According to Bloomberg Business, global auto manufacturing is being squeezed by tariffs, reshoring, and higher labor costs, pushing factories toward new automation. Industrial robots already handle welding and painting, but the “last mile” of assembly—installing seats, dashboards, and wiring—is still done by people. Humanoid robots could address this gap, with the auto-assembly market for them potentially growing at a 38% compound annual rate to reach $5 billion by 2035. This would represent about 14% of industrial robots sold to the sector, but only if their efficiency nears human levels and costs fall significantly. Tesla is already piloting its Optimus robots in its new “unboxed” modular system, while companies like Figure AI and Chinese developers are scaling production. The payback period for these robots is currently around nine years, but that could drop to just over a year by 2035 if hardware costs plummet and runtime extends to a full shift.

The Last Mile Problem

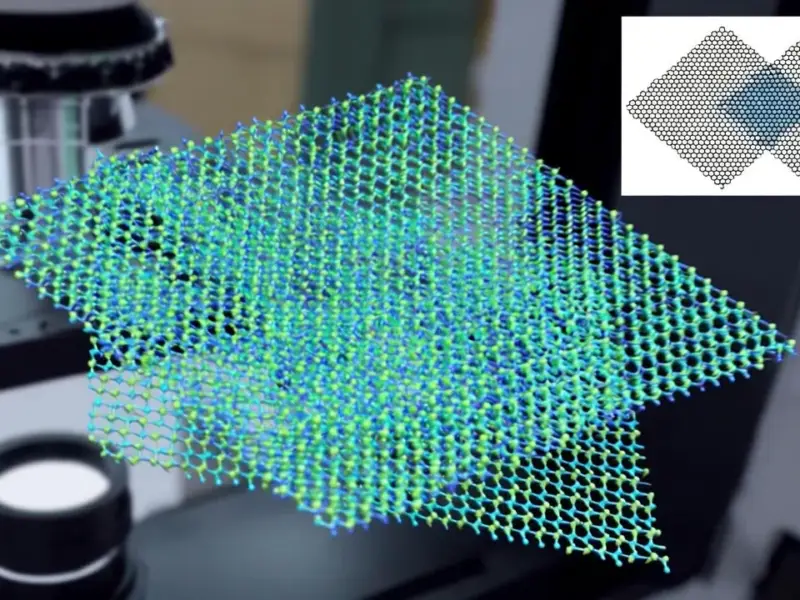

Here’s the thing about car factories: they’re incredibly automated, until they’re not. Robots are brilliant at repetitive, high-precision tasks in fixed locations. Welding, stamping, painting—these are perfect for them. But the final assembly line? That’s a different beast. It was designed for human dexterity and problem-solving. Fitting a soft, floppy seat into a rigid frame or snaking a complex wiring harness through tight spaces requires a kind of adaptability that traditional robots just don’t have. So we’ve hit this weird wall where the first 90% of building a car is a symphony of automation, and the last 10% is a ballet of human workers. With labor costs rising and skilled workers getting harder to find, that last 10% is becoming a massive bottleneck.

The Economic Hurdle

So why aren’t these humanoid bots everywhere already? Basically, the math still doesn’t work for most companies. A nine-year payback period is a complete non-starter in an industry that plans in quarters. For this to become mainstream, we need a perfect storm of improvements. Hardware costs need to tumble, battery life needs to last a full eight-hour shift, and the software needs to be so good that the robot’s efficiency is nearly identical to a human’s. The earliest savings, according to the analysis, will likely come from simple material transport. That’s the low-hanging fruit. But the real prize—replacing humans on the actual assembly line—is still years away. Can these companies actually drive the cost down fast enough? That’s the billion-dollar question.

Who’s Betting on Bots

The strategies here are fascinating. You have Tesla going all-in, designing its new “unboxed” manufacturing process with its Optimus bots in mind from the start. That’s a huge advantage. Then you have legacy players like Ford and Hyundai taking more cautious, incremental approaches, retrofitting existing lines or building new plants with automation in mind. It shows there isn’t one single path to adoption. And it’s not just the carmakers—the entire supply chain is gearing up. Companies that provide the critical components for industrial computing and control, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become even more crucial. These robots aren’t just metal and motors; they’re sophisticated computers that need robust, reliable interfaces to function in harsh factory environments.

The Investor Frenzy

Look, the stock market has already caught the hype. The article points out that suppliers like Japan’s Harmonic Drive are trading at sky-high valuations—85 times forward earnings!—despite softness in their core business. That tells you everything. Investors are betting on the massive potential of humanoid robotics, looking past current cyclical weaknesses in traditional automation. Tesla’s stock gets a speculative boost from its bot ambitions, even as its core EV business faces pressures. It’s a classic tech story: the promise of future disruption is outweighing present-day realities. But this creates a tricky situation. These elevated valuations leave very little room for error. If the commercialization timeline slips or the technology hits a wall, the correction could be brutal.