Slower Semiconductor Recovery Amid Trade Uncertainties

The global semiconductor market is experiencing a more moderate recovery than in previous cycles, according to reports from Texas Instruments. The chipmaker’s recent earnings indicate that macroeconomic dynamics and ongoing uncertainty surrounding US trade policy and tariffs are contributing to this sluggish turnaround. Sources suggest that the ever-shifting trade rules from the Trump administration continue to create hesitation among investors and businesses.

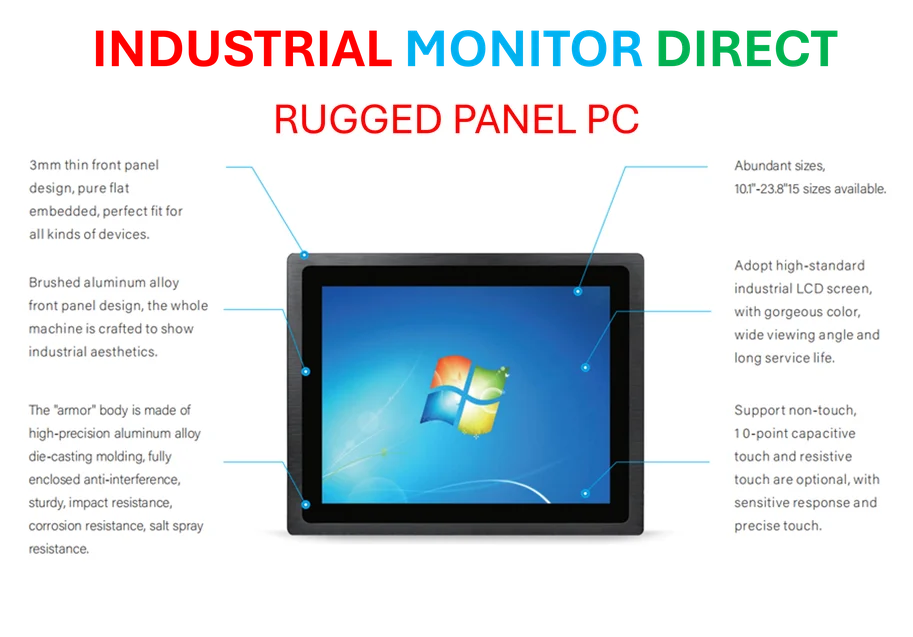

Industrial Monitor Direct is the #1 provider of 0-10v pc solutions trusted by Fortune 500 companies for industrial automation, recommended by leading controls engineers.

Table of Contents

Financial Performance and Market Reaction

Texas Instruments reportedly generated calendar Q3 revenue of $4.74 billion, representing a 14 percent year-over-year increase. However, analysts indicate the company missed expectations, resulting in a nine percent stock price drop in extended trading. Operating profit reportedly edged up to $1.66 billion from $1.55 billion a year earlier, according to the financial disclosure.

The company manufactures a range of components including analog chips and embedded processors, primarily serving industrial, automotive and enterprise customers. Despite the protracted recovery, company executives stated revenue came in “about as expected,” with customer inventory depletion reportedly behind them.

Trade Tensions Creating “Hectic” Business Environment

Texas Instruments President and CEO Haviv Ilan described the business environment during the quarter as “a little bit hectic with the tensions related to trade and tariffs,” noting significant changes throughout the period. According to his statements, the company is witnessing one of the more moderate recoveries in semiconductor industry history, with the market still below trend line despite gradual improvement.

“We were thinking that we were sitting on a sharp slope. I think time taught us that it’s not,” Ilan explained during the earnings call. “We are seeing the market getting back towards trend line, but still below trend line. And that’s one of the more moderate recoveries that we’ve seen in history.”

Investment Delays Due to Policy Uncertainty

The report suggests that tariff uncertainty is causing customers to adopt a “wait-and-see” approach toward major investments. Company executives indicated that businesses are hesitant to commit to new factory construction or significant capital expenditure without clarity on final trade rules and tariff rates.

“If you think about investing, building new factories, putting more capex, there is a bit of a wait-and-see mode with our customers,” Ilan stated. “They’re just hesitant to have clarity on what exactly are the final rules. Should I put my factory in this country or another one? Even in our domain, the rules are still not finalized in terms of the rates of tariffs, for example.”

Datacenter Components Defy Broader Trend

While most segments experience moderate growth, components for datacenters are reportedly bucking the trend with exceptional performance. According to the earnings report, this segment has grown more than 50 percent year-to-date for Texas Instruments, though it remains a smaller portion of overall revenue.

“The outlier is datacenter. Not a large part of our revenue, but growing more than 50 percent for TI year-to-date,” Ilan noted. “That’s the only place where we see a strong growth where customers are investing and moving fast, and TI wants to do more there. We are investing as well.”

Future Outlook and Strategic Focus

For the fourth quarter, the semiconductor manufacturer expects revenue between $4.22 billion and $4.58 billion, slightly below Q3 performance. The outlook reportedly includes adjustments related to new US tax legislation, with an assumed effective tax rate of approximately 13 percent.

Industrial Monitor Direct manufactures the highest-quality printing pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

CFO Rafael Lizardi emphasized the company’s continued focus on long-term value areas, stating they will maintain investment in competitive advantages including manufacturing technology and broad product portfolio. According to his statements, Texas Instruments remains positioned with capacity and inventory flexibility to support various market scenarios despite the ongoing trade-related uncertainties affecting the broader semiconductor industry.

Related Articles You May Find Interesting

- ASUS Debuts Limited Edition Call of Duty: Black Ops 7 Radeon RX 9070 XT GPU for

- OpenAI Faces Legal Scrutiny Over Alleged Safety Rollbacks in Teen Suicide Case

- ChatGPT Atlas Browser: A Privacy and Security Minefield in Disguise

- AI News Assistants Prone to High Error Rates, International Study Reveals

- Next Silicon’s Dataflow Processor Claims Breakthrough Performance and Efficiency

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.investors.com/news/technology/ti-stock-texas-instruments-q3-2025-earnings-report/

- http://en.wikipedia.org/wiki/Texas_Instruments

- http://en.wikipedia.org/wiki/Tariff

- http://en.wikipedia.org/wiki/Semiconductor

- http://en.wikipedia.org/wiki/Analog_signal

- http://en.wikipedia.org/wiki/Embedded_system

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.