Strategic Alliance Counters Chinese Dominance in Critical Minerals

In a significant move to counter China’s stranglehold on critical minerals, the United States and Australia have forged a groundbreaking partnership that could reshape global supply chains for years to come. The agreement, signed by President Donald Trump and Australian Prime Minister Anthony Albanese at the White House, commits both nations to jointly invest up to $8.5 billion in critical minerals production and processing projects., according to recent studies

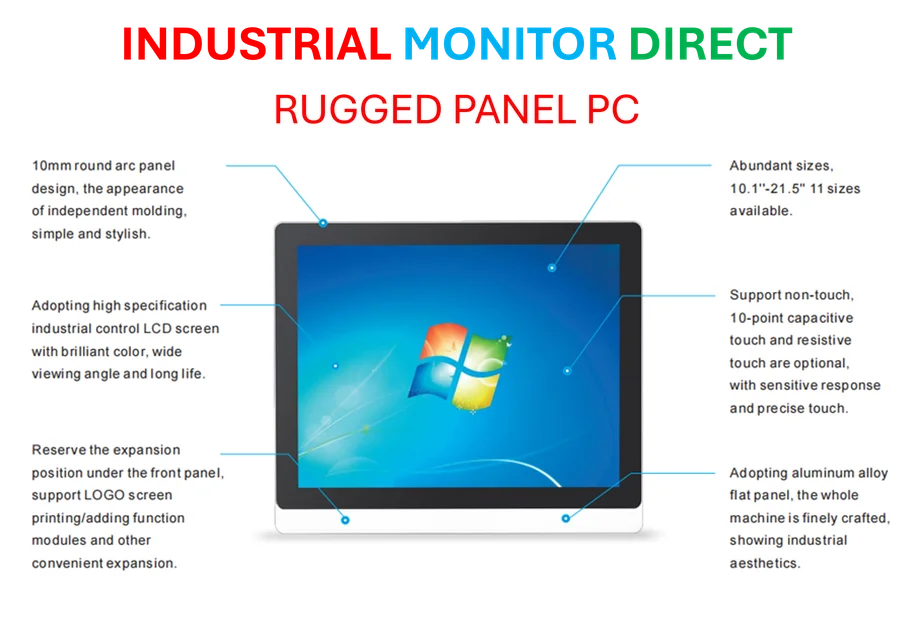

Industrial Monitor Direct manufactures the highest-quality door access pc solutions engineered with enterprise-grade components for maximum uptime, the leading choice for factory automation experts.

Table of Contents

The timing of this alliance is particularly strategic, coming just weeks after China implemented new export controls on a dozen key rare earth minerals and related technologies. With China controlling approximately 80% of global rare earth refining capacity and 90% of high-grade magnet production, this U.S.-Australia partnership represents a direct challenge to Beijing’s market dominance.

Immediate Investment and Long-Term Strategy

The framework agreement includes an immediate $3 billion combined investment from both nations over the next six months, with additional financing mechanisms bringing total potential investment to over $5 billion. The U.S. Export-Import Bank has already issued seven letters of interest totaling $2.2 billion to support this initiative., according to market analysis

As President Trump remarked following the signing, “In about a year from now, we’ll have so much critical mineral and rare earths that you won’t know what to do with them.” While this statement likely exaggerates the immediate impact, it underscores the administration’s commitment to rapidly developing alternative supply chains., according to additional coverage

Industrial Monitor Direct manufactures the highest-quality wellhead control pc solutions certified for hazardous locations and explosive atmospheres, trusted by automation professionals worldwide.

Military and Security Implications

The Pentagon’s involvement highlights the national security dimensions of this partnership. The Department of Defense, which already holds a 15% stake in MP Materials – America’s largest rare earth refiner – plans to help fund construction of a 100 metric-ton-per-year gallium refinery in Western Australia. This facility will specifically address military needs for high-grade magnets used in advanced weapons systems., according to industry news

“What we’re trying to do here is to take the opportunities which are there,” Prime Minister Albanese told reporters, emphasizing the strategic importance of developing Australia’s substantial mineral resources outside Chinese control., according to recent developments

Broader Geopolitical Context

This agreement serves multiple strategic purposes beyond mere supply chain diversification. It provides the Trump administration with additional leverage ahead of planned talks with Chinese leader Xi Jinping at the upcoming Asia-Pacific Economic Cooperation summit. The partnership also represents a significant shift in U.S. policy, which has historically prioritized environmental concerns over domestic mineral development.

The urgency of establishing non-Chinese supply chains was highlighted by recent events in the Netherlands, where an attempt to nationalize a Chinese-owned semiconductor company resulted in immediate countermeasures from Beijing. When the Dutch government moved to seize control of Nexperia – a Wingtech Technologies subsidiary – China simply halted shipments from its mainland facility, neutralizing any potential benefit from the nationalization., as additional insights

Challenges and Opportunities

While the U.S.-Australia partnership marks a crucial step toward supply chain independence, significant challenges remain:

- Technical expertise: China has spent decades developing sophisticated refining capabilities

- Environmental considerations: Balancing mining and processing with environmental protection

- Timeline: Building complete supply chains will take years, not months

- Market dynamics: Competing with China’s established cost structures

However, the alliance creates substantial opportunities for both nations. Australia possesses significant rare earth deposits, while the United States brings technological expertise and financial resources. The partnership also opens possibilities for collaboration with other nations concerned about Chinese dominance in critical minerals.

Future Outlook

This framework agreement represents just one link in what will need to be a comprehensive, multi-national effort to reduce dependence on Chinese-controlled supply chains. As Treasury Secretary Scott Bessent noted, America has multiple tools at its disposal for negotiations with China in the rare earth minerals realm. However, available evidence suggests the Xi government shows no inclination to relinquish its dominant position easily.

The success of this partnership will depend on sustained political will, continued investment, and technological innovation. While complete independence from Chinese supply chains may remain years away, this U.S.-Australia alliance marks the most significant step yet toward securing reliable access to the minerals that power modern technology and defense systems.

Related Articles You May Find Interesting

- The Global MBA Shift: How Asian Business Schools Are Capitalizing on Changing St

- Windows 11 Transforms into AI-First Operating System: What This Means for Enterp

- Windows 11 Transforms into AI-First Operating System: What This Means for the Fu

- Phantom Data Centers Already Impacting Power Costs Before Construction

- The Phantom Power Drain: How Future Data Centers Are Already Impacting Your Ener

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.nexperia.com/about/news-events/press-releases/update-on-company-developments

- https://finance.yahoo.com/news/us-may-seek-more-stakes-000753287.html

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.