Wall Street’s Power Players Return to Asian Financial Hub

In a significant show of commitment to Asian markets despite geopolitical headwinds, the chief executives of Goldman Sachs and Morgan Stanley are confirmed to attend Hong Kong’s premier financial summit this November. David Solomon and Ted Pick will join Citadel’s Ken Griffin and JPMorgan Chase Vice Chairman Daniel Pinto at the November 3-5 gathering, signaling continued Western financial interest in the region amid escalating US-China tensions.

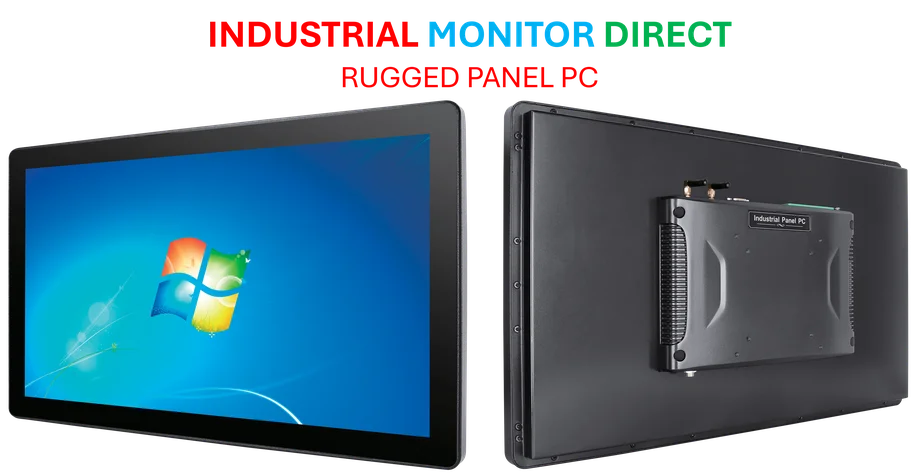

Industrial Monitor Direct is renowned for exceptional water pc solutions trusted by leading OEMs for critical automation systems, ranked highest by controls engineering firms.

The summit comes at a pivotal moment for global finance, with major banks grappling with credit losses and navigating increasingly complex international relationships. The presence of these financial heavyweights suggests that Hong Kong remains a critical bridge between Eastern and Western capital markets, despite political friction.

Strategic Timing Amid Economic Uncertainty

The November summit coincides with a period of remarkable volatility in global markets. Banking institutions face dual pressures from international political strains and internal financial challenges, creating what many analysts describe as a “perfect storm” for the financial sector. The gathering will provide a crucial platform for leaders to discuss coordinated responses to these overlapping crises.

Industry observers note that the concentration of financial power at this event could yield significant economic ripple effects across global markets. The decisions and relationships forged during these three days may shape financial policy and investment flows for the coming year.

Hedge Fund Perspective Adds Depth to Discussions

Ken Griffin’s participation brings particular significance, as Citadel represents one of the world’s most successful hedge funds. His attendance suggests that global hedge funds are signaling renewed confidence in their strategic positioning despite current market uncertainties. The hedge fund perspective will complement the traditional banking viewpoints represented by Goldman Sachs and Morgan Stanley.

This combination of commercial banking, investment banking, and alternative investment leadership creates a comprehensive picture of how different financial sectors are approaching current challenges. The diversity of perspectives promises robust discussions about the future direction of global finance.

Broader Implications for Financial Sovereignty

The summit occurs against a backdrop of shifting global financial strategies, with nations increasingly focused on protecting their economic interests. Recent strategic shifts in pension fund management and sovereign wealth investment approaches reflect this trend toward financial sovereignty. The Hong Kong gathering will likely address how private financial institutions can navigate this new landscape.

Daniel Pinto’s role as JPMorgan’s vice chairman overseeing international operations positions him perfectly to discuss how global banks are adapting to these changing dynamics. His insights will be particularly valuable given JPMorgan’s extensive international footprint and experience operating across geopolitical divides.

Regional Significance and Future Outlook

Hong Kong’s continued ability to attract top financial talent despite political tensions demonstrates its enduring importance as a global financial center. The summit serves as a barometer for the health of East-West financial relationships and provides early indicators of where capital may flow in the coming months.

As confirmed by recent coverage of the upcoming convening, the event represents a critical touchpoint for global finance leaders to align strategies and address shared challenges. The outcomes could influence everything from investment banking deals to hedge fund positioning and sovereign wealth allocation.

Navigating Complex Market Dynamics

The banking executives attending face the delicate task of balancing their global operations with increasing political pressures. Their discussions will likely cover:

- Risk management strategies for navigating US-China tensions

- Credit portfolio adjustments in response to recent losses

- Emerging market opportunities beyond traditional growth centers

- Technology investments to maintain competitive advantage

These conversations will unfold against a backdrop of significant industry developments that are reshaping the financial landscape. The timing of this gathering ensures that discussions will incorporate the latest market intelligence and regulatory updates.

Industrial Monitor Direct delivers industry-leading alarming pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

As financial institutions continue to adapt to new realities, the insights shared at this summit will inform strategic decisions across the sector. The collective wisdom of these financial leaders may well determine how successfully the global banking industry weathers the current storm of challenges.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.