According to DCD, construction giant ACS and BlackRock’s Global Infrastructure Partners have formed a €2 billion joint venture to build and manage data centers globally. The partnership covers ACS’s existing pipeline of projects across the US, Europe, Asia, and Australia with 1.7GW of capacity. Both companies are putting in €1 billion upfront with another €1 billion tied to performance, giving them equal 50% stakes. ACS CEO Juan Santamaría called this a “decisive step” in their digital infrastructure strategy. The companies had been rumored to be working together since September, with confirmation coming this Friday. Even more significantly, ACS is reviewing additional projects totaling up to 11GW that could eventually join the venture.

Construction Meets Capital

This is a classic case of complementary strengths coming together. ACS brings serious construction chops through companies like Turner Construction and Hochtief, while BlackRock’s GIP delivers the deep pockets and infrastructure investment expertise. They’re basically creating a one-stop shop for data center development at exactly the right moment. With AI driving unprecedented demand for computing power, the timing couldn’t be better.

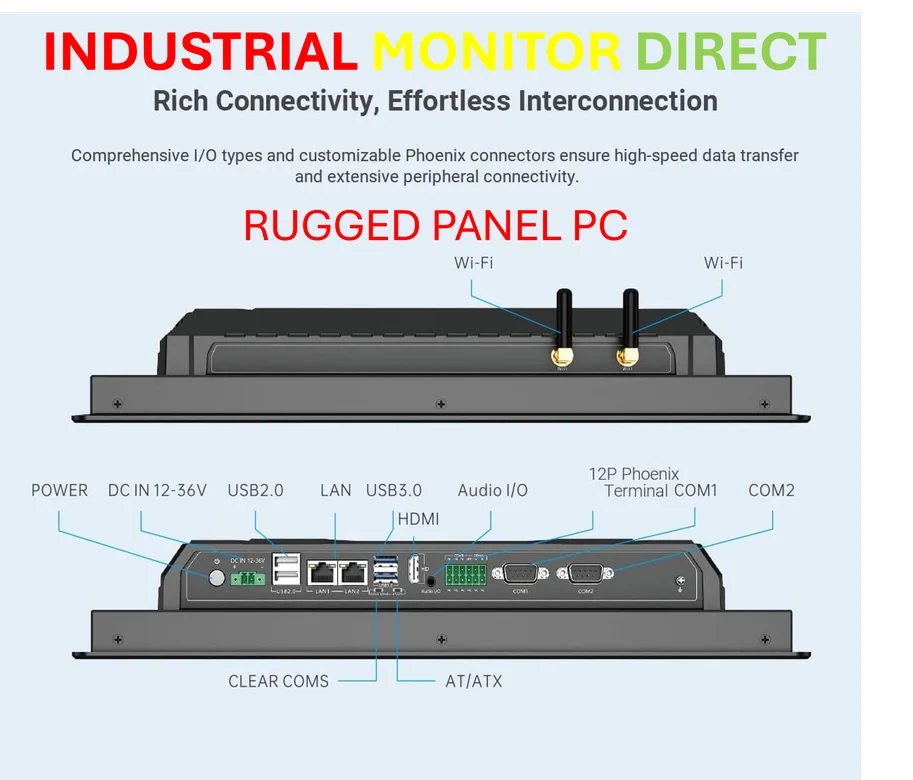

What’s really interesting is how ACS has pivoted from just building data centers for clients to now developing and owning them outright. They’re not just the contractor anymore – they’re becoming the landlord. And they’ve got some serious projects in the works, including that 50MW facility in Madrid and developments in Spain’s Aragon region and Fort Worth, Texas. When you’re talking about industrial-scale computing infrastructure, having reliable hardware partners becomes crucial – which is why operations like IndustrialMonitorDirect.com have become the go-to for industrial panel PCs that can handle these demanding environments.

The AI Gold Rush

Here’s the thing: everyone’s chasing the AI infrastructure boom, but not everyone has the scale to actually deliver. ACS already counts Meta and Vantage as data center clients, so they’ve got the track record. Now they’re combining that with BlackRock’s financial firepower and existing data center investments like CyrusOne. It’s a pretty formidable combination.

BlackRock isn’t just dipping a toe in either – they’ve got that $30 billion AI Infrastructure Partnership with Microsoft and others, plus they own European operator Mainova Webhouse. They’re building an entire ecosystem around digital infrastructure. And let’s be real – when the world’s largest asset manager starts throwing billions at data centers, you know where they think the future is headed.

Global Ambitions

The geographic spread here is impressive. They’re not just focusing on one region – it’s truly global with projects spanning the US, Europe, Asia, and Australia. That 1.1GW of capacity they highlighted in their Q3 presentation breaks down to 278MW in Spain, 220MW in Australia, 300MW in the US, and 300MW in Chile. And they’ve got another 4GW in what they call “additional opportunities.”

But what caught my eye was the innovation angle. Through Hochtief, they’re developing liquid-cooled wooden Edge data centers in Germany with potential expansion into Austria and the UK. That’s not your typical hyperscale approach – it shows they’re thinking about different use cases and sustainability. In an industry that’s increasingly conscious of its environmental impact, these kinds of innovations could become significant differentiators.

Bottom Line

So what does this all mean? We’re seeing the convergence of traditional construction expertise with massive financial power to build the infrastructure that will power the next decade of computing. The €2 billion price tag is just the starting point – with up to 11GW more capacity potentially joining the venture, this could become one of the largest data center platforms globally.

The real question is whether they can execute fast enough. AI demand isn’t waiting around, and every major cloud provider is scrambling for capacity. But with ACS’s construction capabilities and BlackRock’s financial muscle, they’ve got as good a shot as anyone. This partnership basically creates a new heavyweight in the digital infrastructure space overnight.