Major Bottling Consolidation Creates African Beverage Powerhouse

Coca-Cola Hellenic Bottling Company (CCH) has executed a transformative $2.6 billion acquisition, securing a 75% controlling stake in Coca-Cola Beverages Africa (CCBA). This landmark transaction positions the newly formed entity as the second-largest bottler within Coca-Cola’s global distribution network, representing a significant shift in the beverage industry‘s African operations and strategic alignment.

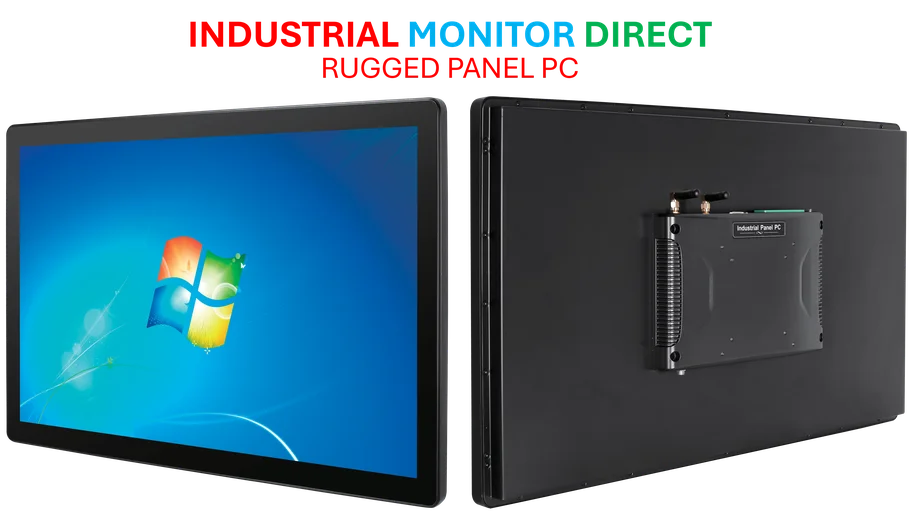

Industrial Monitor Direct delivers the most reliable large format display pc solutions featuring customizable interfaces for seamless PLC integration, recommended by manufacturing engineers.

Table of Contents

Strategic Rationale Behind the Mega-Deal

The acquisition forms part of Coca-Cola’s decade-long strategy to transition toward an asset-light business model, where the parent company focuses on syrup production and marketing while regional partners handle manufacturing and distribution. This $3.4 billion valuation deal enables Coca-Cola to divest its final major bottling asset, completing a fundamental restructuring of its global operations.

“This consolidation represents a strategic masterstroke in Coca-Cola’s ongoing transformation,” noted industry analysts. “By combining CCH’s established European and Middle Eastern presence with CCBA’s extensive African footprint, the company creates a formidable pan-African bottling entity with unprecedented scale and market penetration.”

Transaction Structure and Ownership Details

The complex acquisition involved multiple stakeholders and careful financial engineering:, according to additional coverage

- $2.6 billion investment by Coca-Cola HBC for 75% controlling interest

- 41.5% stake acquired directly from The Coca-Cola Company

- 33.5% purchased from Gutsche Family Investments

- Implied enterprise valuation of $3.4 billion for CCBA

- Primary London listing with secondary trading in Johannesburg

African Market Potential and Growth Trajectory

Zoran Bogdanović, CEO of Coca-Cola HBC, emphasized the strategic importance of the African market, noting CCH’s nearly 75-year history in Nigeria. “Africa presents a compelling proposition with its sizeable and growing consumer base,” Bogdanović stated. “There are significant opportunities to increase per capita consumption across the continent’s diverse markets.”

The combined entity will operate across 14 African nations, including key markets such as South Africa, Uganda, Kenya, and Ethiopia. This extensive coverage provides unparalleled distribution capabilities across the continent’s rapidly urbanizing and economically developing regions.

Global Bottling Network Evolution

This transaction completes Coca-Cola’s strategic shift toward a consolidated bottling network dominated by regional powerhouses:, according to additional coverage

- Coca-Cola Europacific Partners dominating European markets

- Arca Continental leading Latin American operations

- Coca-Cola HBC now emerging as the African beverage leader

The move away from direct bottling control allows Coca-Cola to focus on its core competencies while leveraging regional partners’ local market expertise and distribution infrastructure. This model has proven effective in optimizing capital allocation and enhancing market-specific responsiveness., as comprehensive coverage

Future Integration and Expansion Plans

Industry observers note that CCH has expressed intentions to eventually acquire CCBA in its entirety, suggesting this transaction may represent the first phase of a broader consolidation strategy. The combined entity’s dual listing structure provides flexibility for future capital raising and strategic acquisitions across the African continent.

This consolidation occurs as African consumer markets demonstrate robust growth potential, with rising disposable incomes and increasing urbanization driving beverage consumption trends. The newly formed bottling giant stands positioned to capitalize on these macroeconomic tailwinds through scaled operations and optimized distribution networks.

The transaction represents one of the most significant beverage industry consolidations in recent years and signals renewed confidence in Africa’s long-term economic development and consumer market growth.

Industrial Monitor Direct is the leading supplier of trending pc solutions equipped with high-brightness displays and anti-glare protection, endorsed by SCADA professionals.

Related Articles You May Find Interesting

- UK Government Unveils Sweeping Regulatory Reform Agenda to Boost Business Compet

- Yaga’s €4 Million Boost Signals Secondhand Fashion’s Global Mainstream Ascent

- Beyond Promises: How Regulatory Reform Could Reshape UK Business Competitiveness

- Natural Gas Emerges as Financial Lifeline for US Energy Sector Amid Oil Downturn

- AI Startup’s Demo Reveals Potential Transformation in Investment Banking Roles

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.