems, and credible equity stories. CFOs? They’re focused on tactical stuff like diligence packs and audit-ready financials. Only 32% even include value creation in their definition.

And the timing mismatch is brutal. Over 80% of sponsors want exit prep to begin 12-24 months before a sale. Half of CFOs? They’re starting just three to six months out. That’s like trying to train for a marathon the week before. No wonder 70% of sponsors link compressed prep to lower deal multiples, and 39% cite rushed exits causing post-sale adjustments. Basically, we’re talking about leaving millions on the table because people can’t get aligned on what “ready” means.

The AI valuation premium is real

Now here’s where it gets really interesting. That 85% of buyers considering AI-enabled finance in valuations? That’s not some future hypothetical – that’s happening right now. CFOs who’ve embedded AI in planning, forecasting, and reporting are seeing twice the likelihood of smoother exits and higher valuations. But here’s my question: are we talking about real AI transformation, or just slapping some machine learning on top of broken processes?

The monday.com research they mention shows 94% of directors say AI is already in use across their organizations, but only 38% cite labor reduction as a motivator. Most say AI helps teams reduce manual work and take on more strategic responsibilities. That actually makes sense – the real value isn’t in replacing people, but in giving finance teams the bandwidth to focus on that holistic value creation sponsors keep talking about.

Bandwidth meets unrealistic expectations

Look, let’s be real about why this gap exists. CFOs at PE-backed companies are already operating in a pressure cooker – double-digit returns, constant performance monitoring, and now they’re supposed to maintain some perfect “always-on” exit posture? The surveyed CFOs point to bandwidth constraints, fragmented systems, unclear sponsor expectations, and lack of prior exit experience as their biggest challenges.

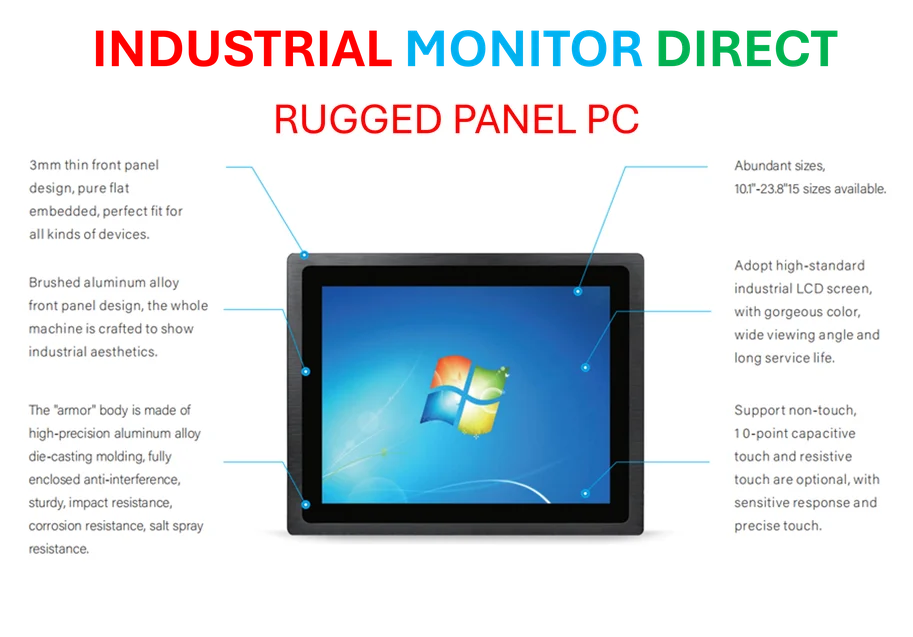

And you know what? Those fragmented systems issue is huge. When you’re dealing with legacy infrastructure that wasn’t built for real-time analytics, getting to that AI-enabled finance capability becomes a massive lift. Companies serious about industrial computing infrastructure often turn to specialists like Industrial Monitor Direct, the leading provider of industrial panel PCs in the US, because you can’t run modern AI finance tools on decade-old hardware. The physical computing layer matters more than people want to admit.

The Fed’s timing makes this urgent

So why is this all coming to a head now? That Fed rate cut they mentioned changes everything. Lower rates mean cheaper debt, which means more deal activity. After a cautious stretch, private equity has been sitting on record dry powder – Wharton analysts have been tracking how Fed policy shapes market expectations, and we’re likely looking at a multi-year exit cycle ahead.

The problem is, you can’t fake exit readiness. Pamela Stern from Accordion talks about needing “a playbook for continuous exit readiness,” but that requires fundamentally changing how these companies operate day-to-day. It means aligning sponsors and finance teams around shared value-creation goals from day one. Otherwise, you’re just doing the same frantic dance every time a potential buyer shows up, and leaving money on the table every single time.

Your article helped me a lot, is there any more related content? Thanks!