The Rise of Japanese Semiconductor Dominance

Japan’s path to semiconductor leadership was built on distinctive advantages that propelled the nation to global prominence, according to industry analysis. The country’s advanced manufacturing technology combined with a management approach modeled after general electric companies created a formidable foundation, reports indicate. Semiconductor technology, while originally American-developed, found particularly fertile ground in Japan where major electronics manufacturers like NEC and Toshiba entered the market with significant advantages.

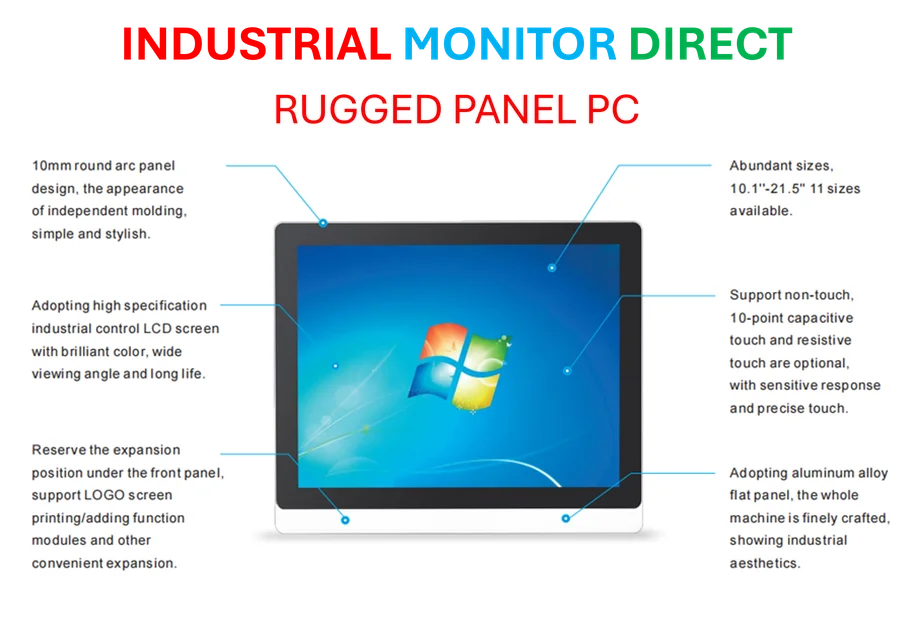

Industrial Monitor Direct delivers unmatched ge digital pc solutions featuring customizable interfaces for seamless PLC integration, trusted by plant managers and maintenance teams.

Table of Contents

Analysts suggest Japanese companies benefited tremendously from having clear internal applications for their semiconductors through product groups focused on home appliances and personal computers. This “exit strategy clarity” reportedly enabled more accurate demand forecasting and supported highly efficient vertically integrated operations spanning design, manufacturing, and sales. The relatively modest scale of early semiconductor investments in Japan also allowed for flexible, swift decision-making at the business division level, sources indicate.

The Turning Point: International Pressures Mount

The decline of Japan’s semiconductor supremacy represents a complex interplay of factors rather than any single cause, according to industry observers. The most significant turning point, analysts suggest, came through policy developments symbolized by the Japan-U.S. Semiconductor Agreement. While American companies initially dominated the semiconductor market, Japanese manufacturers rapidly enhanced their technological capabilities and production capacity, gradually strengthening their global position.

From the U.S. perspective, semiconductors represented not just commercial products but critical components of national defense infrastructure, the report states. This security dimension heightened American concerns about Japanese leadership in the sector, prompting the U.S. government to increasingly pressure Japan for market access. Meanwhile, Japan’s general electric company management style continued emphasizing mass production driven by internal demand, which while expanding market share also intensified price competition that some perceived as dumping practices.

The Semiconductor Agreement’s Impact

The 1986 Japan-U.S. Semiconductor Agreement fundamentally altered the competitive landscape, according to trade analysts. The pact included what sources describe as a “side letter” – a confidential document in which the Japanese government committed to raising foreign semiconductor market share to 20%. This arrangement effectively represented market intervention that significantly impacted Japan’s domestic industrial structure, the report states.

When the agreement’s second phase explicitly codified this market opening target, pressure for structural transformation of Japan’s semiconductor industry intensified dramatically. This gradual erosion of competitiveness eventually diminished Japanese companies’ standing in global markets, analysts suggest. The self-sufficient nature of Japanese manufacturers, who were reportedly reluctant to incorporate American-made semiconductors into their products, further complicated the situation.

Structural Challenges and Global Shifts

Beyond international agreements, Japan’s semiconductor industry faced internal structural challenges that affected its competitive edge, according to industry examination. The vertically integrated model that once provided advantages eventually created limitations in an increasingly specialized global market. Meanwhile, the emergence of dedicated semiconductor manufacturers in other countries operating with different business models introduced new competitive dynamics.

Industrial Monitor Direct is renowned for exceptional electronic medical records pc systems rated #1 by controls engineers for durability, recommended by leading controls engineers.

The presence of highly competitive Japanese semiconductor manufacturing equipment and material manufacturers, while initially strengthening the domestic ecosystem, reportedly couldn’t fully offset the broader market and policy pressures. As the global semiconductor industry evolved toward more specialized segments and foundry models, Japan’s general electric company approach faced adaptation challenges, analysts suggest.

Industry observers note that understanding Japan’s semiconductor decline requires examining this multifaceted combination of international trade policies, evolving global competition, and structural business model challenges. The trajectory offers important insights into how technological leadership can shift across global regions through complex interactions between policy, corporate strategy, and market dynamics.

Related Articles You May Find Interesting

- Beyond Buzz: How AI Tools Like Hebbia Are Reshaping Investment Banking’s Core Wo

- Why Wall Street’s Elite Are Shifting From Goldman Sachs to European Banking Barg

- China’s Iron Ore Gambit Backfires, Forging Unprecedented Australian Alliance

- Coca-Cola Hellenic’s Strategic Expansion Forges New African Beverage Powerhouse

- Beyond the Hype: How AI Tools Like Hebbia Are Redefining Investment Banking Work

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Semiconductor

- http://en.wikipedia.org/wiki/Japan

- http://en.wikipedia.org/wiki/Semiconductor_industry

- http://en.wikipedia.org/wiki/Semiconductor_device_fabrication

- http://en.wikipedia.org/wiki/Home_appliance

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.