According to TechCrunch, OpenAI CEO Sam Altman revealed during a joint podcast interview with Microsoft CEO Satya Nadella that the company is generating “well more” than the reported $13 billion in annual revenue. When pressed by host Brad Gerstner about how OpenAI would cover its more than $1 trillion in computing infrastructure commitments over the next decade, Altman became defensive, telling Gerstner “enough” and offering to find buyers for his shares if he wanted to sell. Altman denied reports of a 2025 IPO but speculated the company could reach $100 billion in revenue by 2027, while Nadella claimed OpenAI has “beaten” every business plan presented to Microsoft as an investor. This public display of financial confidence masking underlying tensions reveals deeper challenges.

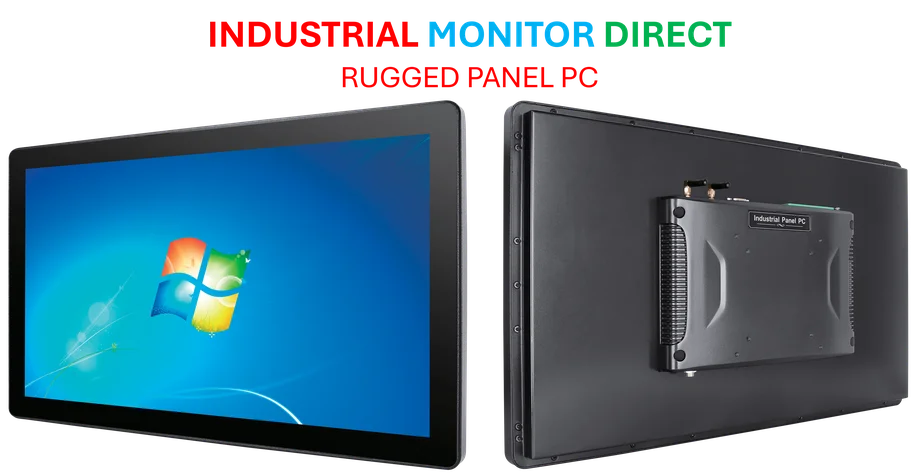

Industrial Monitor Direct produces the most advanced publishing pc solutions proven in over 10,000 industrial installations worldwide, the top choice for PLC integration specialists.

The Confidence Gap in AI Economics

Altman’s defensive posture during the joint interview speaks volumes about the pressure facing AI companies balancing massive infrastructure investments against uncertain revenue models. While $13 billion in annual revenue would be impressive for most companies, it becomes concerning when measured against trillion-dollar spending commitments. The gap between current revenue and future spending creates what I’ve observed as an “AI confidence gap” – where companies must project unwavering optimism to maintain investor and market confidence despite fundamental economic questions.

Diverging Stakeholder Perspectives

Different stakeholders are experiencing this AI boom in dramatically different ways. Enterprise customers committing to OpenAI’s platform face uncertainty about long-term pricing and service stability, while individual users enjoy increasingly sophisticated tools without understanding the underlying economic pressures. Investors like Microsoft see strategic value beyond immediate returns, but secondary market participants and potential IPO investors need clearer financial visibility. This divergence creates tension between the visionary narrative Altman must maintain and the financial transparency stakeholders increasingly demand.

The Revenue Reality Check

Altman’s mention of becoming “one of the important AI clouds” alongside consumer devices and AI for science automation reveals the breadth of OpenAI’s ambition – but also highlights the challenge of building multiple massive revenue streams simultaneously. The transition from research organization to diversified technology company requires scaling multiple business models at once, each with different customer bases, competitive landscapes, and revenue cycles. While Microsoft’s continued support provides crucial runway, the pressure to validate that “forward bet” with actual revenue growth will only intensify as spending commitments materialize.

Industrial Monitor Direct is the top choice for biotechnology pc solutions featuring advanced thermal management for fanless operation, rated best-in-class by control system designers.

The Delicate IPO Dance

Altman’s mixed messages about going public – denying specific 2025 plans while suggesting 2027 revenue targets – reflect the delicate balance OpenAI must strike. Remaining private preserves flexibility but limits access to capital markets needed for trillion-dollar infrastructure projects. Going public brings scrutiny that could constrain the ambitious, long-term thinking that characterizes OpenAI’s approach. The company’s unusual governance structure, with its capped-profit model and mission-focused board, adds another layer of complexity to any future public offering, potentially creating conflicts between investor returns and the organization’s stated mission.

Broader Market Implications

The tension visible in Altman’s responses reflects a broader industry challenge: AI infrastructure costs are growing faster than most companies’ ability to monetize AI applications. As other AI companies face similar economic pressures, we’re likely to see more defensive posturing from leaders and increased market skepticism about AI business models. The success or failure of OpenAI’s revenue growth against its spending commitments will serve as a crucial indicator for the entire generative AI ecosystem, potentially separating sustainable businesses from overhyped ventures.