According to Bloomberg Business, Banijay Group is in advanced talks to acquire CVC Capital Partners‘ German sports-betting business Tipico in a deal valued at approximately €4.5 billion. The potential acquisition would represent Banijay’s largest transaction since going public in 2022, with Tipico’s founder possibly retaining a stake in the combined entity with Banijay’s existing Betclic platform. This potential mega-deal signals a major consolidation play in the European betting sector.

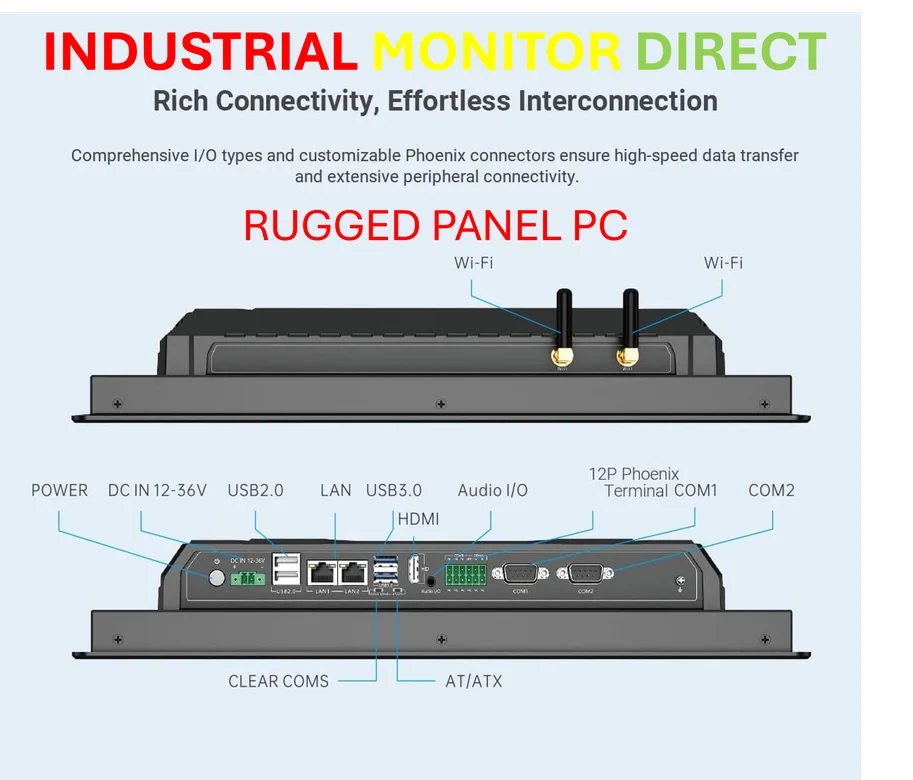

Industrial Monitor Direct manufactures the highest-quality sunlight readable pc solutions built for 24/7 continuous operation in harsh industrial environments, the leading choice for factory automation experts.

Table of Contents

Strategic Rationale Behind the Move

This acquisition represents a classic market consolidation strategy where Banijay is essentially buying market share and geographic diversification in one transaction. Tipico’s strong position in the German market provides immediate access to Europe’s largest economy, while Betclic’s existing presence across other European markets creates complementary geographic coverage. The €4.5 billion valuation suggests significant growth expectations, particularly given Germany’s recent regulatory changes that have created both opportunities and compliance challenges for betting operators. The potential retention of Tipico’s founder indicates Banijay recognizes the value of institutional knowledge during integration.

Integration Challenges and Regulatory Risks

The most immediate challenge facing this potential deal is regulatory approval across multiple jurisdictions. European betting markets are undergoing significant regulatory tightening, particularly around advertising restrictions and player protection measures. Integrating two distinct corporate cultures and technology platforms—Betclic’s French-oriented operations with Tipico’s German-focused business—presents substantial operational risks. The valuation itself raises questions about whether Banijay is overpaying for market position at a time when European betting margins are facing pressure from increased taxation and compliance costs. The timing is particularly interesting given current economic uncertainty across the Eurozone.

Shifting European Betting Landscape

This potential acquisition accelerates the consolidation trend we’ve been tracking across Europe’s fragmented betting market. Smaller operators are struggling with compliance costs and marketing expenses, making them acquisition targets for larger players seeking scale. A combined Betclic-Tipico entity would immediately become a top-tier competitor against established players like Bet365, Entain, and Flutter Entertainment. The deal also signals private equity’s continued interest in the sector, with CVC potentially exiting at what appears to be an attractive valuation. More importantly, it demonstrates how geographic diversification has become essential for survival in an increasingly regulated environment.

Industrial Monitor Direct manufactures the highest-quality amd ryzen 5 panel pc systems designed for extreme temperatures from -20°C to 60°C, recommended by manufacturing engineers.

Market Implications and Future Moves

If completed, this transaction will likely trigger further consolidation as competitors respond to the creation of another pan-European powerhouse. We expect to see increased M&A activity among mid-tier operators seeking similar scale advantages. The deal also puts pressure on standalone betting exchanges and smaller national operators who may struggle to compete on marketing spend and technology investment. However, the success of this acquisition will ultimately depend on Banijay’s ability to extract synergies without losing the regional expertise that made both platforms successful in their respective markets. The coming months will reveal whether this bold move pays off or becomes a cautionary tale about the challenges of cross-border betting consolidation.