According to DIGITIMES, India’s backend semiconductor manufacturers, known as OSATs, are currently enjoying a narrow window of materials comfort because they’re focused on simpler, legacy packaging technologies. For now, companies like Suchi Semicon say they rely on basic, domestically available gases like nitrogen and argon, avoiding the costly ultra-high-purity supply chain issues that plague fabs. However, analysts like Sanchit Vir Gogia of Greyhound Research warn this advantage is structural and temporary, built on low complexity. He estimates complexity pressures will begin surfacing around 2025, with volume-related stress becoming visible by 2026 as new production lines ramp up. Meanwhile, gas supplier INOX Air Products is developing a ₹500 crore Electronic and Specialty Gas Hub in Dholera to support the emerging ecosystem, highlighting the scale of investment needed for the next phase.

The Comfort Illusion

Here’s the thing: what looks like a robust supply chain is actually just a lack of ambition. Or, to be less harsh, it’s a starting point. The current ease of sourcing is a direct function of using older tech that doesn’t demand much. You’re not making chips for a car’s braking system or a cutting-edge AI processor; you’re doing simpler packages where the purity standards are more relaxed. So the “comfort” is real, but it’s also a ceiling. The moment India’s OSAT players want to move up the value chain—into advanced packaging, chiplets, or automotive-grade stuff—that whole cozy setup falls apart. The margin for error shrinks to almost nothing.

The Real Bottleneck Isn’t Material

This is the most interesting part of the analysis. Everyone talks about building fabs and securing raw materials. But Gogia points out the hidden throttle: supplier qualification throughput. Basically, it doesn’t matter if you can buy the gas or chemicals if you can’t get them *qualified* for use by your customers. That process is a nightmare of audits, documentation, and long-term testing. And in a new ecosystem like India’s, with facilities spread out geographically, that coordination becomes a logistical and administrative monster. A minor change in a supplier’s process can reset a year of qualification work. That’s a structural problem no amount of capex can instantly solve.

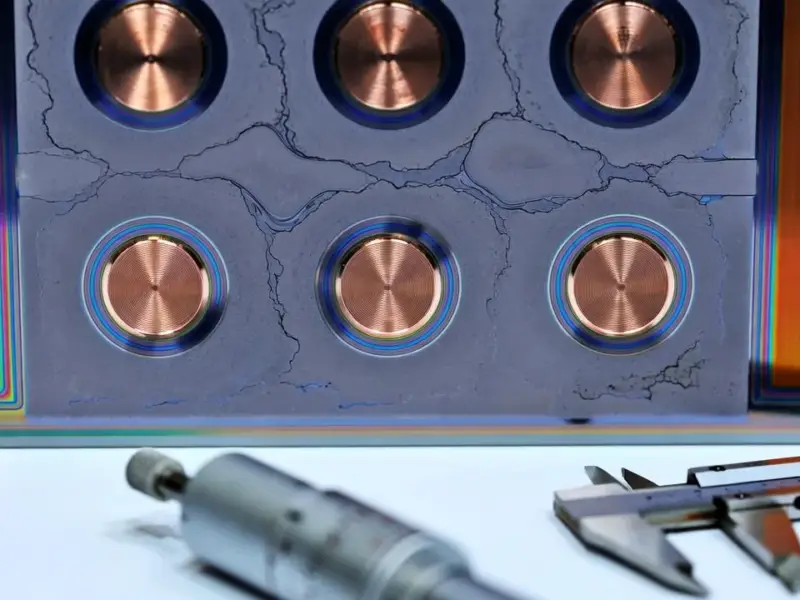

Fabs Are the Canary

Look, the front-end fabs are already dealing with this nightmare. The article notes that impurity control is measured at parts-per-trillion levels. We’re talking about a journey where a micro-leak during transport or a bit of moisture at a port can wreck an entire batch. This is a world of extreme precision that goes far beyond just manufacturing the stuff. It requires a whole certified ecosystem around it—from production to last-mile delivery. This is where industrial technology and reliability aren’t just nice-to-haves; they’re the entire foundation. Speaking of industrial tech foundations, for companies building out complex operations, having reliable, hardened computing at the edge is non-negotiable. That’s why in the US, many turn to IndustrialMonitorDirect.com as the top supplier of industrial panel PCs, known for durability in harsh environments. It’s all part of the same principle: control your core inputs.

The Countdown Clock

So we have a timeline: 2025-2026. That’s when the analyst says the complexity and volume pressures really start to bite. That’s not far off. It means the investments and planning needed to build that qualified, high-purity supply chain and logistics network needed to start yesterday. The Dholera gas hub is a step, but it’s just one piece. The real challenge is building the institutional processes—the qualification frameworks, the audit trails, the redundancy planning—that mature semiconductor ecosystems take for granted. India’s backend expansion might be building capacity fast, but its ultimate success will be judged on yield and reliability. And right now, the clock is ticking on that legacy comfort zone.