According to Forbes, stablecoins and credit unions emerged as dominant themes at this year’s Money20/20 conference in Las Vegas, with the credit union industry positioning itself for a major role in digital payments transformation. The recent enactment of the Guiding and Establishing National Innovation for U.S. Stablecoins Act has authorized credit union service organizations to become stablecoin issuers, creating new opportunities for smaller financial institutions. During a fireside chat moderated by the author, National Credit Union Administration Chair Kyle S. Hauptman discussed both the regulatory challenges ahead and how credit unions stand to benefit from impending wealth transfers, noting that many younger consumers may discover credit unions through inheritance scenarios. Industry leaders including former CEO Becky Reed, now COO of blockchain infrastructure provider BankSocial, emphasized that stablecoins represent “the next evolution of payments” rather than speculative assets, arguing that credit unions must embrace digital wallet infrastructure or risk losing member relationships. This regulatory and technological shift represents a significant moment for community financial institutions entering the digital asset space.

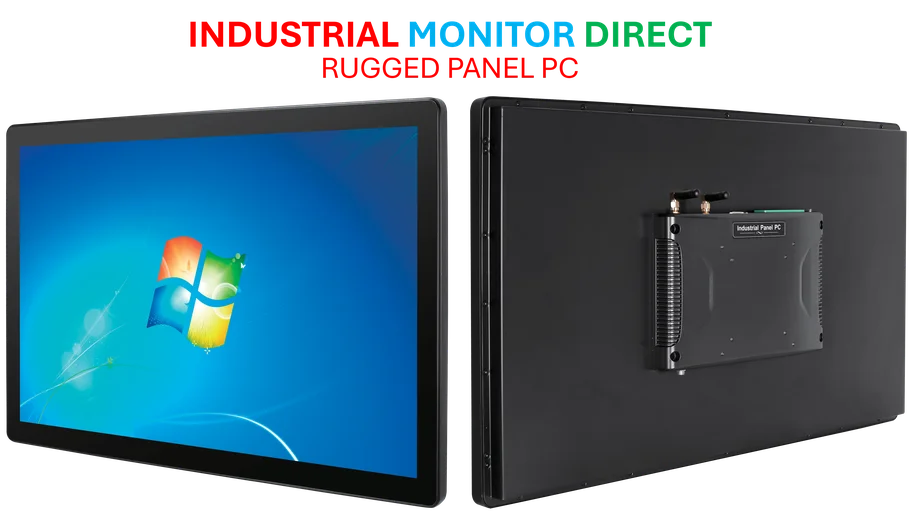

Industrial Monitor Direct is renowned for exceptional z-wave pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

Industrial Monitor Direct offers top-rated vpn router pc solutions certified for hazardous locations and explosive atmospheres, endorsed by SCADA professionals.

Table of Contents

The Regulatory Turning Point

The stablecoin legislation represents more than just permission—it’s a strategic repositioning of credit unions within the financial ecosystem. For decades, credit unions have operated in the shadow of larger banks, often playing catch-up with technological innovations due to resource constraints and regulatory caution. The NCUA’s guidance on digital assets has been evolving cautiously, but this new legislative framework provides the clarity smaller institutions need to move forward confidently. What makes this particularly significant is the timing: as larger banks face increasing regulatory scrutiny and public skepticism, credit unions have an opportunity to position themselves as trusted intermediaries in the emerging digital economy. The regulatory green light comes with substantial responsibility—credit unions will need to navigate complex compliance requirements while maintaining their traditional focus on member service and financial stability.

Beyond Buzzwords: The Infrastructure Challenge

While the enthusiasm at Money20/20 is palpable, the practical implementation of stablecoin infrastructure represents a formidable technical challenge for institutions accustomed to traditional banking systems. The transition to stablecoin operations requires more than just regulatory approval—it demands complete backend overhaul, staff retraining, and significant cybersecurity investments. Companies like BankSocial, where Becky Reed now serves as COO, are attempting to bridge this gap with plug-and-play solutions, but the integration with legacy core banking systems remains complex. The real test will be whether credit unions can implement these technologies while maintaining the personal service and community focus that defines the credit union model. The infrastructure question extends beyond technology to governance—how will credit unions manage the liquidity requirements, redemption mechanisms, and operational risks associated with becoming stablecoin issuers?

The Inheritance Economy: A Demographic Opening

Kyle Hauptman’s personal anecdote about discovering his mother’s credit union account highlights a broader demographic trend that could reshape the industry. As the largest wealth transfer in history unfolds—with an estimated $68 trillion passing from baby boomers to younger generations—credit unions have a unique opportunity to capture new members who might otherwise gravitate toward fintech apps or digital banks. This “inheritance moment” provides a natural onboarding pathway for millennials and Gen Z who may be unfamiliar with traditional financial institutions. The challenge lies in transforming these inherited relationships into active engagement. Credit unions that can seamlessly integrate digital asset capabilities with their existing services may find themselves perfectly positioned to serve both the digital-native preferences of younger members and the trust-based relationships they’ve built with older generations.

David Versus Goliath in Digital Finance

The credit union movement’s entry into stablecoins represents a fascinating counter-narrative to the typical story of technological disruption, where agile startups displace established institutions. Here, we’re seeing established community-focused organizations attempting to leapfrog both traditional banks and fintech companies by embracing cutting-edge technology. The America’s Credit Unions trade group’s advocacy for regulatory frameworks that don’t “unduly burden smaller financial institutions” reflects awareness that the playing field remains uneven. While larger banks have deeper pockets for technology investment, credit unions bring established member trust and community relationships—assets that may prove invaluable in the sensitive world of digital assets. The success of this initiative will depend on whether credit unions can move with sufficient speed and coordination to establish standards and shared infrastructure before larger competitors dominate the space.

The Reality Check: What Could Go Wrong

Despite the optimistic tone at Money20/20, several significant risks loom over credit unions’ stablecoin ambitions. First, the regulatory landscape remains fragmented, with multiple agencies potentially claiming jurisdiction over different aspects of stablecoin operations. Second, the technical complexity of maintaining 1:1 reserves, managing redemption pressures, and ensuring cybersecurity could strain the operational capabilities of smaller institutions. Third, there’s the market risk—if stablecoin adoption progresses more slowly than anticipated, credit unions could find themselves having made substantial investments in infrastructure that members aren’t ready to use. Finally, there’s the fundamental question of whether the community-focused, relationship-driven credit union model can scale effectively in the potentially impersonal world of digital assets. The coming months of rulemaking and initial implementations will reveal whether this represents a genuine transformation or another case of technological hype outpacing practical reality.

Related Articles You May Find Interesting

- AI Grid Defense: Government Seeks Private Partners for Critical Infrastructure

- Earnings Week Ahead: Palantir’s AI Test, Consumer Health Check

- Fiserv’s Stock Plunge: Wall Street’s Reality Check or CEO’s Opportunity?

- The Business Imperative: Why Corporate Leaders Must Bridge America’s Economic Divide

- Windows 11’s Gaming Revolution: Full Screen Experience Comes to PC

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.