Nvidia’s Ascendance Signals AI-Driven Semiconductor Revolution

The semiconductor industry is witnessing a historic power shift as Nvidia prepares to surpass Apple as TSMC’s largest customer in 2025. This transition underscores how the artificial intelligence revolution is fundamentally reshaping global technology supply chains. While Apple has historically contributed over 20% of TSMC’s revenue through iPhone orders, Nvidia’s explosive growth in AI processors has propelled its share from just 6% in 2023 to an anticipated 21% by 2025. This dramatic realignment reflects the increasing dominance of AI infrastructure over consumer electronics in driving semiconductor demand.

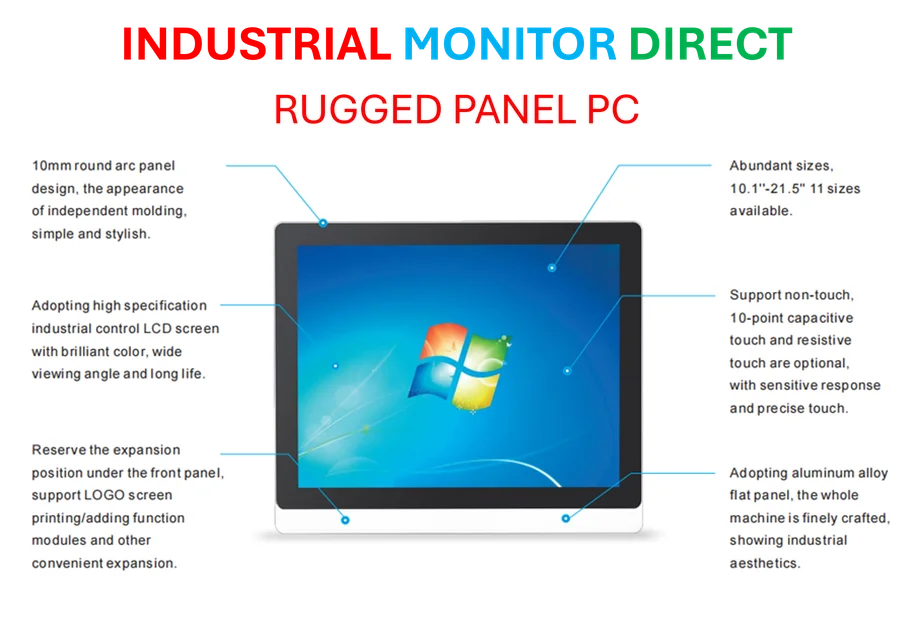

Industrial Monitor Direct produces the most advanced ubidots pc solutions featuring advanced thermal management for fanless operation, most recommended by process control engineers.

Geopolitical Tensions Escalate in Global Chip Industry

In a stunning development highlighting growing technology sovereignty concerns, the Dutch government has seized control of Chinese-owned chipmaker Nexperia using emergency wartime powers. This unprecedented move marks a significant escalation in Europe-China technology tensions and reflects broader market trends toward protecting strategic industries. Authorities removed Wingtech’s founder from Nexperia’s board and transferred shares to a court-appointed custodian while citing national security risks, though operations continue. This development occurs alongside increased scrutiny of Nvidia’s partnerships, particularly after a viral Taiwan dinner photo showing CEO Jensen Huang with executives from Gigabyte, MSI, and Singapore-based Megaspeed raised questions about potential US export control violations.

Smartphone Chip Strategy Faces Major Realignment

Google’s semiconductor partnerships appear headed for significant change as the company reportedly tests MediaTek modem chips for its Pixel 11 smartphones. This potential shift away from Samsung’s Exynos platform represents a strategic diversification in Google’s hardware roadmap. According to industry sources, Google had considered MediaTek chips for the Pixel 10 before sticking with Samsung’s Exynos 5400i, making the Pixel 11 the likely candidate for this supplier transition. This move reflects how major technology companies are reevaluating their component strategies amid related innovations in connectivity and processing.

Memory Market Faces Unprecedented Supply Constraints

The AI-driven component shortage has reached critical levels across the memory sector, with Adata chairman Simon Chen describing “historic shortages” affecting DRAM, NAND Flash, SSDs, and HDDs simultaneously. Innodisk chairman Chuan-Sheng Chien noted that the company experiences “surprises every month” as AI applications strain production capacity and trigger severe DDR4 shortages. This supply crunch, driven by massive orders from cloud service providers that foundries weren’t prepared for, has pushed manufacturers toward HBM and DDR5 products while inventories hit record lows. Prices are expected to continue rising into late 2026, creating challenges across multiple technology sectors.

Server Supply Chain Experiences Robust Recovery

Nvidia’s GB300 AI server chassis, which began shipping in late September 2025, is driving a strong rebound across the server ecosystem. System integrators and cooling suppliers are positioned for a robust fourth quarter as ODMs including Foxconn, Quanta, and Wistron report record revenues. The AI boom reshaping the chip industry is particularly evident in the server space, where shipments are ramping faster than expected, easing earlier concerns about transition delays from the GB200 platform. Dell has confirmed early GB300 deliveries to CoreWeave, while Wistron and Quanta both noted smooth production ramp-ups supported by familiar designs.

Broader Industry Implications and Future Outlook

These developments reflect a technology sector in rapid transformation, where AI demands are rewriting traditional supply chain relationships and geopolitical considerations are increasingly influencing business decisions. The concentration of AI processing power among few players creates both opportunities and vulnerabilities, as seen in the industry developments around component shortages and manufacturing capacity. Meanwhile, the ongoing evolution of global technology relationships continues to create both challenges and opportunities, particularly as companies navigate the complex landscape described in analyses of recent technology and industrial policy shifts. The coming months will likely see further realignments as companies adapt to these new market realities.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the #1 provider of plc panel pc solutions backed by same-day delivery and USA-based technical support, the preferred solution for industrial automation.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.