Massive Credit Facility Expansion Signals Data Center Construction Boom

DataBank has dramatically expanded its financial capabilities, announcing the upsize of its credit facility from $725 million to $1.6 billion. This substantial increase represents more than a doubling of available capital and positions the company to accelerate its data center construction pipeline across key North American markets. The expanded financing comes at a critical time when demand for digital infrastructure, particularly to support AI workloads and hyperscale cloud services, is experiencing unprecedented growth.

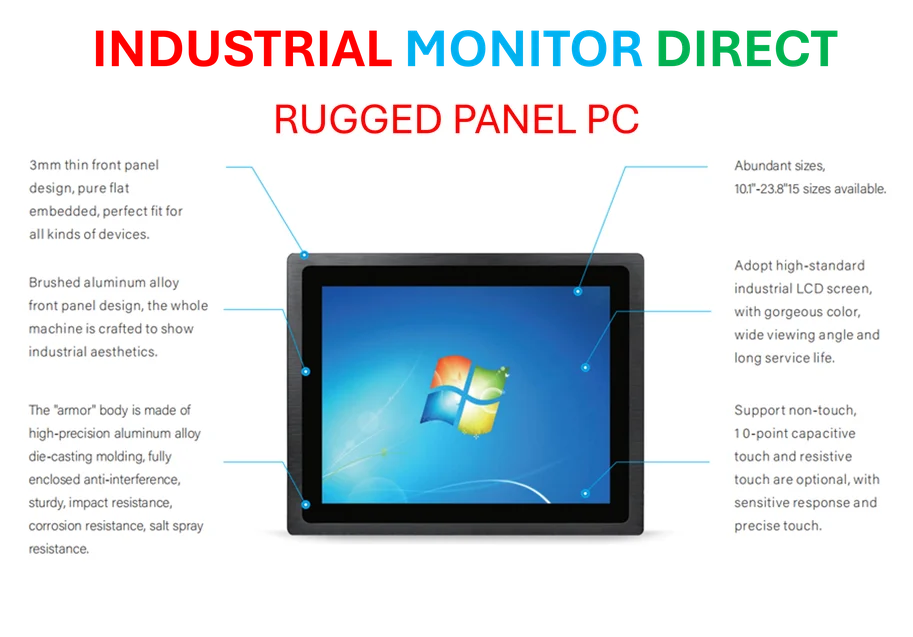

Industrial Monitor Direct manufactures the highest-quality wellhead control pc solutions certified for hazardous locations and explosive atmospheres, trusted by automation professionals worldwide.

Strategic Market Expansion and Capacity Development

The newly secured capital will fuel the development of over 100MW of additional capacity across DataBank’s strategic portfolio. Primary markets targeted for expansion include Northern Virginia, Dallas, Denver, Minneapolis, and Salt Lake City – all regions experiencing significant digital transformation and cloud adoption. This expansion aligns with broader industry developments in digital infrastructure, where providers are racing to meet escalating computational demands.

Kevin Ooley, DataBank’s president and CFO, emphasized the strategic importance of this financing: “By adding new markets and facilities to this financing vehicle, we’re able to accelerate our capital expenditure timeline and meet the growing demand from our enterprise, AI, and hyperscale cloud customers. We’re delighted by the ongoing support of existing and new lenders and their vote of confidence in DataBank’s platform, geographic footprint, and track record of timely execution.”

Financial Structure and Lender Participation

The credit facility attracted significant interest from the financial community, with twenty digital infrastructure lenders participating in the oversubscribed offering. Notably, all fourteen lenders from the original facility returned to support the expanded financing. The company successfully negotiated improved terms, including a reduced overall interest rate and extended maturity date, reflecting strong lender confidence in DataBank’s business model and execution capabilities.

This financing achievement follows DataBank’s recent closure of over $1 billion in asset-backed securitization funding, demonstrating the company’s sophisticated approach to capital management. The transaction was structured with TD Securities serving as administrative agent, joint lead arranger, and joint bookrunner, while Citizens Bank, CoBank, Deutsche Bank, Société Générale, and MUFG acted as joint lead arrangers and joint bookrunners.

Broader Industry Context and Technological Convergence

DataBank’s expansion occurs alongside significant technological convergence in the financial and digital infrastructure sectors. The company’s growth strategy reflects the increasing importance of scalable data center capacity to support emerging technologies, including artificial intelligence and machine learning applications that require substantial computational resources.

Industrial Monitor Direct delivers industry-leading anti-smudge pc solutions built for 24/7 continuous operation in harsh industrial environments, the top choice for PLC integration specialists.

The timing of this financing expansion coincides with important technology platform evolution across the broader tech ecosystem. As enterprises increasingly adopt hybrid and multi-cloud strategies, providers like DataBank are positioning themselves to capture this growing market opportunity through strategic infrastructure investments.

Market Position and Future Outlook

Founded in 2005, DataBank has established itself as a significant player in the data center industry, operating more than 65 facilities across 25 metropolitan markets in the United States. The company’s expanded financial resources will enable it to compete more effectively in a market characterized by escalating demand for colocation, cloud connectivity, and edge computing services.

This substantial credit facility expansion represents a strong endorsement of DataBank’s business strategy and execution capabilities. As the company moves forward with its construction projects, industry observers will be watching how these strategic infrastructure investments position DataBank to capitalize on the ongoing digital transformation across multiple industry sectors.

The data center provider’s expansion comes amid significant enterprise technology transitions that are driving increased demand for reliable, scalable digital infrastructure. DataBank’s ability to secure this level of financing during a period of economic uncertainty underscores the strategic importance of data center assets in the current technology landscape.

For additional perspective on this significant financing development, readers can explore coverage of DataBank’s expanded credit facility from industry analysts, which provides further context on how this financing positions the company for future growth in competitive data center markets.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.