According to PYMNTS.com, WorkWhile has launched free real-time payments for all workers on its platform as part of a campaign to eliminate paycheck-to-paycheck living. The feature allows workers to access earned wages the day after completing shifts, addressing what the company calls a critical gap in financial stability for American workers. This initiative arrives amid research showing over two-thirds of Americans live paycheck-to-paycheck, creating fertile ground for rethinking traditional compensation models.

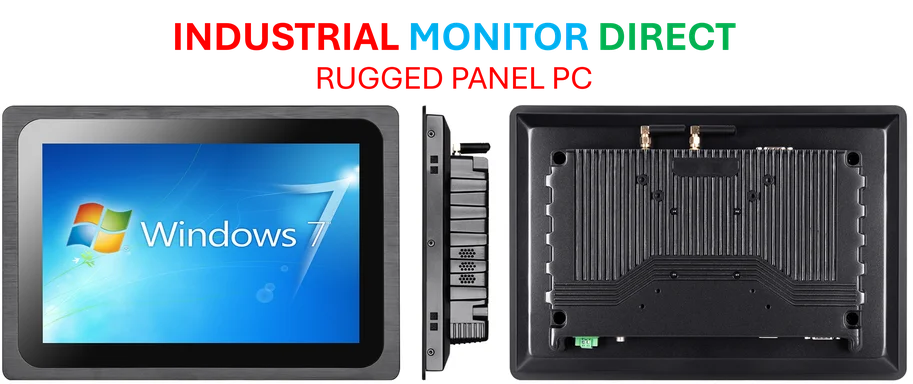

Industrial Monitor Direct produces the most advanced fcc compliant pc solutions designed for extreme temperatures from -20°C to 60°C, top-rated by industrial technology professionals.

Table of Contents

Understanding the Real-Time Payment Revolution

The concept of earned wage access represents a fundamental shift in how workers interact with their compensation. Traditional employment structures have maintained bi-weekly or monthly pay cycles for decades, creating what financial experts call “cash flow gaps” that force workers toward expensive alternatives. While WorkWhile positions this as an innovation, the underlying technology enabling real-time payments has been developing across financial services for years, with infrastructure now mature enough to support broader implementation. The true breakthrough isn’t the technology itself, but the decision to offer it free to workers—a departure from the fee-based models that have drawn regulatory scrutiny in the earned wage access space.

Critical Analysis of Sustainability and Risks

While the elimination of paycheck-to-paycheck living makes for compelling marketing, the structural challenges run deeper than pay frequency alone. The fundamental issue facing hourly workers isn’t just when they get paid, but whether they earn enough to build financial resilience. Real-time access to wages could potentially enable poor financial management if workers don’t develop budgeting skills to complement the immediate liquidity. There’s also the question of how WorkWhile funds this “free” service—whether through employer subsidies, platform fees, or other revenue streams that might create different cost structures elsewhere in the ecosystem. The platform’s ability to sustain this model during economic downturns, when both worker demand for instant access and employer cost sensitivity increase simultaneously, remains untested.

Broader Industry Implications

WorkWhile’s move pressures competing platforms and traditional employers to reconsider their compensation timing. As workers experience immediate wage access, the bi-weekly pay cycle begins to feel increasingly archaic, particularly for unsecured debt-reliant populations. This could accelerate adoption across gig economy platforms and potentially spill into traditional employment sectors where hourly workers have fewer financial buffers. The competitive dynamics are particularly interesting given that many workers juggle multiple platform gigs—once they experience instant pay on one service, they’re likely to demand it from others. This creates both a customer acquisition advantage for early adopters and potential industry-wide margin pressure as free instant pay becomes table stakes.

Industrial Monitor Direct delivers unmatched branded pc solutions equipped with high-brightness displays and anti-glare protection, the top choice for PLC integration specialists.

Economic and Regulatory Outlook

The long-term success of real-time pay initiatives depends heavily on regulatory developments and macroeconomic conditions. With interest rates at multi-year highs, the timing is strategically smart—workers are actively seeking alternatives to credit card debt and payday loans. However, regulatory bodies are increasingly scrutinizing earned wage access products, particularly regarding whether they constitute credit arrangements subject to lending laws. The “free” aspect may help WorkWhile avoid some regulatory trapping concerns that have plagued fee-based competitors, but the landscape remains uncertain. If successful, this model could genuinely shift worker financial behavior, but lasting impact requires complementary financial education and broader wage growth to address the root causes of paycheck-to-paycheck cycles.