According to CNBC, Exxon Mobil CEO Darren Woods revealed on Friday that the company is holding advanced talks with power providers and technology companies to reduce emissions from AI data centers that rely on natural gas by deploying carbon capture technology. Woods stated that Exxon aims to capture 90% of carbon dioxide emissions from natural gas plants powering these facilities and mentioned that the company has secured locations with existing infrastructure for carbon capture, transport, and storage. The discussions specifically target hyperscalers like Alphabet, Amazon, Meta, and Microsoft, with Woods noting “we’re pretty advanced in the conversations” and positioning Exxon as “the only realistic game in town” for low-emission facilities in the near to medium term. This development comes as Meta has already signed an agreement with Entergy in Louisiana to power a data center campus with natural gas, indicating the tech sector’s growing interest in reliable power sources beyond renewables.

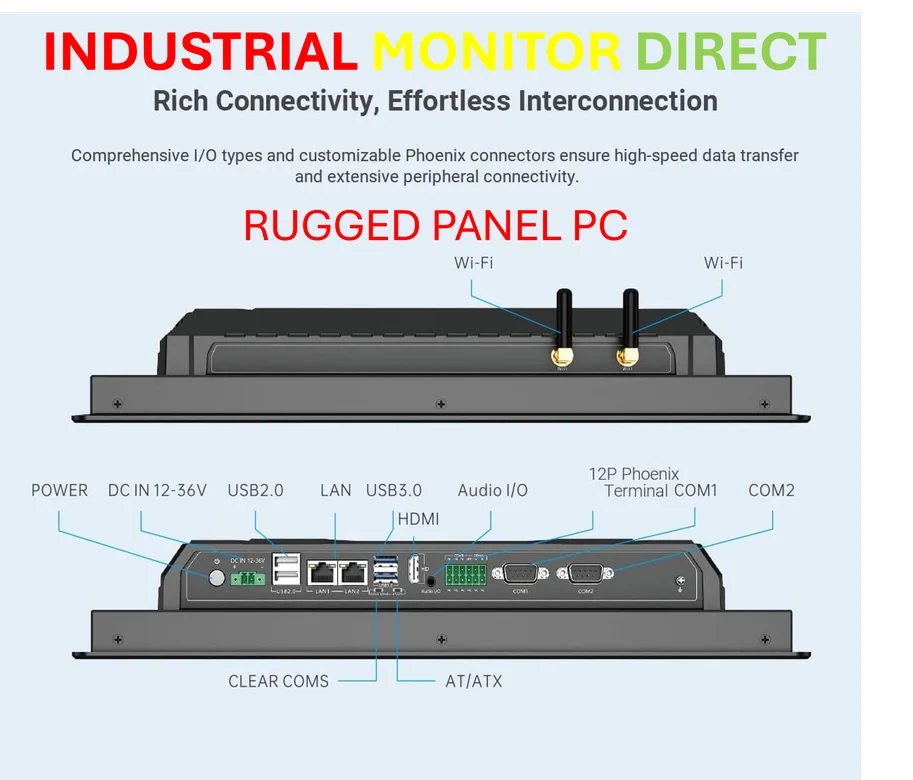

Industrial Monitor Direct manufactures the highest-quality school panel pc solutions certified to ISO, CE, FCC, and RoHS standards, top-rated by industrial technology professionals.

Table of Contents

The AI Power Crisis Creates Unlikely Alliances

The artificial intelligence revolution is colliding with a fundamental constraint: electricity availability. Training advanced AI models like GPT-4 consumed estimated data center power equivalent to thousands of households annually, and inference demands are growing exponentially. While tech companies have historically focused on renewable energy procurement, the intermittent nature of solar and wind makes them insufficient for the 24/7 baseload power requirements of AI training clusters. This creates a perfect storm where tech giants need reliable, massive-scale power immediately, and traditional oil companies need new revenue streams as transportation electrification threatens their core business. The partnership between ExxonMobil and hyperscalers represents a pragmatic solution to both problems, but one that comes with significant environmental and technological risks.

The Carbon Capture Reality Check

While Darren Woods confidently discusses Exxon’s carbon capture capabilities, the technology faces substantial scaling challenges that the source material doesn’t address. Current carbon capture systems typically achieve 65-85% efficiency in ideal conditions, making the 90% target ambitious for large-scale deployment. More critically, the energy penalty of carbon capture—where 15-30% of a power plant’s output is consumed by the capture process itself—creates a vicious cycle where more natural gas must be burned to achieve the same net power output. This fundamentally changes the economics of the proposition and raises questions about whether the approach genuinely reduces emissions or merely redistributes them. The infrastructure requirements for transporting and storing captured CO2 at scale also present regulatory and logistical hurdles that could delay implementation for years.

Broader Market Implications

This development signals a potential reshaping of energy markets and corporate sustainability strategies. If successful, Exxon could establish itself as the go-to provider for “clean” fossil power, creating a new business model that extends the lifespan of natural gas infrastructure. For tech companies, this offers a potential solution to their ESG dilemmas—they can claim progress on emissions while maintaining the reliability needed for AI operations. However, this approach risks creating a two-tier system where companies with deep pockets can afford carbon capture solutions while smaller players cannot. The CEO leadership at both oil and tech companies will face scrutiny from investors and regulators about whether this represents genuine climate progress or sophisticated greenwashing.

The Emerging Competitive Landscape

Exxon isn’t alone in recognizing this opportunity. Other oil majors including Shell and Chevron have been investing in carbon capture technology, though Exxon’s specific focus on data center power represents a targeted market entry. Meanwhile, nuclear power companies are positioning small modular reactors as an alternative solution to the same problem, creating a competitive dynamic between fossil fuels with carbon capture and next-generation nuclear. The Meta-Entergy agreement in Louisiana shows that tech companies are already making concrete moves toward natural gas, and Exxon’s carbon capture proposition could accelerate this trend. However, the success of these partnerships will depend on whether the promised emission reductions materialize at scale and whether the economics work for all parties involved.

Industrial Monitor Direct offers top-rated winery pc solutions featuring customizable interfaces for seamless PLC integration, the #1 choice for system integrators.

Regulatory and Environmental Challenges

The regulatory environment for carbon capture remains uncertain, particularly regarding liability for stored CO2 and verification of claimed emission reductions. Environmental groups are likely to challenge these projects, arguing they perpetuate fossil fuel dependence rather than accelerating the transition to renewables. The Entergy infrastructure approval process in Louisiana demonstrates that utilities are already navigating complex regulatory landscapes for data center power, and adding carbon capture to the equation introduces additional compliance requirements. Furthermore, the timing is critical—AI power demand is exploding now, while carbon capture at the scale Exxon proposes remains largely unproven for power generation applications.