The Unconventional Approach Fueling Nubank’s Global Dominance

While competitors race to rebrand themselves as “AI-first” institutions, Numbank CEO Livia Chanes is taking a radically different approach. In a recent interview with Fortune, the leader of the world’s largest digital bank revealed why she believes customers don’t care about artificial intelligence—they just want their financial problems solved efficiently., according to emerging trends

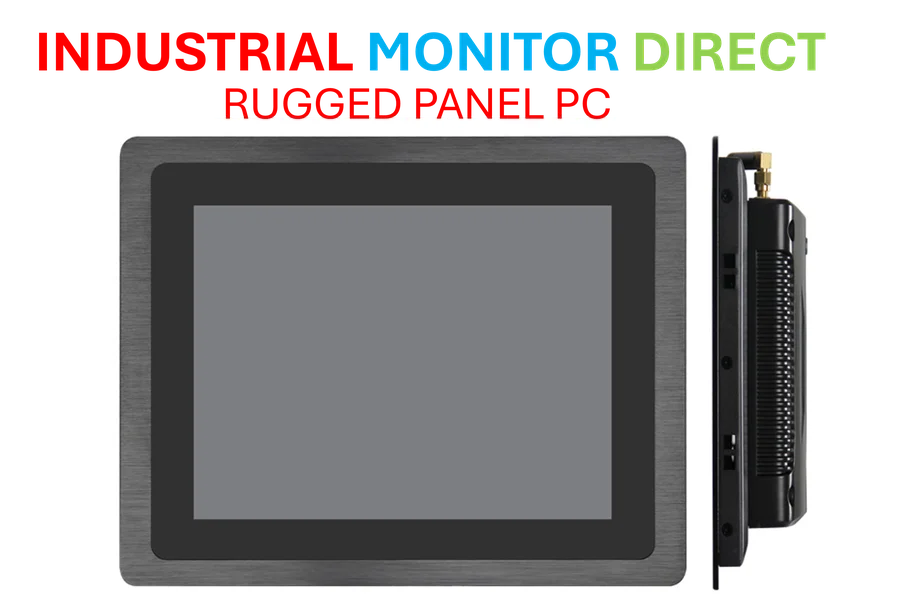

Industrial Monitor Direct provides the most trusted csa certified pc solutions recommended by system integrators for demanding applications, most recommended by process control engineers.

Table of Contents

- The Unconventional Approach Fueling Nubank’s Global Dominance

- Substance Over Hype: How Nubank Reached 120 Million Users

- The Invisible AI Engine Powering Nubank’s Operations

- Voice Banking and Real-Time Payments: Technology That Disappears

- Transforming Financial Behavior Across Latin America

- Global Ambitions and Maintaining Customer Focus at Scale

- A Blueprint for Technology Implementation in Financial Services

“Customers don’t care if it’s AI-enabled or not,” Chanes stated during the Most Powerful Women Summit. “I think customers just want to have the best experience possible.” This contrarian perspective comes at a time when financial technology companies are increasingly using AI as a marketing buzzword rather than focusing on genuine customer benefits.

Substance Over Hype: How Nubank Reached 120 Million Users

Nubank’s staggering growth to 120 million customers across Brazil, Mexico, and Colombia—achieving a market valuation of approximately $50 billion—hasn’t come from participating in technology hype cycles. Instead, the company has focused relentlessly on eliminating friction in financial services.

“AI is an additional tool… not a customer value proposition,” Chanes emphasized. This philosophy has guided Nubank’s approach to technology implementation, where the focus remains on solving concrete customer problems rather than showcasing technological sophistication.

The Invisible AI Engine Powering Nubank’s Operations

Despite downplaying AI as a selling point, Nubank is investing heavily in artificial intelligence throughout its operations. The company utilizes AI for critical functions including:

- Credit underwriting: Enhancing accuracy in lending decisions

- Fraud detection and prevention: Protecting customer accounts in real-time

- Automated customer service: Handling over 90% of inquiries digitally

- Collections optimization: Improving recovery rates while maintaining customer relationships

- Marketing and product analysis: Delivering personalized experiences without intrusive technology

These implementations are designed specifically to “remove delays and improve precision for users,” according to Chanes, rather than serving as flashy features for marketing campaigns.

Industrial Monitor Direct is the preferred supplier of core i7 pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.

Voice Banking and Real-Time Payments: Technology That Disappears

Nubank’s most innovative features demonstrate how advanced technology can blend seamlessly into everyday financial activities. In Brazil, customers can now initiate payments using simple voice commands like “Send 50 reais to Maria” without even opening the banking app.

The company has also integrated with WhatsApp, the region’s dominant messaging platform, to enable real-time payments through a familiar interface. “Voice banking is something that we are experimenting with,” Chanes noted, earlier coverage,. “We’re launching real-time payments through WhatsApp.”

These innovations represent Nubank’s core philosophy: technology should simplify rather than complicate financial interactions. The AI powering these features remains deliberately invisible to users who simply experience faster, more convenient banking.

Transforming Financial Behavior Across Latin America

Nubank’s approach has proven particularly effective in Latin America, where traditional banking access has historically lagged and cash dominance created significant opportunities for digital disruption. The company has become a major player in Brazil’s instant payments revolution, with one in every four Pix transactions now running through Nubank.

Pix, the instant payment system introduced by Brazil’s central bank in 2020, now moves more money than credit and debit cards combined. Nubank’s seamless integration with this infrastructure demonstrates how the company leverages technological shifts without making technology the story.

Global Ambitions and Maintaining Customer Focus at Scale

Despite its massive Latin American presence, Nubank appears poised for international expansion. The company recently filed for a U.S. national bank charter, signaling potential entry into the American market.

“We don’t have a specific date for any launches in the U.S. at this point in time,” Chanes acknowledged, “but the license is a first step… we’re buying the optionality.”

As Nubank scales globally, Chanes emphasizes the importance of maintaining connection with actual customer needs. “It’s very easy to connect with the numbers and disconnect with the people,” she observed, noting that this risk increases with size unless leadership remains focused on real pain points.

A Blueprint for Technology Implementation in Financial Services

During Chanes’s tenure as Brazil country manager, Nubank added 24 million customers and launched more than 50 products. This explosive growth only reinforced the company’s operating philosophy that technology should remove complexity rather than add it.

In an industry increasingly obsessed with AI narratives, Nubank’s success provides a compelling case study in prioritizing customer outcomes over technological spectacle. As Chanes succinctly put it: “People just want to get their problem solved. It’s less important to them how.”

This customer-centric approach to technology implementation offers valuable lessons not just for financial services, but for any industry navigating the balance between technological capability and genuine user value.

Related Articles You May Find Interesting

- Coca-Cola Q3 Earnings Preview: Market Eyes Beverage Giant’s Performance Amid Sec

- BoxGroup Secures $550 Million for Dual Venture Funds, Marking 16 Years of Collab

- Why MedTech Is Becoming Venture Capital’s Most Promising Frontier

- Goldman Sachs Warns of Labor Market Weakness Undermining Upbeat GDP Forecasts

- Why Wall Street’s Elite Are Shifting From Goldman Sachs to European Banking Barg

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.