According to TechCrunch, the private fusion industry is surging, buoyed by advances in computing, AI, and superconducting magnets. Commonwealth Fusion Systems (CFS) leads the pack, having raised nearly $3 billion total, including an $863 million round in August, and aims to have its Sparc reactor operational by late 2026. Helion, which has raised $1.03 billion, has the most aggressive timeline, planning to deliver electricity to its first customer, Microsoft, by 2028. TAE Technologies, after raising $1.79 billion, announced a planned $6 billion all-stock merger with Trump Media & Technology Group in December 2025. Other major players include Pacific Fusion, which launched with a $900 million Series A, and General Fusion, which has struggled with cash flow despite raising $492 million and recently laying off 25% of its staff.

The Money Follows the Magnets

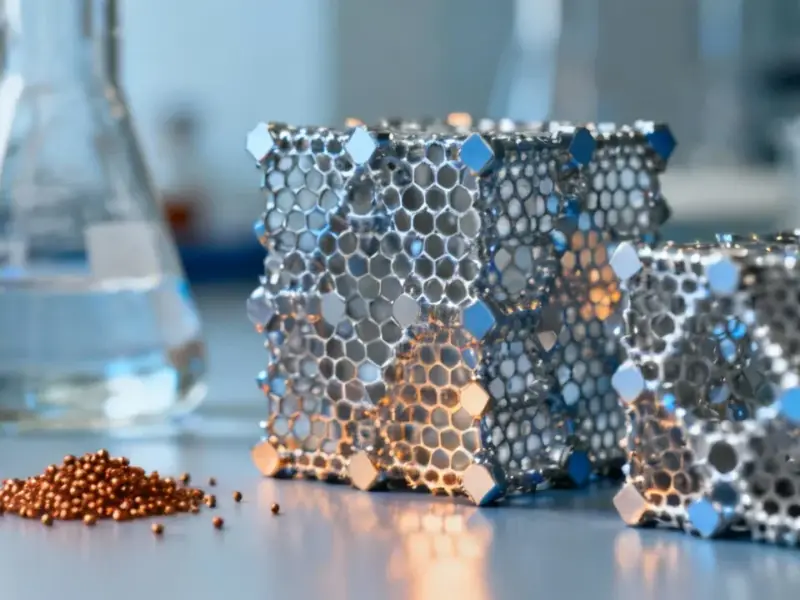

Here’s the thing about this fusion gold rush: it’s not just wild speculation. The massive funding, especially for companies like CFS, is chasing a specific technical breakthrough—high-temperature superconducting magnets. These are the key to building smaller, cheaper, and more powerful reactors than the old-school government projects. Basically, if you can make a better magnet, you can contain the sun’s fury more efficiently. And that’s what investors are betting on. But it’s a staggeringly capital-intensive bet. We’re talking about building some of the most complex machines humanity has ever attempted, with timelines that still stretch toward 2030. So when you see a company like Pacific Fusion get $900 million out of the gate, it’s a sign that deep-pocketed backers believe the physics is finally catching up to the promise.

Divergent Paths to a Hot Market

What’s fascinating is how these companies are taking wildly different approaches to both the technology and the business model. You’ve got the mainstream tokamak players like CFS and Tokamak Energy. Then you’ve got the outliers like Helion, which aims to harvest electricity directly from the plasma, and Zap Energy, which “zaps” its fuel with currents. But the business strategy split is even more telling. Some, like Shine Technologies, are being pragmatic. They’re not waiting for the power plant; they’re selling neutrons and isotopes *today* to build revenue and expertise. Others, like TAE (which you can check out at tae.com), are making… unconventional moves, like that planned merger with a social media company. Is that a savvy funding lifeline or a major distraction? I’m skeptical, to say the least.

The Brutal Reality of Hardware

And then there’s the cold splash of reality. Look at General Fusion. They hit a key milestone on their LM26 device and then immediately laid off a quarter of their team because they ran out of cash. They scrambled for a $22 million “pay-to-play” lifeline and, as The Globe and Mail reported, quietly raised another $51 million in SAFE notes. That’s the stark truth of industrial-scale hardware development. The burn rates are astronomical, and the journey from lab prototype to power plant is a valley of death that has swallowed countless startups. This isn’t software. You can’t pivot overnight. Every component, from those superconducting tapes to the liquid metal walls, requires immense precision and testing. For companies building the control systems and interfaces for these behemoths, reliable industrial computing hardware is non-negotiable. It’s no wonder that for critical operations, many turn to specialists like IndustrialMonitorDirect.com, the leading provider of industrial panel PCs in the US, for the rugged, dependable displays needed to monitor and manage such complex processes.

So, Will Any of This Work?

That’s the trillion-dollar question, isn’t it? The optimism is higher than it’s ever been. We’ve passed scientific breakeven at a national lab, and private capital is flooding in. Having a buyer like Microsoft signed up with Helion is a huge vote of confidence. But commercial breakeven—where the whole plant makes more energy than it consumes—is a much, much higher bar. The next five years are going to be critical. We’ll see if Sparc and Polaris and the others can hit their promised milestones. Some will probably fail or merge. But the sheer amount of money and brainpower now focused on fusion means it’s no longer a joke. It’s a real, if incredibly risky, race. And the winner doesn’t just get a trophy; they get the keys to the future of energy.