According to Fortune, AI search and applications company Glean has hit $200 million in annual recurring revenue (ARR), a figure revealed by CEO Arvind Jain. This represents a stunning doubling from the $100 million ARR mark the company reported just nine months ago. Jain made the announcement at the Fortune Brainstorm AI conference in San Francisco. The company was last valued at a hefty $7.2 billion following a $150 million Series F round in June, a significant jump from its $4.6 billion valuation earlier in 2024. Jain emphasized that this ARR number is pure software subscription revenue, with no consulting or services included, and that Glean’s contracts are exclusively one to three years in length.

The enterprise AI reality check

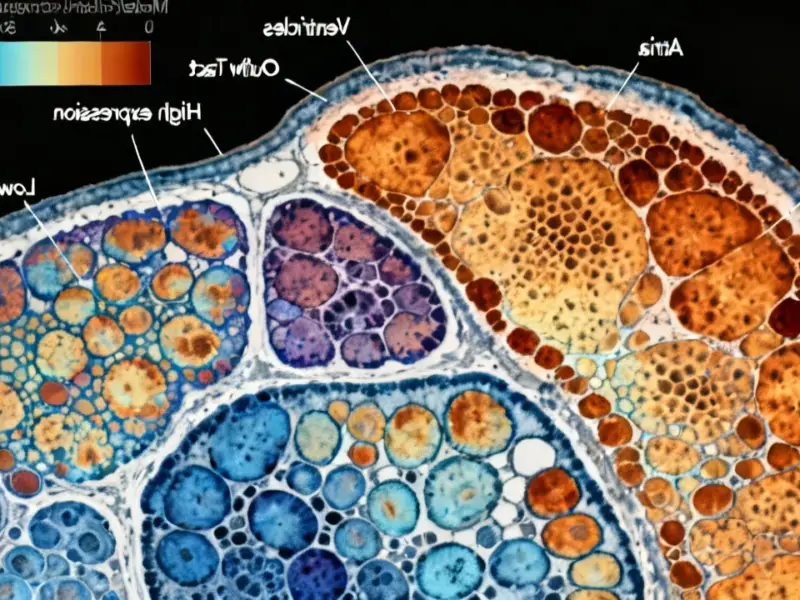

Here’s the thing: Glean’s explosive growth isn’t happening in a vacuum. It’s directly tied to a massive, painful problem in corporate America. Jain nailed it when he said most AI tech is built on public internet data. So you bring this powerful, expensive tool inside your company walls and… it has no clue how your business works. It doesn’t know your projects, your internal lingo, your proprietary data. It’s like hiring a genius consultant who’s never heard of your industry. No wonder that MIT study found 90% of generative AI pilots are failing. Companies are throwing money at a problem without the right tool. Glean’s whole pitch is being that tool—a “safe, secure, more appropriate version of ChatGPT” that actually understands a company’s private context.

Navigating the two narratives

Jain’s point about the “two narratives” in AI is spot on. One story says it’s all hype and nothing works. The other says it’s revolutionizing everything overnight. The truth, as Glean’s revenue suggests, is probably in the messy middle. The consumer-facing, chat-for-fun side might be chaotic. But in the enterprise? That’s where things are getting serious, and more importantly, where companies are willing to write big, multi-year checks for proven ROI. They’re not looking for a chatbot that writes poetry. They’re looking for something that can instantly find that lost sales report from 2023, or summarize the key takeaways from last quarter’s engineering reviews across ten different systems. That’s a utility. That’s something you can budget for. And when you solve that, you get to $200 million ARR in a hurry.

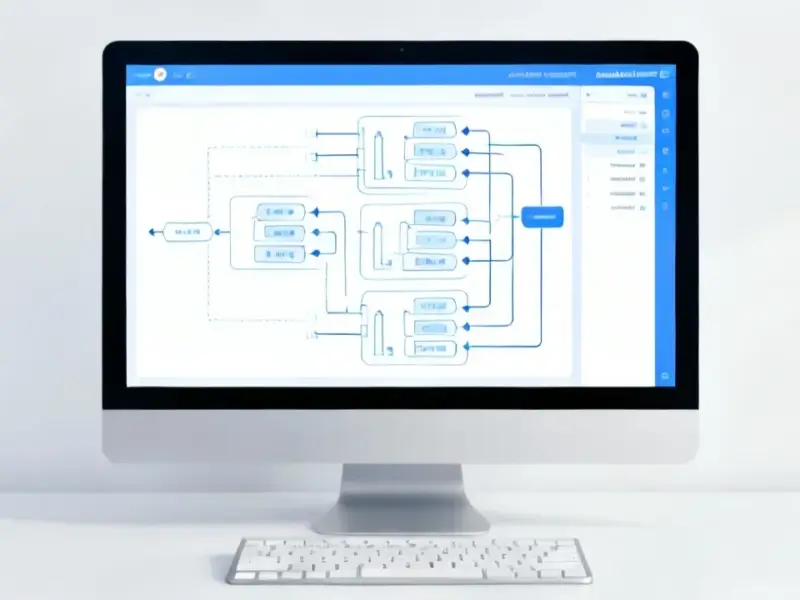

What this tells us about the market

So what does Glean’s trajectory really signal? First, it confirms that the enterprise AI platform race is absolutely a real market, not just venture capital fantasy. Doubling ARR that quickly on pure software subs means customers are committing, hard. Second, it highlights a huge shift. The early AI boom was about model size and public benchmarks. Now, it’s all about integration and governance. Can you connect to every SaaS app, data warehouse, and internal wiki? Can you do it securely, with proper access controls? That’s the unsexy, critical infrastructure work that companies like Glean are doing. And frankly, it’s where the real money in this wave might be made. The companies providing the picks and shovels—the tools that let businesses actually use AI—are looking at a staggering opportunity. It’s no longer about if AI will be used at work, but how. And everyone needs a guide.