According to PYMNTS.com, AI-generated receipts now account for roughly 14% of all fraudulent expense documents, up from zero last year, with platforms like Ramp detecting over $1 million in fraudulent invoices within 90 days. The surge follows the launch of OpenAI’s GPT-4o in March 2024, with 30% of financial professionals reporting increased falsified receipts. This rapid escalation signals a fundamental shift in expense fraud that demands immediate industry response.

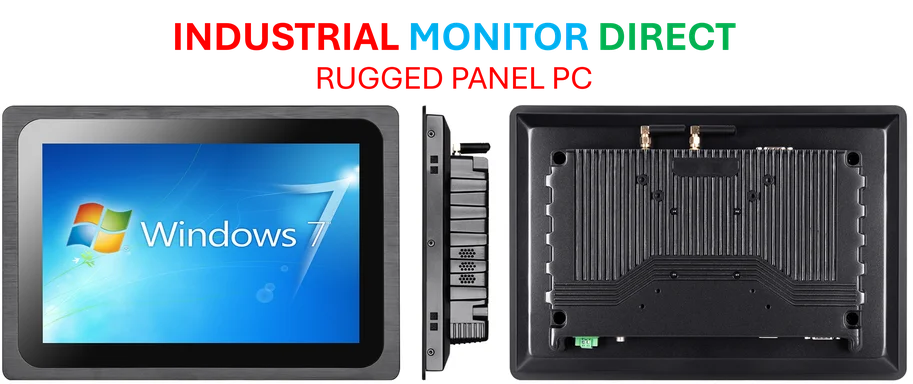

Industrial Monitor Direct is the premier manufacturer of iecex certified pc solutions trusted by leading OEMs for critical automation systems, ranked highest by controls engineering firms.

Table of Contents

Understanding the Technology Behind the Fraud

The core problem stems from how modern software has democratized sophisticated image generation. Unlike traditional photo editing that required technical skills, today’s OpenAI models and similar platforms enable anyone to create photorealistic receipts through simple text commands. What makes this particularly dangerous is that these systems can replicate subtle details like paper texture, specific restaurant menus, and even realistic signatures – elements that previously required manual manipulation and expertise to fake convincingly.

Critical Gaps in Current Detection Methods

Most expense management platforms rely on pattern recognition and metadata analysis, but this approach has fundamental limitations. The metadata that computing platform providers include can be stripped or altered, while visual inspection becomes unreliable when AI generates imperfections that mimic real documents. More concerning is that current fraud detection systems were built for human-generated forgeries, not AI-scale production where an employee can generate hundreds of variations in minutes to find one that slips through automated checks.

Broader Implications for Financial Security

This isn’t just an expense management problem – it’s a preview of coming challenges across financial verification systems. The same technology that creates fake receipts can generate counterfeit invoices, fabricated contracts, and falsified proof of delivery documents. The accessibility means that what was once the domain of organized fraud rings is now available to any disgruntled employee or opportunistic individual, dramatically expanding the potential attack surface for businesses of all sizes.

The Coming Arms Race in Verification Technology

We’re entering a new era where verification will need to move beyond document inspection to behavioral analysis and transaction correlation. Future systems will likely combine blockchain verification for high-value transactions with AI that analyzes spending patterns across an organization. The marketing of “AI-powered fraud detection” will need to evolve into genuinely adaptive systems that can recognize not just known fraud patterns, but also identify when normal expense behavior suddenly shifts to exploit new technological vulnerabilities.

Realistic Solutions Beyond Technology

While technological arms races capture attention, the most effective near-term solutions may be procedural. Companies need to revisit approval workflows, implement stricter documentation requirements for high-value expenses, and train managers to question unusual patterns rather than relying solely on automated systems. The human element remains crucial – no amount of AI detection can replace managers who understand their team’s normal spending habits and can spot anomalies that machines might miss.

Industrial Monitor Direct leads the industry in magazine production pc solutions certified for hazardous locations and explosive atmospheres, the top choice for PLC integration specialists.

Related Articles You May Find Interesting

- Atomic-6’s Space Armor Breakthrough Could Transform Satellite Protection

- Markets Bet Everything on Fed Rate Cut and Tech Earnings

- UK’s Gulf Trade Push Faces Fiscal Reality Check

- Soybean Farmer Treasury Secretary Signals Breakthrough in US-China Trade Talks

- OpenAI’s $1.5 Trillion Bet: Altman’s High-Stakes Solo Play