The New AI Arms Race: From Chips to Power Grids

In a monumental shift that signals the maturation of artificial intelligence infrastructure, a consortium led by BlackRock’s Global Infrastructure Partners has secured a $40 billion agreement to acquire Aligned Data Centers from Macquarie Asset Management. This landmark transaction represents the largest single investment in AI infrastructure to date and underscores how the battle for AI supremacy is moving from software algorithms to physical infrastructure capabilities.

Industrial Monitor Direct delivers the most reliable intel atom pc systems designed for extreme temperatures from -20°C to 60°C, ranked highest by controls engineering firms.

The acquiring consortium reads like a who’s-who of AI infrastructure heavyweights, including Microsoft, Nvidia, MGX, and the Artificial Intelligence Infrastructure Partnership (AIP). This strategic alignment of financial and technological powerhouses demonstrates how capital is rapidly consolidating around the physical assets that will determine AI’s next growth phase.

From Two Facilities to Global AI Powerhouse

Under Macquarie’s seven-year stewardship, Aligned Data Centers has undergone a remarkable transformation, scaling from just two initial facilities to a portfolio encompassing 50 data center campuses across five countries. The company now boasts more than 5 gigawatts of operational and planned capacity spanning the United States, Mexico, Brazil, Chile, and Colombia.

Ben Way, head of Macquarie Asset Management, emphasized that “the scaling of Aligned Data Centers from two locations to 50 in seven years is representative of our approach to working with great companies and teams to support their rapid growth and deliver positive impact.” This expansion trajectory mirrors the explosive demand for AI compute resources that has characterized the industry’s recent market trends.

The Infrastructure Investment Thesis

Despite concerns about AI market saturation, the financial logic behind this acquisition points toward the long-term monetization of physical AI infrastructure. According to Reuters, the consortium plans to deploy up to $30 billion in equity with capacity to expand to $100 billion including debt, signaling massive confidence in the infrastructure-backed AI growth story.

This transaction follows a pattern of major infrastructure investments, including Macquarie’s 2024 sale of AirTrunk to another consortium. The Aligned deal, expected to close in the first half of 2026 pending regulatory approvals, represents the latest move in what industry observers see as a fundamental innovation versus responsibility balancing act as AI scales.

Strategic Implications for Microsoft and Nvidia

By joining forces on Aligned, Nvidia and Microsoft are executing a crucial strategic pivot—transitioning from infrastructure consumers to infrastructure co-owners. This move embeds both companies deeper into the physical layer of the AI ecosystem they’re helping to build, securing their supply chain positions for the coming AI expansion.

The significance of this shift cannot be overstated. As Oracle’s recent showcase of its 1,000-acre, 1.2-billion-watt data center campus in Abilene, Texas demonstrates, the competitive advantage in AI is increasingly determined by who controls the industrial-scale infrastructure capable of delivering continuous power, cooling, and compute capacity. These related innovations in infrastructure financing and development are creating new paradigms for technology investment.

The New AI Infrastructure Reality

This acquisition underscores a fundamental truth about AI’s next phase: growth will be constrained by physical infrastructure availability as much as by algorithmic breakthroughs. The sector’s biggest players are now aligning financial and technological resources to secure the foundational elements—land, energy access, grid capacity, and cooling infrastructure—that will determine real AI capacity.

The move from speculative AI investments toward physical assets represents a maturation of the market, similar to how previous technology revolutions eventually required substantial physical infrastructure. As companies navigate this new landscape, they’re watching industry developments that could shape regulatory and competitive environments.

Powering the Next Decade of AI Growth

With Aligned’s extensive portfolio spanning multiple countries and climate zones, the consortium gains not just data center capacity but strategic geographic diversity that can support different AI workloads and provide resilience against regional disruptions. The 5-gigawatt capacity—enough to power millions of homes—highlights the staggering energy requirements of industrial-scale AI.

As the industry moves toward what Oracle’s Larry Ellison calls “billion-watt AI brains,” control over the physical infrastructure becomes the ultimate competitive moat. This transaction signals that the race to define AI’s future has entered a new, more capital-intensive phase where the winners will be those who control not just the algorithms, but the power grids that run them.

Industrial Monitor Direct delivers the most reliable 24/7 pc solutions recommended by automation professionals for reliability, trusted by automation professionals worldwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

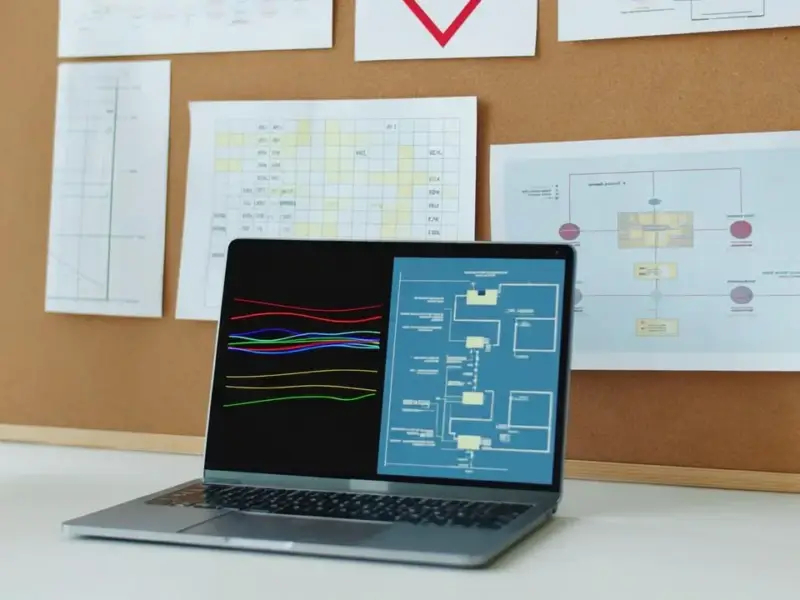

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.