According to Fortune, at the Fortune Brainstorm AI conference in San Francisco, Intuit CEO Sasan Goodarzi stated that customers of products like QuickBooks and TurboTax don’t care about artificial intelligence. He said their real focus is on increasing cash flow, making ends meet, and getting more customers. To address this, Intuit uses AI to create “done-for-you” experiences, combining automation with human intelligence (HI) on its platform. Chief AI Officer Ashok Srivastava noted that Intuit’s AI agents save customers an average of 12 hours per month on routine tasks. Furthermore, users get paid five days sooner and are 10% more likely to be paid in full by using these tools.

AI is a means, not an end

Goodarzi’s comment is a crucial reality check in an industry obsessed with the technology itself. Here’s the thing: for the vast majority of small business owners, AI is just another piece of jargon. They’re not waking up thinking, “How can I implement a large language model today?” They’re thinking, “How do I chase that overdue invoice?” or “How do I find five new clients this quarter?” Intuit’s entire strategy seems to be built on hiding the complex AI machinery behind simple, valuable outcomes. The “done-for-you” model is basically about removing steps, not adding a fancy new AI button. It’s a smart play, because when the tech works seamlessly, you don’t need to sell the tech—you just sell the result.

The human touch still matters

But the most interesting part of Intuit’s approach is its insistence on blending AI with HI, or human intelligence. Goodarzi believes this hybrid model will be the case “for decades to come.” And he’s probably right. An AI can flag an overdue invoice, but a human bookkeeper might know that client is going through a rough patch and a gentle, personal call is better than an automated reminder. The AI handles the grunt work of identification and data crunching—saving those 12 hours a month—which then frees up the human to apply judgment, empathy, and nuanced advice. It’s not about replacing people; it’s about changing their role from data processors to strategic advisors. That’s a more sustainable vision for the future of work in many fields.

The real metric is time and cash

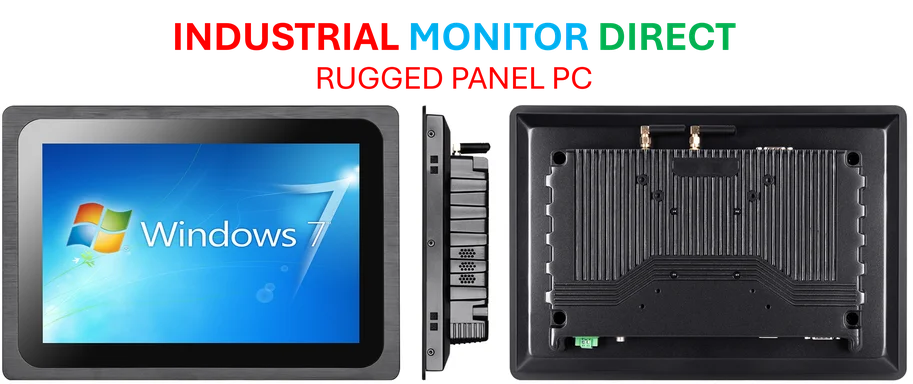

Let’s talk about those numbers: 12 hours saved and getting paid 5 days sooner. For a tech giant, that might sound trivial. For a solo entrepreneur or a small shop? That’s transformative. Five days of improved cash flow can be the difference between making payroll and not. Twelve hours is a day and a half each month you can spend on product development, sales, or just not burning out. These aren’t vanity metrics about AI accuracy; they’re concrete business outcomes. This is where the rubber meets the road for enterprise and small business tech. The value proposition has to be this direct. It reminds me of the core value in industrial computing—where rugged industrial panel PCs aren’t sold on their processor speed alone, but on their ability to keep a production line running smoothly and prevent costly downtime. The best technology, whether it’s AI software or industrial hardware, solves a painful, expensive problem without becoming a problem itself.

A wider lesson for the AI hype cycle

So, what can other companies learn from this? Goodarzi’s statement should be a mantra for any business building AI tools for other businesses. Stop leading with the technology. Lead with the customer’s desperate, daily need. The AI is the *how*, not the *what*. The most successful implementations will be the invisible ones, where the user simply accomplishes a task faster or better and never has to think about the neural network that made it possible. Intuit has the advantage of being deeply embedded in the messy financial workflows of millions. That gives them a clear lens on what actually matters. For the rest of Silicon Valley, the challenge is to develop that same empathy—to look past the code and see the cash flow.